MSE Trading Report for Week ending 27 January 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index headed 1.1% north, as it reached 7,421.991 points. A total of 18 equities were active; six of which closed in the green while another seven headed south. During the week, total turnover was €0.2m lower than the previous week, as it stood at €0.6m, generated across 110 transactions.

The MSE MGS Total Return Index lost ground, as it closed 0.2% lower at 884.769 points. A total of 12 issues were active, with two registering gains and another eight closing in the red. The 3.4% MGS 2027 (VI) r headed the list of gainers, as it closed 1% higher at €102.50. On the other hand, the 5.2% MGS 2031 (I) ended the week 1.7% lower at €113.28.

The MSE Corporate Bonds Total Return Index advanced marginally by 0.1% to 1,123.814 points. Out of 51 active issues; 19 registered gains, while another 21 traded lower. The best performance, that of 2.8%, was recorded by the 3.5% Simonds Farsons Cisk plc Unsecured € 2027, as it closed at €92.50. Conversely, the 3.25% AX Group plc Unsecured Bonds 2026 Series I closed at €85.51, translating into a 10% decline.

| Market Highlights: |

The share price of HSBC Bank Malta plc (HSBC) shot up to an eight-month high of €0.83. This translated to a 13% increase, as 199,285 shares exchanged ownership across 30 transactions.

International Hotel Investments plc gained 3.5%, as it finished the week at €0.60. This was the result of four deals of 20,335 shares. Since the beginning of the year, the equity is down by 11%.

APS Bank plc finished the week 2.5% higher at €0.62, as 14,710 shares were spread across four deals.

Malita Investments plc headed north as three deals of 20,400 shares pushed the share price 3.3% higher. The equity ended the week at €0.62.

The highest liquidity was recorded by PG plc. The equity generated a total weekly turnover of €170,049 as 81,803 shares changed hands across 11 transactions. As a result, PG ended the week unchanged at €2.06, despite reaching a weekly high of €2.08.

Bank of Valletta plc also closed flat at €0.90, recording a total turnover of €112,258. A total of 19 deals involving 125,078 shares were executed, as the share price oscillated between a weekly high of €0.93 and a low of €0.85.

Similarly, Malta International Airport plc (MIA), closed unchanged at €5.60. MIA traded 11 times over 10,516 shares, generating a total turnover of €58,737.

Trident Estates plc registered the worst performance, as it lost 4%. The equity ended the week at €1.39, as a result of a sole transaction involving 2,120 shares.

GO plc was active across three trades during the week, resulting into a 0.7% fall in price, to close at €2.76. A total of 4,150 shares worth €11,488 were executed.

A total of 2,710 Simonds Farsons Cisk plc shares were traded over five deals. This yielded a negative 0.7% movement in price, to close at €7.20.

| Company Announcements: |

MedservRegis plc announced that its subsidiary, Medserv Cyprus Limited, has been awarded a new contract with Chevron Cyprus Limited for the provision of operational base support services from the company’s facilities in the port of Limassol, Cyprus.

Yesterday HSBC announced that the Bank has entered into a €30m loan agreement with HSBC Continental Europe. The purpose of the loan is to enable the Bank to meet the minimum requirement for own funds and eligible liabilities. The loan, which is unsecured, is for a period of four years with an option of early repayment as from the third year. The loan bears interest at a rate equal to 3-months EURIBOR plus a margin of 127 basis points, which is currently resulting in an effective rate of 3.77%.

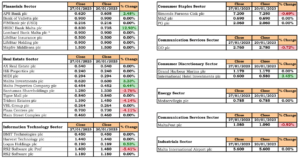

| Market Movers by Sector: |

| Upcoming Events: |

| 31 January 2023 | MT: Loqus Holdings – Annual General Meeting |

| 02 February 2023 | MT: MaltaPost plc – Annual General Meeting |

| 16 March 2023 | MT: MaltaPost plc – Dividend Payment Date |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]