MSE Trading Report for Week ending 28 October 2022

| MSE Equity Total Return Index: |

| Highlights: |

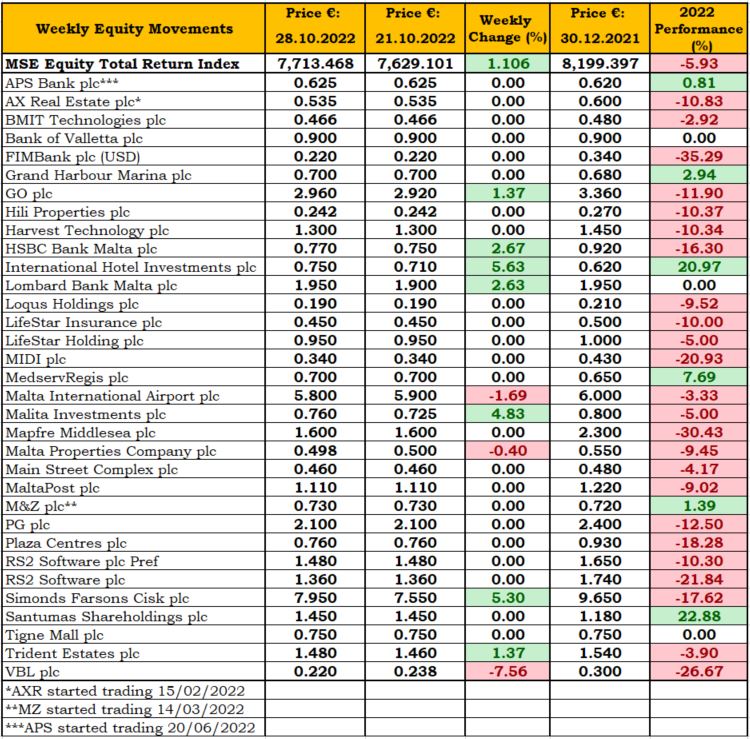

The MSE Equity Total Return Index ended a two-week negative streak, as it closed in the green at 7,713.468 points – an increase of 1.1%. During the week, 18 equities were active, seven of which gained while three closed in the opposite direction. Total weekly turnover stood at €598,492 down from €933,524 recorded last week. In total, 75 transactions were recorded.

The share price of International Hotel Investments plc was this week’s best performing equity, as it recorded an increase of 5.6% to close at €0.75. Trading activity included the exchange of 2,000 shares over two trades.

Simonds Farsons Cisk plc was among the best performers during the week, as seven trades worth €63,566 pushed the share price up by 5.3% to the €7.95 level.

In the banking industry, Bank of Valletta plc closed unchanged at €0.90 as a result of 22 trades of 127,935 shares. Although starting the week positively, the share price incrementally dropped over the rest of the week but managed to regain lost ground during yesterday’s session. Trading turnover reached €114,992.

Similarly, APS Bank plc (APS) shares remained unchanged, as two small trades worth €750 were recorded. The bank’s share price closed at €0.625.

APS announced that for the nine months ended September 2022, it posted €8.4m pre-tax profit at Group level compared to €16.7m during the first nine months of 2021, and €21.7m pre-tax profit at Bank level compared to €16m during the first nine months of 2021.

HSBC Bank Malta plc shares trended 2.7% higher to close at €0.77. The bank’s shares traded once during Wednesday’s trading session, with 3,156 shares exchanging ownership.

The equity of Lombard Bank Malta plc (Lombard) also gained during the week, as it closed at €1.95, a week-on-week increase of 2.6%. Lombard’s shares were involved in four trades of 5,220 shares.

In the telecommunications industry, GO plc shares rose by 1.4% to the €2.96 price level. Eight trades worth €54,127 were recorded. Since January, GO plc shares dropped by nearly 12%.

Looking at the IT sector, both BMIT Technologies plc (BMIT) and RS2 Software plc (RS2) held on to last week’s closing price of €0.466 and €1.36 respectively. BMIT recorded one trade across 5,000 shares, while RS2 traded four times on a volume of 3,550 shares.

The retail conglomerate PG plc closed the week unchanged at €2.10, as 91,000 shares, spread over five trades were executed. Total trading turnover reached €191,100 making it this week’s most liquid equity.

The Annual General Meeting of PG plc was held last Monday. The shareholders approved a number of resolutions put forward by the Board of Directors, including the approval of the audited financial statements for the financial year ended April 30, 2022 and amendments to the company’s Memorandum and Articles of Association.

Malta International Airport plc (MIA) shed 1.7% to close at €5.80. The airport operating company traded eight time across 15,464 shares. MIA announced that the European Commission approved a state aid measure to compensate MIA for the losses suffered due to the coronavirus pandemic. The sum of €12m will be granted in the form of tax credit.

Both Malita Investments plc (Malita) and Trident Estates plc (Trident) recorded gains, as the former gained 4.8% to end the week at €0.76, while the latter increased by 1.4% to close at €1.48. Malita shares experienced higher liquidity as trading value reached €12,768 compared to €7,104 recorded by Trident.

Contrastingly, VBL plc and Malta Properties Company plc (MPC) declined by 7.6% and 0.4% respectively. VBL plc traded twice during Tuesday’s trading session on a volume of 55,000 shares and closed the week at €0.22. On the other hand, MPC traded once on a mere volume of 66 shares to close at €0.498.

AX Real Estate plc closed unchanged at €0.535, as one trade involving the exchange of 5,000 shares was recorded.

Mapfre Middlesea plc kept hold of the €1.60 price level, as one small trade worth €1,346 across 841 shares was executed.

The postal service operator MaltaPost plc was also active during the week, as 24,100 shares spread over two trades were recorded. The company’s equity value closed unchanged at €1.11.

On Friday, the Board of Directors of Loqus Holdings plc approved the financial statements for the financial year ended June 30, 2022. The company achieved its highest results so far as revenues increased by 24% to €1.9m from the prior year, with EBITDA amounting to €2.7m and a profit of €1.75m.

The MSE Corporate Bonds Total Return Index dropped further, as it registered a marginal decline of 0.05% to 1,138.884 points. Out of 45 active issues, the 4.25% Best Deal Properties Holding plc Secured € 2024 issue was the most liquid, generating €0.4m in turnover and closing at €102.50.

The MSE MGS Total Return Index bounced back, as it gained 1% to close at 870.889 points. Trading was spread across a total of 11 issues with the 2.6% MGS 2028 (V) I bond being the most active, recording €0.4m in turnover over a single transaction and closing at €97.99.

On Thursday evening, the Malta Stock Exchange announced that the latest government stock issues will start trading on Monday, October 31, 2022.

In the Prospects MTF market, one issue was active. The 5% The Convenience Shop Holding plc Unsecured Callable € 2026-2029 recorded a total weekly turnover of €5,050, closing at €101.

| Upcoming Events | ||||

| 10 November 2022 | MT: Lombard Bank Malta plc – EGM | Best Performers: | ||

| IHI | +5.63% | |||

| SFC | +5.30% | |||

| MLT | +4.83% | |||

| Worst Performers: | ||||

| VBL | -7.56% | |||

| MIA | -1.69% | |||

| MPC | -0.40% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]