MSE Trading Report for Week ending 24 March 2023

| Movement in Equity and Bond Indices: |

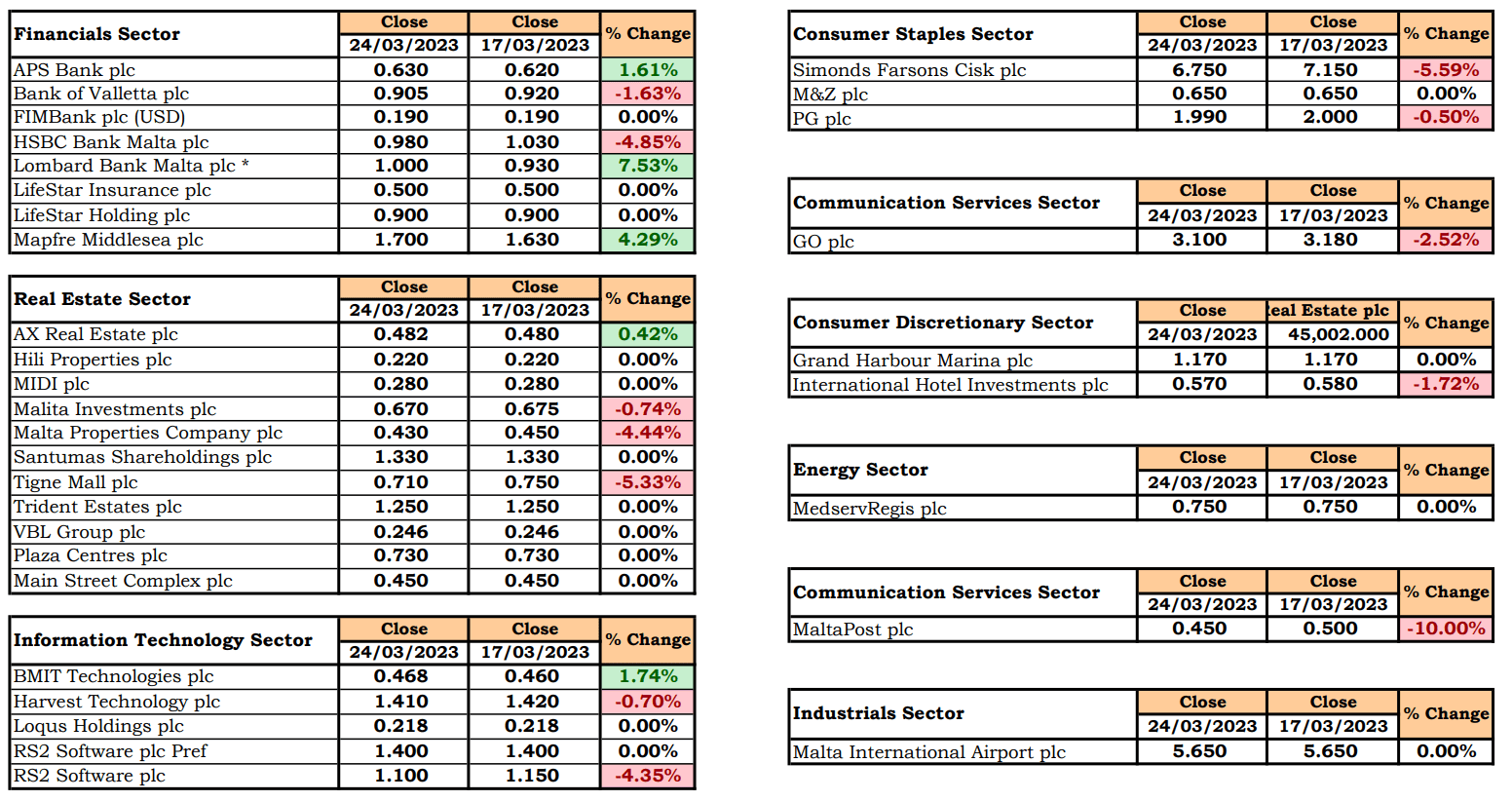

The MSE Equity Total Return Index extended its recent declines, as it dropped to 7,465.092 points, equivalent to a 1.1% change. A total of 23 issues were active, out of which, five headed north while another 12 closed in the opposite direction. During the week, total turnover stood at €0.6m. This was generated across 132 transactions.

The MSE MGS Total Return Index closed relatively unchanged at 881.766 points, a mere increase of 0.01%. A total of 20 issues were active, 12 of which registered gains, while another eight closed in the red. The 1.8% MGS 2051 headed the list of gainers, as it closed 4.7% higher at €64. On the other hand, the 1.70% MGS 2028 ended the week 8.8% lower at €92.25.

The MSE Corporate Bonds Total Return Index managed to recoup some lost ground, as it closed 0.7% higher at 1,133.530 points. Out of 62 active issues, 25 registered gains, while another 18 traded lower. The best performing issue was the 3.85% Hili Finance Company plc Unsecured € 2028, as it closed 6.1% higher, at €95.99. Conversely, the 5.9% Together Gaming Solutions plc Unsecured Callable Bonds €2024-2026 closed at €98 – a 3% decline.

| Market Highlights: |

HSBC Bank Malta plc, significantly impacted the MSE Index, as a total of 170,884 shares, worth €171,451, were executed across 21 deals. This resulted into a 4.9% decline in share price, ending the week at €0.98. Despite the decline, on a year-to-date basis, the share price remains 38% higher.

