MSE Trading Report for Week ending 07 October 2022

| MSE Equity Total Return Index: |

| Highlights: |

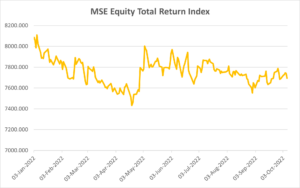

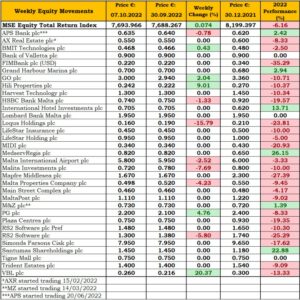

The MSE Equity Total Return Index posted a marginal 0.1% gain, as gains in five equities outweighed losses in another seven equities. The index closed the week at 7,693.966 points. Total turnover reached €0.3m, as 65 deals were executed. Since the beginning of the year, the equity index is down by 6.2%.

Five transactions of 4,460 Malta International Airport plc shares dragged the share price by 2.5% to €5.80. From a year-to-date perspective, the equity is 3.3% lower.

A total of 6,775 International Hotel Investments plc shares exchanged ownership across a single trade, remaining at the €0.705 price level.

In the financial services sector, the only movers during the week were HSBC Bank Malta plc (HSBC) and APS Bank plc (APS).

The share price of HSBC retracted by 1.3%, ending the week at €0.74. This was the outcome of five transactions worth €49,334.

Similarly, APS shares shaved off 0.8% of its share price, as three transactions of just 6,000 shares were active. Despite this week’s negative performance, the equity is still up by 2.4% compared to its IPO price last June.

Bank of Valletta plc shares managed to keep the previous week’s closing price of €0.90 after trading at a weekly low of €0.88. The equity was active over 60,958 shares and changing ownership over nine deals.

Meanwhile, the board of Lombard Bank Malta plc resolved that it would be in the best interest of the bank to recommend to its shareholders a share split of the bank’s shares on a two for one share basis. As a result, every one share having a nominal value of €0.25 will be split into two shares, each with a nominal value of €0.125.

The proposed share split, which is subject to regulatory approval, is intended to allow easier access to a larger number of investors which should result in improved trading liquidity in the bank’s shares.

Approval of the share split by the bank’s shareholders will be sought during the forthcoming EGM scheduled for November 10, 2022.

Mapfre Middlesea plc shares remained at the €1.67 price level, after being active over a single trade of negligible volume.

Telecommunication company, GO plc was the most active equity as 19,730 shares exchanged ownership across 14 deals, worth €58,525. GO plc finished the week 2% higher at €3. The equity traded between a weekly high of €3.08 and a low of €2.94.

The worst performer was in the IT sector, as a sole transaction of 40,000 Loqus Holdings plc dragged the share price to the €0.16 price level. This translated into a double-digit decline of 15.8%.

BMIT Technologies plc closed the week higher by 0.4%, as the equity finished at €0.468. Turnover totalled €936 across a single deal.

Meanwhile, RS2 Software plc Ordinary shares shed 5.8%, to end the week at the €1.30 price level. Total turnover amounted to €14,265 across four transactions.

In the property sector, VBL Group plc registered the best performance during the week, adding 20%, or €0.044 to its share price. This was the outcome of a single transaction of 3,000 shares worth just €780, to close at €0.26.

Hili Properties plc shares jumped by 9%, to close at €0.242, a price last seen in May. A total of 74,250 shares were traded.

On the other hand, three deals of 10,500 Malita Investments plc shares recorded a decline of 7.7%, ending the week €0.06 lower at €0.72.

The share price of Malta Properties Company plc fell by 4.2% after trading at a weekly high of €0.53 on Monday. The equity ended the week at €0.498, as 19,201 shares changed hands across seven transactions.

Main Street Complex plc ended the week unchanged at €0.46, as a single deal of just 232 shares was executed.

The retail conglomerate, PG plc gained 4.8%, finishing the week €0.10 higher at €2.20. A single deal generated €12,760 in turnover.

Simonds Farsons Cisk plc traded at a weekly low of €7.90 on Wednesday, but managed to close the week unchanged at €7.95. This was the outcome of three deals worth €24,645.

Similarly, MaltaPost plc was active on Monday over two transactions involving 8,066 shares, ending the week flat at €1.11.

Meanwhile, Medserv Regis plc announced that TotalEnergies EP Cyprus B.V. has extended the current contract with Medserv Cyprus limited, a subsidiary of the company, for the provision of operational base support services in Cyprus for an additional twelve months until June 2023. The contract extension includes the provision of dedicated facilities and services in the port of Limassol. No trading activity was recorded in the shares of Medserv Regis plc.

In terms of IPO activity, further to the announcement issued on September 30, 2022, last Thursday the Accountant General announced the prices of the upcoming issue of Malta Government Stocks. The 3.40% Malta Government Stock 2027 will be offered at a price of €101.25 with a yield to maturity (YTM) of 3.124%. The 4% Malta Government Stock 2032 will be offered at €100 with a YTM of 4%. Applications open on Monday, October 10, and close on Wednesday, October 12, 2022 or earlier at the discretionary of the Accountant General.

On Wednesday, the board of JD Capital plc announced that the company’s application to the MFSA for admissibility to listing on the Official List of the MSE of up to €25m JD Capital plc secured bonds through a secured bond issuance program, was approved. A bondholder meeting of the existing €5m JD Capital plc 5% unsecured bonds 2028, will be held on October 26, 2022 for the purpose of considering and, if thought fit, approving the exchange of the prospects bonds for new bonds being issued by the company.

The MSE MGS Total Return Index lost 1.4%, closing the week at 904.855 points. A total of 11 issues were active, eight of which lost ground and the other three closed unchanged. The 4.3% MGS 2033 (I) issue registered the worst performance, as it closed 10.2% lower to €103.33.

The MSE Corporate Bonds Total Return Index extended the previous week’s decline, as it eased by 0.8%, reaching 1,147.079 points. Out of 59 active issues, nine headed north, while another 33 closed in the opposite direction. The 4% Shoreline Mall plc Secured € 2026 issue headed the list of gainers, as it closed 1.5% higher at €100. On the other hand, the 3.25% APS Bank plc Unsecured Sub € 2025-2030 lost 5.3%, ending the week at €94.

In the Prospects MTF market, six issues were active, as a total turnover of €81,548.50 was generated over 11 deals. The 4.75% KA Finance plc Secured Callable Bonds 2026-2029 was the most active issue, generating €34,131in turnover and ending the week at €93.

| Upcoming Events | ||||

| 19 October 2022 | MT: APS Bank plc – EGM | Best Performers: | ||

| 24 October 2022 | MT: PG plc – AGM | VBL | +20.4% | |

| 28 October 2022 | MT: Santumas Shareholdings plc – AGM | HLI | +9.01% | |

| PG | +4.76% | |||

| Worst Performers: | ||||

| LQS | -15.8% | |||

| MLT | -7.69% | |||

| RS2 | -5.80% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]