MSE Trading Report for Week ending 23 September 2022

| MSE Equity Total Return Index: |

| Highlights: |

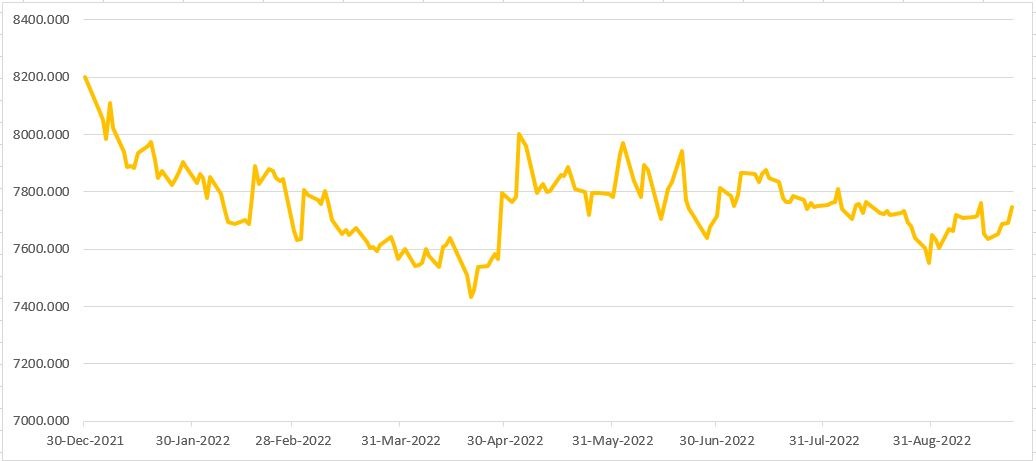

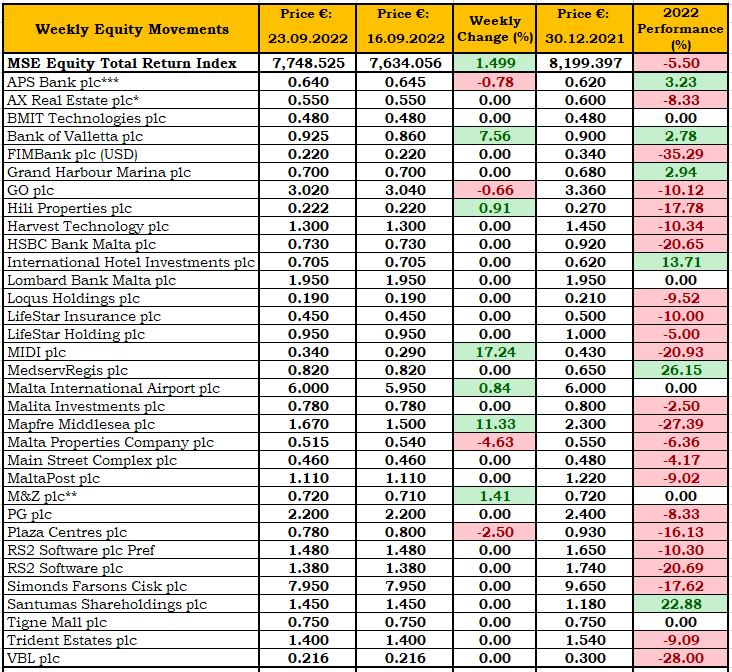

The MSE Equity Total Return Index bounced back following last week’s drop, as it advanced by 1.5%, to close the week at 7,748.525 points. A total of 15 equities were active, six of which headed north, while another four lost ground. Total weekly turnover reached €0.5 million, generated across 75 transactions.

Bank of Valletta plc saw its share price jump by 7.6% to €0.925, as 31 trades involving the exchange of 230,502 shares were recorded. The bank’s share price fluctuated between a weekly-high of €0.925 and a weekly-low of €0.86. Most of the trading occurred late during yesterday’s session.

Meanwhile APS Bank plc eased by 0.8% to close the week at €0.64, as five trades of 22,176 shares and worth €14,139 were executed. Since the bank’s IPO earlier this year, the equity is up by 3.2%.

