MSE Trading Report for Week ending 4 November 2022

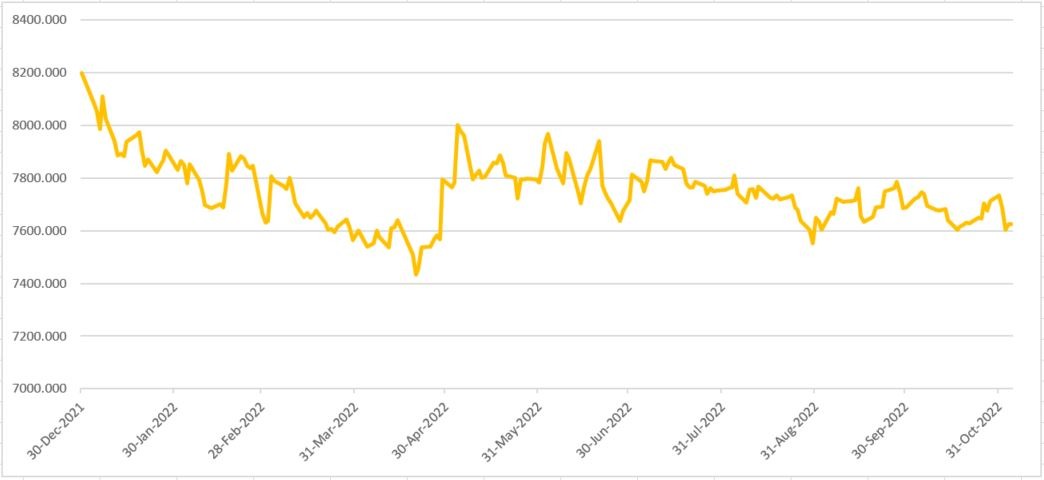

| MSE Equity Total Return Index: |

| Highlights: |

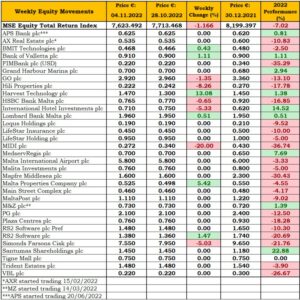

- The MSE Equity Total Return Index returned to negative territory, as it closed 1.2% lower at 7,623.492 points. A total of 18 issues were active, as gainers and losers tallied to six each. Total weekly turnover amounted to €0.58m, generated across 76 transactions.

- Bank of Valletta plc (BOV) saw its equity price gain 1.1% to close at €0.91. Trading activity included 12 deals on a volume of 73,000 shares with a total trading value of €65,904. Furthermore, BOV’s share price traded between an intra-week low of €0.89 and an intra-week high of €0.91.

- BOV published their interim directors’ report for the period January to September 2022. The bank reported a loss before tax for the year-to-date amounting to €55.7m. Excluding the effect of the settlement of the Deiulemar claim in May this year, the nine-month profit amounted to €47.8m, up by 3% compared to the same period last year. Revenue for the first nine months of 2022 stood at €202.3m. This constituted an improvement of 16.8%, reflecting the increase in Eurozone interest rates coupled with a rise in volumes in the retail sector, particularly in home lending, cards, and payments.

- Similarly, Lombard Bank Malta plc saw its equity gain 0.5% to end the week at €1.96, as 1,015 shares spread over two trades were recorded.

- The shares of HSBC Bank Malta plc shed 0.7%, as five trades involving 22,964 shares caused the bank’s price per share to close at €0.765.

- Both APS Bank plc (APS) and FIMBank plc managed to hold onto last week’s closing price, as they closed unchanged at €0.625 and $0.220 respectively. In terms of liquidity, APS shares traded 11 times across 7,805 shares, while FIMBank plc shares changed hands four times on a volume of 43,109 shares.

- Meanwhile, Malta International Airport plc (MIA) was this week’s most liquid equity, as it generated a total turnover of €0.15m. MIA closed the week flat at €5.80 as a result of six deals involving 25,000 shares.