Its peer, Bank of Valletta plc, closed at €0.905. This equates to a 1.6% decline in share price. A total of 47,980 shares exchanged ownership across 15 deals.

A sole transaction of 2,988 Lombard Bank Malta plc shares pushed the share price 7.5% higher. The banking equity ended the week at €1.

APS Bank plc added 1.6% to the previous week’s closing price, to close at €0.63. A total of 69,067 shares were executed across 11 transactions.

Elsewhere, the share price of MAPFRE Middlesea plc advanced by 4.3%, closing the week at €1.70. This was the outcome of 21,544 shares executed across 12 deals.

Similarly, Simonds Farsons Cisk plc was active on Tuesday, recording a 5.6% drop. The equity closed the week at €6.75, as a total of 558 shares exchanged hands over two trades.

RS2 Software plc declined further, as a result of 4,000 shares spread across three deals. The price of the ordinary shares retracted by 4.4%, closing the week at €1.10.

GO plc, started off on a negative note, as it closed Tuesday’s session at €3.00. The equity managed to recoup some lost ground on Wednesday, as it closed at €3.10 – a 2.5% decline. This was the outcome of 3,950 shares spread over five deals.

International Hotel Investments plc traded on eight occasions during the week, resulting into a 1.7% fall in share price, to settle at €0.57. A total of30,437 shares, worth €17,075, were executed.

The share price of MaltaPost plc was adjusted from €1 to €0.50 as a result of a two for one share split which took place on Tuesday. The equity registered a 10% decline, to close at €0.45. This was the outcome of eight deals involving 17,106 shares.

| Announcements: |

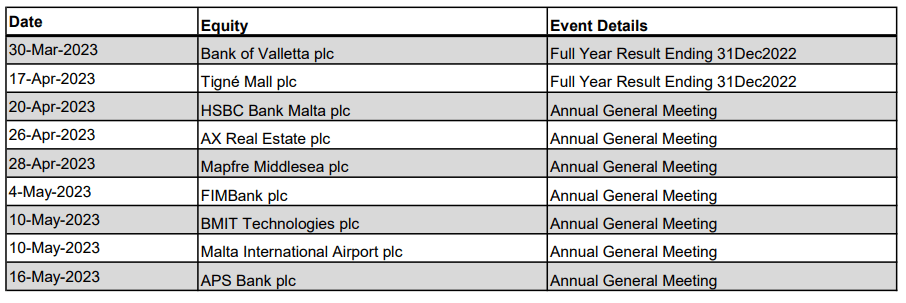

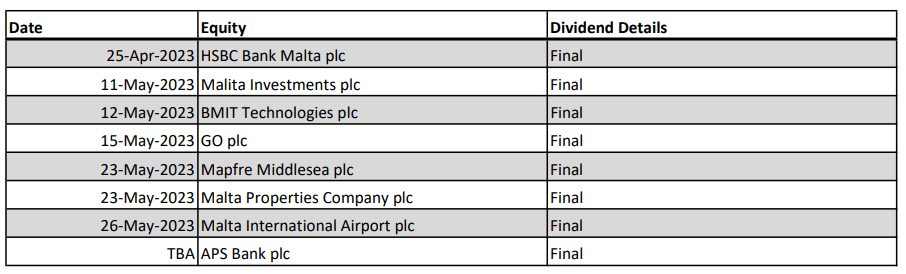

Bank of Valletta plc (BOV) announced that the board is scheduled to meet on March 30, 2023, to consider and approve the group’s and the bank’s audited financial statements for financial year ended December 31, 2022. BOV also announced that the bank’s AGM will be held on May 25, 2023.

The board of Lombard Bank Malta plc is scheduled to meet on April 27, 2023 to approve the group’s and the bank’s audited financial statements for financial year ended December 31, 2022.The declaration or otherwise of a final dividend will be recommended and considered at the bank’s AGM.

FIMBank plc approved the bank’s annual report and financial statements for the financial year ended December 31, 2022. The group and the bank reported a loss after tax of $26.7m and $22m respectively, for the year under review.

The board of MAPFRE Middlesea plc approved the audited financial statements for financial year ended December 31, 2022. The company registered a profit after-tax of €3.8m for the year ending December 31, 2022 when compared to €2.6m in the previous year.

MaltaPost plc announced that with effect from March 21, 2023, the nominal value of each ordinary share in the company has been redenominated from €0.25 per Ordinary Share to €0.125 per Ordinary Share, as a result of the share split.

VBL plc announced to the market that it has started to review various strategic options for the company’s future, to assess available options with a view to further developing VBL. The company is considering the possibility of raising further capital from strategic and/or financial investors or carrying out equity transaction(s), including options which might result in a change to the shareholding structure.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]