MSE Trading Report for Week ending 30 September 2022

| MSE Equity Total Return Index: |

| Highlights: |

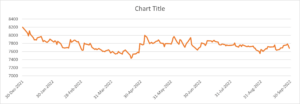

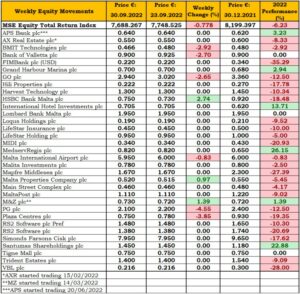

The MSE Equity Total Return Index headed south, closing at 7,688.267 points, translating into a 0.8% fall. A total of 15 equities were active; three of which edged higher while six closed in negative territory. The total weekly turnover stood just below the €0.6m and was generated over 93 deals.

The equity heading the list of fallers was PG plc, as three transactions worth €5,010 dragged the price 4.6% down, to close at €2.10.

In the banking industry, HSBC Bank Malta plc headed north, as it registered the best performance – adding 2.7% and closing at €0.75. This result was achieved as 101,004 shares changed ownership over 10 transactions.

Its peer, Bank of Valletta plc, closed 2.7% in the red, at €0.90. The equity featured in nine separate deals worth a total of €17,407.

Elsewhere, Lombard Bank Malta plc closed flat at €1.95. The equity traded twice, generating a total turnover of €15,036.

A total of 55,000 APS Bank Malta plc (APS) shares were transacted across seven deals but closed unchanged at €0.64.

APS announced that the bank’s extraordinary general meeting shall be held remotely on October 19, 2022.

Telecommunications company, GO plc, lost 2.7%, or €0.08, as the equity’s price closed the week at €2.94, despite an intra-week high of €3.08. The equity generated €38,666 in turnover across 12 trades.

Elsewhere, International Hotel Investments plc and AX Real Estate plc kept the previous week’s share price, closing flat at €0.705 and €0.55, respectively.

On the other hand, Malta Properties Company plc (MPC) ended the week in positive territory, as a result of four deals involving 9,810 shares. The equity advanced by 1%, closing at €0.52.

By virtue of an agreement dated September 28, 2021, BKE Property Company Limited entered into a promise of sale agreement with Excel Investments Limited. MPC announced that on the September 27, 2022, BKE executed the final deed of sale in respect of the property through which BKE sold and transferred to Excel Investments Limited who accepted and purchased the property. The consideration for the sale and acquisition of the property is €8m which €0.8m was paid upon the execution of the promise of sale agreement and the balance of €7.2m has been paid in full and final settlement of the consideration upon the final deed of sale through bank financing.

BMIT Technologies plc saw its share price decline by 2.9%, to end the week €0.014 lower at €0.466. Eight transactions worth €39,394 were executed.

Plaza Centres plc shares retracted by 3.9%, as the equity price read €0.75 at the end of yesterday’s session. This was the outcome of one trade of slim volume.

Malta International Airport plc share price, eased by 0.8%, to close at €5.95, as 15 deals saw a total of 23,141 shares change hands.

M&Z plc declined by 1.4%, to close at the €0.73 price mark. This, following a single deal involving 5,074 shares.

Grand Harbour Marina plc was active but closed unchanged at €0.70. This was the outcome of two transactions worth a total of €4,889.

Elsewhere, Simonds Farsons Cisk plc (SFC) also closed unchanged at €7.95, although it was the most liquid equity, as 13 transactions generated €170,461 in turnover.

Last Wednesday, the board of directors of SFC approved the group’s unaudited financial statements and Interim Directors’ Report for the six months ended July 31, 2022.

The group registered an increase of €15.7m in turnover when compared to the same period last year. The total turnover for the first six months of the current financial year amounted to €57.3m. Profit after taxation for the period amounted to €7m compared with €4.9m for the equivalent period last year. The improved profitability resulted from improved operating margins and overall comparative cost containment.

The board of SFC also resolved to distribute, out of tax-exempt profits, an interim dividend of €1.6m equivalent to €0.045 per ordinary share. This dividend will be paid on October 19, 2022.

On the bond side, the Government of Malta will be launching a new issue of Malta Government Stocks. The Treasury will offer a medium-dated bond with a coupon of 3.4% with maturity in 2027 and a 10-year bond with a coupon of 4%. The total issue size will be €200m, subject to an over-allotment option of €100m in the event of over-subscription.

The price for each stock will be announced on October 6, 2022 after close of business of the secondary market of the Malta Stock Exchange.

The MSE MGS Total Return Index added to the previous week’s decline, closing at 917.604 – a 0.5% fall. Out of 10 active issues, six declined while the rest remained unchanged. The 3% MGS 2040 (I) issue headed the list of fallers with a 2.9% decline, to close at par.

The MSE Corporate Bonds Total Return Index closed 0.03% lower at 1,155.783 points. A total of 64 issues were active; 22 of which gained, while another 23 declined. The 4% SP Finance plc € Secured 2029 headed the list of gainers, registering an appreciation of 3%, to close at €103. On the other hand, the 3.5% GO plc € Unsecured 2031 fell by 2.5%, to end the week at €97.50.

In the Prospects MTF market, seven issues were active. The most active bond was the 4.75% KA Finance plc Secured Callable Bonds 2026-2029 issue, generating a total turnover of €9,300 and closing at €93.

| Upcoming Events | ||||

| 19 October 2022 | MT: APS Bank plc – EGM | Best Performers: | ||

| 24 October 2022 | MT: PG plc – AGM | HSB | +2.74% | |

| 28 October 2022 | MT: Santumas Shareholdings plc – AGM | MZ | +1.39% | |

| MPC | +0.97% | |||

| Worst Performers: | ||||

| PG | -4.55% | |||

| PZC | -3.85% | |||

| BMIT | -2.92% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]