MSE Trading Report for Week ending 6 January 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index (MSE) extended the previous week’s gain by a further 0.6%, as it closed at 7,446.083 points. A total of 14 equities were active, as five registered gains and six declined. A total weekly turnover of €0.9m, up from €0.3m last week, was generated across 128 transactions.

The MSE Malta Government Stocks Total Return Index lost 0.6%, as it declined to the 879.528 level. A total of 15 issues were active, as seven advanced while another six closed in the red. The best performer was the 3% MGS 2040 (I), as it added 1.6%, closing at €97.50. The 0.80% MGS 2027 (III) declined by 12.6%, to close at €90.10.

The MSE Corporate Bonds Total Return Index gained 0.1%, as it reached 1,126.107 points. Out of 40 active issues, 10 headed north while another 15 closed in the opposite direction. The top performer was the 4.15% Phoenicia Finance Company plc Unsecured € 2023-2028, as it closed 6.7% higher at €96. On the other hand, the 3.8% Hili Finance Company plc Unsecured € 2029 lost 8.5%, to close at €85.60.

| Top 10 Market Movers: |

Bank of Valletta plc (BOV) started the first week of the year with a gain of 8.6%, to close at €0.88. BOV was the most liquid equity, as €0.6m was generated across 59 deals. During the week the bank’s shares traded at a weekly high of €0.99 and a low of €0.80.

HSBC Bank Malta plc jumped by 14.1% to close at €0.81. A total of 21 transactions worth €106,262 were executed.

FIMBank plc was active across two transactions involving 13,010 shares worth $2,651. The banking group registered a 13.7% increase, to finish the week at the $0.216 level.

Lombard Bank Malta plc closed in the red, with a 29.3% week-on-week decline. A total weekly turnover of €6,321 was spread across four deals involving 8,428 shares, as the equity closed at €0.75.

APS Bank plc traded 2.4% lower, as 25,912 shares changed hands across five transactions. The bank ended the week at the €0.60 price level.

Simonds Farsons Cisk plc joined the list of gainers, as six transactions of 2,475 shares pushed the share price higher to €7.35. This translated to a 7.3% or €0.50 positive movement in price.

A sole transaction of trivial volume pushed the share price of VBL plc 3.1% higher to €0.268.

On the other hand, Malta Properties Company plc registered a double-digit loss of 20%. Two deals involving 2,178 shares pushed the price down to €0.40.

The share price of International Hotel Investments plc retracted by 5.2%, closing the week at €0.64. This was the outcome of a single deal of 15,350 shares worth €9,824.

The share price of Malta International Airport plc lost 3.5% to close at €5.60. Nineteen deals of 18,382 shares were executed. The equity registered a total turnover of €102,898.

| Company Announcements: |

Pharmacare Finance plc announced that pursuant to a bondholders meeting held last Wednesday, the required majority of holders of the €5m 5.75% unsecured bonds 2025-2028, approved the early redemption of the respective bond. In terms of the new upcoming €17m bond issue with an interest rate of 6% and unsecured bonds redeemable in 2033, the company will be granting preference to maturing bondholders for the subscription to the new bonds.

The board of Loqus Holdings plc announced that the forthcoming AGM of the company shall be held on the January 31, 2023.

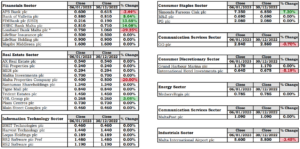

| Market Movers by Sector: |

| Upcoming Events: |

| 31 January 2023 | MT: Loqus Holdings – Annual General Meeting |

| 02 February 2023 | MT: MaltaPost plc – Annual General Meeting |

| 16 March 2023 | MT: MaltaPost plc – Dividend Payment Date |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]