MSE Trading Report for Week ending 25 November 2022

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index (MSE) closed the week 0.5% lower at 7,504.817 points. Total weekly turnover stood at €0.6m, as 20 equities were active, three of which gained, while 13 declined.

The MSE MGS Total Return Index ended the week 0.3% higher at 893.375 points. Out of 12 active issues, eight posted gains while four declined. The 2.5% MGS 2036 (I) gained 2.3% to close at €89.57, ending the week as the best performer. On the other hand, the 3% MGS 2040 (I) suffered the biggest drop, as it declined by 2.6%, to close at €95.48.

The MSE Corporate Bonds Total Return Index increased by 0.3%, to end the week at 1,119.753 points. A total of 41 bonds were active, as nine bonds advanced while 16 declined. The 4% Hili Finance Company plc Unsecured € 2027 was the best performer, as it gained 4%, to close at €98.79. On the other hand, the 3.75% Bank of Valletta plc Unsecured Sub € 2026-2031 suffered the biggest decline, as it shed by 9.5%, to €90.

| Top 10 Market Movers: |

International Hotel Investments plc (IHI) was one of this week’s best performing equities, as the hotel operating company experienced a 7.7% increase in its share price to close at €0.70. One small trade worth €700 was recorded during Wednesday’s trading session.

PG plc trended 0.9% higher to close at €2.14. Trading activity included six trades on a volume of 115,415 shares. Total trading turnover reached €246,898. Since January, the Company’s share price is down by 10.8%.

Bank of Valletta plc shed 3.3%, as 10 transactions spread over 35,504 shares were recorded. The bank’s share price fluctuated between a weekly high of €0.88 and a low of €0.87, this week’s closing price.

HSBC Bank Malta plc suffered a similar faith, as five trades involving the exchange of 23,126 shares pushed the bank’s share price 4.7% lower to €0.715. Trading value tallied to €16,863.

APS Bank plc saw its shares close at €0.595, a week-on-week decline of 2.5%. Trading activity included seven deals worth €10,204.

Malta International Airport plc (MIA) shares declined by 1.7% to close the week at €5.70. The equity was active across 10 trades worth €65,341 on a volume of 11,426 shares.

During Wednesday’s trading session, the equity value of Simonds Farsons Cisk plc slid 2% to the €7.35 price level, as a result of three trades of 1,361 shares.

VBL plc saw its equity value jump by 18.2%, to the €0.26 level. This increase was the result of the exchange of 350,000 shares on a single trade carried out on Monday.

MedservRegis plc shares closed 7.1% lower at €0.65, as one small trade worth €1,084 was recorded.

Similarly, Harvest Technology plc plummeted by 15% to end the week at €1.25. Two small trades on a volume of 1,900 shares were recorded.

| Company Announcements: |

The Board of Directors of PG plc announced that on November 21, 2022, Pavi Shopping Complex Limited, a wholly-owned subsidiary of PG plc, entered into a promise of sale agreement with Nylon Knitting Limited for the transfer of land in the limits of Qormi. The property is being transferred for the consideration of €7m, 10% of which sum has been paid by PG plc to the vendor as a deposit on account of the price. The remaining balance shall be settled upon entry into the final deed of sale by the parties.

During the week, IHI published a business update for the third quarter. IHI Group’s revenue for 2022, for all hotels and other operations, is expected to reach €232m, an increase of €8m on the figure announced in August. Revenue for the year is expected to be 84% of the 2019 level and is being driven by IHI owned hotels. EBITDA is forecast at €49.1m for 2022 and is based on volume increases as business returns.

Mariner Finance plc announced that it received regulatory approval for the issue of up to €44m 5% unsecured bonds, which are to be issued at par, and redeemable in 2032. Application forms were mailed to holders of existing bonds on November 25, 2022. The offer period for holders of existing bonds and for the general public shall commence on November 28, 2022 and lapse on December 16, 2022, but may close earlier in the event of over-subscription.

