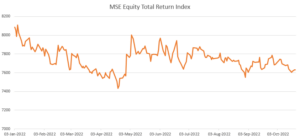

MSE Trading Report for Week ending 21 October 2022

| MSE Equity Total Return Index: |

| Highlights: |

The MSE Equity Total Return Index closed another week in the red, this time at 7,629.101 points – a fall of 0.1%. During the week, a total of 17 equities were active, eight of which headed north while six closed in the opposite direction. Total weekly turnover stood at €934k which is just under 60% higher than that of last week. This was achieved across 59 transactions.

Malta International Airport plc traded 1.7% higher, to close at €5.90, as four deals involving 1,280 shares were executed. This week’s recovery brings the equity’s year-to-date performance to a negative 1.7%.

International Hotel Investments plc was active but closed unchanged at €0.71, after trading flat all week. A total of two deals involving 26,000 shares were executed.

BMIT Technologies plc started off the week lower at €0.45 but ended the week higher at €0.466, equivalent to a 1.3% week-on-week gain. This was the result of 35,066 shares spread across three transactions.

In the same sector, RS2 Software plc ordinary shares (RS2) headed south on Monday, trading at a weekly low of €1.28. Despite this, it, ended the week 4.6% higher at €1.36. A total of 13 transactions worth €78,084 were executed.

On Tuesday, the board of RS2 resolved to capitalise the sum of €1.5m being part of the amount standing to the credit of the company’s non-distributable reserves of the share premium account. The sum will be appropriated to the holders of the issued Ordinary Shares and Preference Shares of the company. The amount of 24,121,071 Ordinary Shares and 1,123,700 Preference Shares at €0.06 each will be allotted in full in the capital of the company. They will be allotted and credited as fully paid up at par to and amongst such holders in the proportion of 1 for every 8 Ordinary Share / Preference Share.

The share price of the HSBC Bank Malta plc advanced by 2.7%, as 5,744 shares changed ownership across four deals. The banking equity is still down by 18.5% since the beginning of the year.

APS Bank plc (APS) returned to positive territory, as six deals saw 9,905 shares change hands. The equity advanced by 5%, closing the week at €0.625.

APS announced that on Wednesday, all resolutions were approved at the Extraordinary General Meeting. An interim dividend through the issuance of new ordinary shares of €1.8m from the bank’s profit, will be capitalised for the purpose of issuing up to 7.21m fully paid-up ordinary shares. The share issue will be issued at the nominal value of €0.25 per share.

Lombard Bank Malta plc (LOM) shares suffered a 2.6% decline to €1.90. This is equivalent to a €0.05 change in price. A total of 1,000 shares were executed across a single deal.

LOM announced that the company’s Extraordinary General Meeting will be held on November 10, 2022.

Two deals of 3,500 Mapfre Middlesea plc shares did not alter the previous week’s closing price of €1.60.

During the week, telecommunications provider, GO plc, declined by 2%, as five deals involving 3,655 shares dragged the price to €2.92.

The oil and gas company, MedservRegis plc, recorded the week’s largest decline in price of 14.6%, to close at €0.70. The equity also recorded the largest turnover of €0.7m, as two trades of 1m shares were executed.

In the property sector, four equities were active, three of which headed north while VBL plc retracted by 8.5%. This was the outcome of a single transaction worth €2,261, closing the week at €0.238.

Three deals involving 6,000 Malita Investments plc shares resulted into a positive 0.7% movement in price, to close at €0.725. Similarly, Malta Properties Company plc increased by 0.4%, to €0.50. Three deals involving 4,498 shares were executed. Meanwhile, Plaza Centres plc appreciated by 1.3%, to close at €0.76, over a single deal of 3,200 shares.

Five transactions of 18,434 PG plc shares saw the price fall by 1.9%, to €2.10.

M&Z plc ended the week unchanged at €0.73. A sole deal of 2,400 shares was executed.

Three deals involving 4,390 Simonds Farsons Cisk plc shares dragged the price 5% into the red. The equity ended the week €0.40 lower at €7.55.

The MSE Corporate Bonds Total Return Index lost ground, as it closed 0.8% lower at 1,139.409 points. Out of 55 active issues, the 4% International Hotel Investments plc Secured € 2026 issue was the most liquid, generating €81,709.88 in turnover.

The MSE MGS Total Return Index retracted by a further 0.8%, as it closed at 862.614 points. Trading was spread across a total of 12 issues with the 2.60% MGS 2028 (V) R bond being the most active, recording €0.2m in turnover over a single transaction.

In the Prospects MTF market, two issues were active. The 5.35% D Shopping Malls Finance plc € Unsecured 2028 was the most liquid, as a total weekly turnover of €12,844 was generated, closing at €93.75.

| Upcoming Events | ||||

| 19 October 2022 | MT: PG plc – AGM | Best Performers: | ||

| 28 October 2022 | MT: Santumas Shareholdings plc – AGM | APS | +5.04% | |

| 10 November 2022 | MT: Lombard Bank Malta plc – EGM | RS2 | +4.62% | |

| HSB | +2.74% | |||

| Worst Performers: | ||||

| MDS | -14.6% | |||

| VBL | -8.46% | |||

| SFC | -5.03% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]