MSE Trading Report for Week ending 16 September 2022

| MSE Equity Total Return Index: |

| Highlights: |

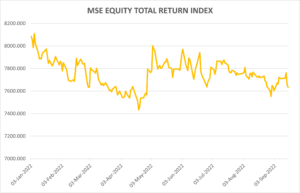

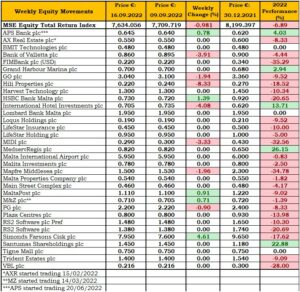

The MSE Equity Total Return Index failed to hold onto last week’s gain, as it shed 1%, to close the week at 7,634.056 points. A total of 17 equities were active, five of which registered gains, while another seven lost ground. A total weekly turnover of €0.5 million was generated across 86 transactions.

In the banking industry, Bank of Valletta plc (BOV) shares fell by 3.9%, ending the week at €0.86. A total of 117,428 shares changed hands over 21 deals, registering the highest turnover during the week.

The bank announced that since the contract of the CEO, Mr Rick Hunkin, is due to expire later on this year, the bank’s directors have appointed Mr Kenneth Farrugia as the bank’s next CEO who will also sit on the bank’s board as an Executive Director, subject to regulatory approval.

In addition, the board of BOV announced that it has been granted approval by the Central Bank of Ireland, in respect of a base prospectus for the purposes of the EU Prospectus Regulation. The base prospectus relates to the establishment of a euro medium term note programme providing for the issuance of notes up to a maximum aggregate principal amount of €500m. The base prospectus is valid for 12 months from its date of issue.

The net proceeds from each issue of notes will be used to further strengthen the minimum requirement for own funds and eligible liabilities and/or capital base of the bank and its subsidiaries. Application will be made for notes issued under the programme to be admitted to the official list and to trading on the regulated market of the Irish Stock Exchange plc.

On the other hand, its peer, HSBC Bank Malta plc was up by 1.4%, as nine deals involving 138,565 shares worth €104,010 were executed. Last Wednesday, the equity traded at a weekly high of €0.755, but closed the week at the €0.73 price level.

APS Bank plc ended the week at €0.645 – translating in an increase of 0.8%. This was the result of 65,678 shares spread across nine transactions.

In the insurance industry, the share price of Mapfre Middlesea plc retracted by 2%, ending the week at €1.50. This was the outcome of nine transactions worth €16,219.

Two contrasting sessions cancelled each other out for Malta International Airport plc shares, finishing the week unchanged at €5.95. This was a result of 12,108 shares spread across eight transactions.

In the property sector, Hili Properties plc headed the list of fallers, as one transaction in the final minutes of yesterday’s trading session, dragged the equity’s price lower by 8.3%. Hili Properties plc closed the week at €0.22 on one deal of 9,000 shares.

AX Real Estate plc ended the week flat at the €0.55 price level, as 25,000 shares changed hands across two deals.

The share price of MIDI plc eased by 3.3%, as 35,000 shares were transacted over a single deal.

Tigne Mall plc shares traded twice over a mix of 15,000 shares but closed unchanged at €0.75.

Meanwhile, two deals of 3,335 International Hotel Investments plc shares dragged the share price 4.1% lower. The equity finished the week at €0.705.

Telecommunications company, GO plc, traded 11 times over a mix of 32,950 shares. As a result, the price declined by 1.9%, to close at €3.04.

Its subsidiary, BMIT Technologies plc kept the previous week’s closing price of €0.48. The equity was active on Monday on a sole trade of 10,000 shares.

Similarly, 3,200 RS2 Software plc Preference shares were active across a sole trade, closing the week unchanged at €1.48.

Simonds Farsons Cisk plc was the best performing equity, as the share price increased by 4.6%. Four deals involving just 733 shares were executed. The equity closed at €7.95. Similarly, a sole deal of 6,820 M&Z plc shares pushed the price 0.7% higher to €0.71.

On the other hand, the share price of retail conglomerate PG plc, eased by 0.9% to the €2.20 level. This was a result of 22,196 shares executed across three deals.

Two transactions of 1,631 MaltaPost plc shares added 0.9% to the equity’s share price, ending the week at €1.11.

The MSE MGS Total Return Index decreased by 0.5%, as it closed at 922.876 points. A total of seven issues were active, of which one headed north, while another five closed in the opposite direction. The 3% MGS 2040 (I) registered the best performance, as it closed 1% higher at €103. Conversely, the 2.5% MGS 2036 (I) lost 5%, ending the week at €96.

The MSE Corporate Bonds Total Return Index recorded a 0.3% decline, as it ended the week at 1,157.565 points. Out of 56 active issues, 15 traded higher, while another 20 closed in the red. The 4% SP Finance plc € Secured 2029 headed the list of gainers with a 2.5% rise, to close at €102.50. Meanwhile, the 4% Stivala Group Finance plc Secured € 2027 closed 2.5% lower at €100.01.

In the Prospects MTF market, five issues were active. The 4.875% AgriHoldings Plc Senior Secured € 2024 was the most liquid, as €17,500 was generated. The bond issue ended the week at €98.

| Upcoming Events | ||||

| 22 September 2022 | MT: Trident Estates plc – Interim Results | Best Performers: | ||

| 23 September 2022 | MT: M&Z plc – Dividend Payment Date | SFC | +4.61% | |

| 28 September 2022 | MT: Simonds Farsons Cisk plc – Interim Results | HSBC | +1.39% | |

| 29 September 2022 | MT: Malita Investments plc – Dividend Payment Date | MTP | +0.91% | |

| Worst Performers: | ||||

| HLI | -8.33% | |||

| IHI | -4.08% | |||

| BOV | -3.91% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]