Lombard Bank Malta plc (Lombard) kept hold of the €1.95 level, as the bank’s equity traded seven times, with trading value reaching €115,324.

Last Tuesday, the board of directors of Lombard announced that it intends to proceed with the issue, allotment and listing of new ordinary shares. The bank also announced that an Extraordinary General Meeting (EGM) will be held on November 10, 2022 to consider and approve the necessary resolutions.

Malta International Airport plc (MIA) trended 0.8% higher to close at €6. Three deals of 2,530 shares were executed.

In the telecommunications sector, GO plc shares shed 0.7% to end the week at €3.02. The equity traded seven times on a volume of 21,840 shares.

International Hotel Investments plc kept the previous week’s closing price of €0.705, as seven trades with a total trading value of €22,924 were recorded.

Both Simonds Farsons Cisk plc (SFC) and RS2 Software plc Ordinary shares (RS2) remained unchanged, at €7.95 and €1.38 respectively. SFC shares exchanged hands four times on a volume of 1,600 shares, while RS2 shares traded twice across 3,427 shares.

Hili Properties plc shares were involved in one small trade worth €888, to close at €0.222. On the week the equity gained 1%.

MIDI plc shares rallied by 17.2%, as a sole trade of 1,000 shares pushed the equity’s price to the €0.34 level.

Malta Properties Company plc slid 4.6%, to close at €0.515. This drop was the result of two trades on Monday and yesterday, with turnover tallying to €2,787.

The price per share of PG plc remained unchanged at €2.20. The retail conglomerate’s equity traded once on a volume of 4,500 shares.

M&Z plc traded once, as its price advanced by 1.4%, to end the week at €0.72. Trading activity involved the exchange of 1,993 shares.

Mapfre Middlesea plc saw its share value increase by 11.3% to re-gain the €1.67 price level. Two trades of 1,000 shares were executed during Monday’s trading session.

The share price of Plaza Centres plc declined by 2.5% to close at €0.78. One small trade worth €3,705 was recorded.

The board of directors of Trident Estates plc approved the unaudited financial statements of the company for the six months ended July 31, 2022. The group recorded revenue of €885,000 during the first six months, resulting in an increase of 62% compared to the same period last year. The group recorded a net profit of €151,000 as compared to a net loss of €28,000 in the same prior period. The Board did not propose the payment of an interim dividend. The extent of a final dividend distribution, shall be determined on the basis of the full year results.

Merkanti Holdings plc announced that it was informed by the Board of Directors of Scully Royalty Ltd, that in light of the current volatility and uncertainty in the global capital markets, the spin-off will be temporarily postponed until 2023.

The MSE MGS Total Return Index decreased by 0.1%, as it closed at 922.134 points. A total of 12 issues were active, three of which increased, while another six closed in the opposite direction. The 1.8% MGS 2051 (I) registered the best performance, as it closed 4.1% higher to close at €81. Conversely, the 3.4% MGS 2042 (I) lost 2.2%, ending the week at €102.

The MSE Corporate Bonds Total Return Index recorded a 0.1% decline, as it ended the week at 1,156.089 points. Out of 47 active issues, 16 traded higher, while another 17 dropped in value. The 4% Stivala Group Finance plc € Secured 2027 headed the list of gainers with a 2% increase, to close at €101.99. Meanwhile, the 4.65% Smartcare Finance plc Secured € 2031 closed 2.9% lower at €100.03.

In the Prospects MTF market, four issues were active. The 5.35% D Shopping Malls Finance plc € Unsecured 2028 was the most liquid, as €10,125 was generated, ending the week at €93.75.

| Upcoming Events | ||||

| 28 September 2022 | MT: Simonds Farsons Cisk plc – Interim Results | Best Performers: | ||

| 29 September 2022 | MT: Malita Investments plc – Dividend Payment Date | MDI | +17.24% | |

| 19 October 2022 | MT: APS Bank plc – EGM | MMS | +11.33% | |

| 24 October 2022 | MT: PG plc – AGM | BOV | +7.56% | |

| 28 October 2022 | MT: Santumas Shareholdings plc – AGM | |||

| Worst Performers: | ||||

| MPC | -4.63% | |||

| PZC | -2.50% | |||

| APS | -0.78% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]