On Thursday, Von der Heyden Group Finance plc announced that its recently issued €35m 5% Unsecured Bonds 2032 were subscribed in full and allocated amongst the maturing bondholders and authorised financial intermediaries in accordance with the terms of the Prospectus. Accordingly, subscription closed last Thursday.

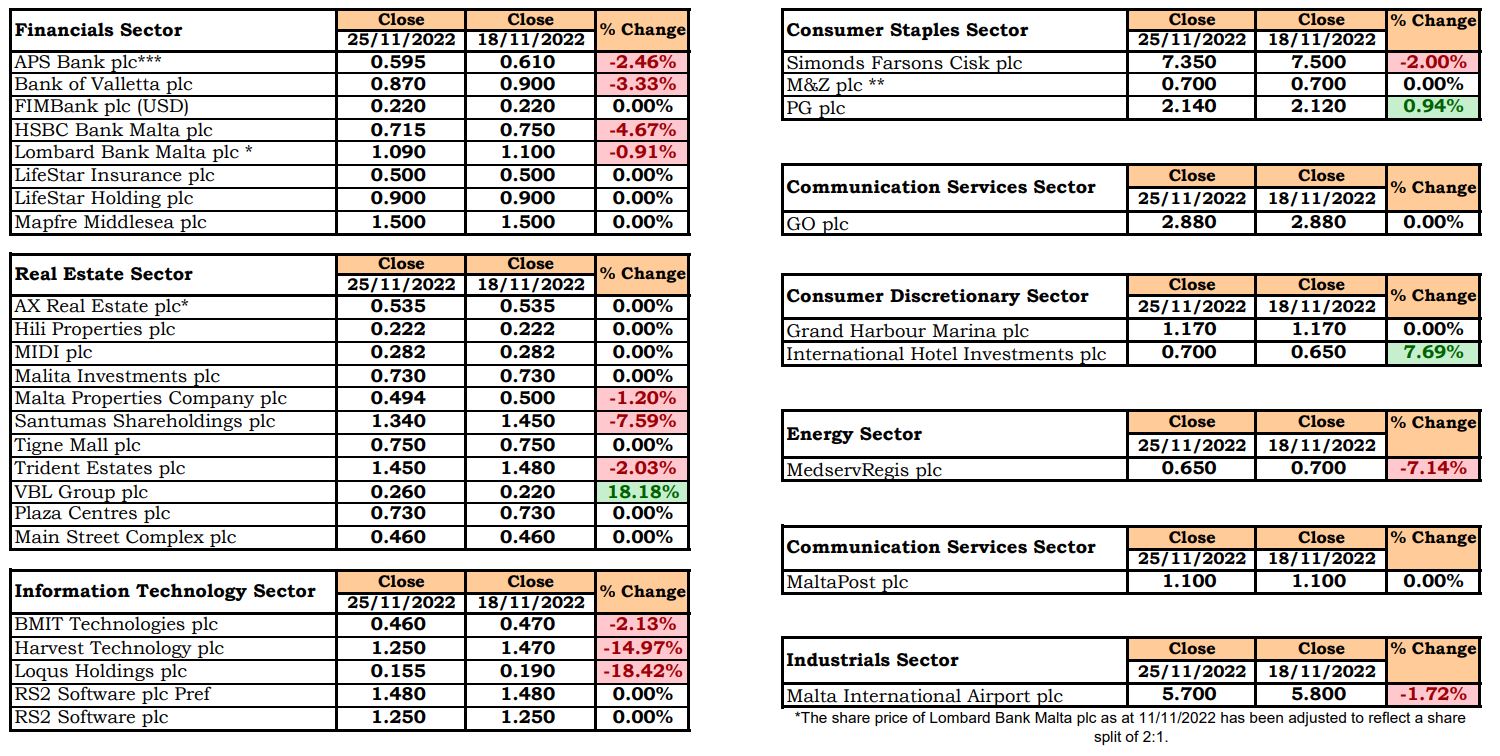

| Market Movers by Sector: |

| Upcoming Events: |

| 19 December 2022 | MT: MaltaPost plc – Full-Year Results |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]