- International Hotel Investments plc reached an intra-week low of €0.71 on Tuesday, ending the week with a negative 5.3% movement in price. This was the outcome of seven deals involving 103,170 shares.

- In the IT Services sector, the equity price of Harvest Technology plc jumped by 13.1% to the €1.47 price level, making it this week’s best performing equity. Trading activity was limited, as two small trades worth €766 were recorded.

- The shares of RS2 Software plc (RS2) experienced an increase of 1.5%, as it closed at €1.38. RS2 shares traded seven times, with trading turnover reaching €53,098.

- BMIT Technologies plc (BMIT) trended 0.4% higher to €0.468, as four trades across 16,000 shares were recorded. On a year-to-date basis, BMIT shares are down 2.5%.

- Telecommunications company GO plc lost 1.4%, as 15,025 shares were traded over three deals. The equity ended the week at €2.92.

- Simonds Farsons Cisk plc recorded a total turnover of €0.1m, as it reached a low of €7.55 on Wednesday, closing 5% lower. A total of 13,812 shares changed ownership over three transactions.

- Mapfre Middlesea plc closed unchanged at €1.60, as the equity traded once on Friday on a volume of 1,224 shares.

- In the property sector, Malta Properties Company plc advanced to the €0.525 price level. Five deals involving 35,125 shares pushed the price 5.4% higher.

- On the other hand, MIDI plc plummeted by 20%, making it this week’s worst performing equity. The equity closed at €0.272, as 1,500 shares changed hands over a single deal.

- Hili Properties plc shares retracted by 8.3% to end the week at €0.222. A total of 100,000 shares changed ownership across a single transaction.

- AX Real Estate plc was active during Wednesday’s trading session, as a sole transaction of trivial volume kept the previous week’s share price of €0.535.

- Similarly, 4,800 PG plc shares changed hands over a single deal. The equity ended the week unchanged at €2.10.

- Santumas Shareholdings plc announced that during the AGM held on October 28, 2022 a number of resolutions were approved, including the approval of the annual report and financial statements of the company for the year ended April 30, 2022.

- MedservRegis plc announced that it filed an application with the Malta Financial Services Authority requesting admissibility to listing on the Official List of the Malta Stock Exchange a maximum of €13m secured bonds redeemable in 2029, issued at par and bearing a rate of interest of 5%.

- The Board of Directors of MaltaPost plc announced that they will meet on December 19, 2022 to consider and approve the financial statements for the year ended September 30, 2022.

- The MSE MGS Total Return Index gained 1%, as it reached 879.666 points. Out of 11 active issues, eight advanced while another three closed in the red. The 2.5% MGS 2036 (I) (xd) and 4% MGS 2032 (VII) r headed the list of gainers, each closing 4% higher at €87.58 and €103.99, respectively. Conversely, the 4.65% MGS 2032 (I) closed 0.9% lower at €109.27.

- The MSE Corporate Bonds Total Return Index registered a 1.1% decline, as it closed at 1,126.790 points. A total of 52 issues were active, 14 of which traded higher while another 21 lost ground. The 3.85% Hili Finance Company plc Unsecured € 2028 was the best performer, as it closed 3.2% higher at €98. On the other hand, the 4% Hili Finance Company plc Unsecured € 2027 ended the week 5.5% lower at €95.

- In the Prospects MTF market, seven issues were active. The 5% Busy Bee Finance plc Unsecured € 2029 was the most liquid bond, as it generated a total turnover of €29,878.

| Upcoming Events | ||||

| 10 November 2022 | MT: Lombard Bank Malta plc – EGM | Best Performers: | ||

| 19 December 2022 | MT: MaltaPost plc – Full-Year Results | HRV | +13.1% | |

| MPC | +5.42% | |||

| RS2 | +1.47% | |||

| Worst Performers: | ||||

| MDI | -20.0% | |||

| HLI | -8.26% | |||

| IHI | -5.33% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]