MSE Trading Report for Week ending 30 March 2023

| Movement in Equity and Bond Indices: |

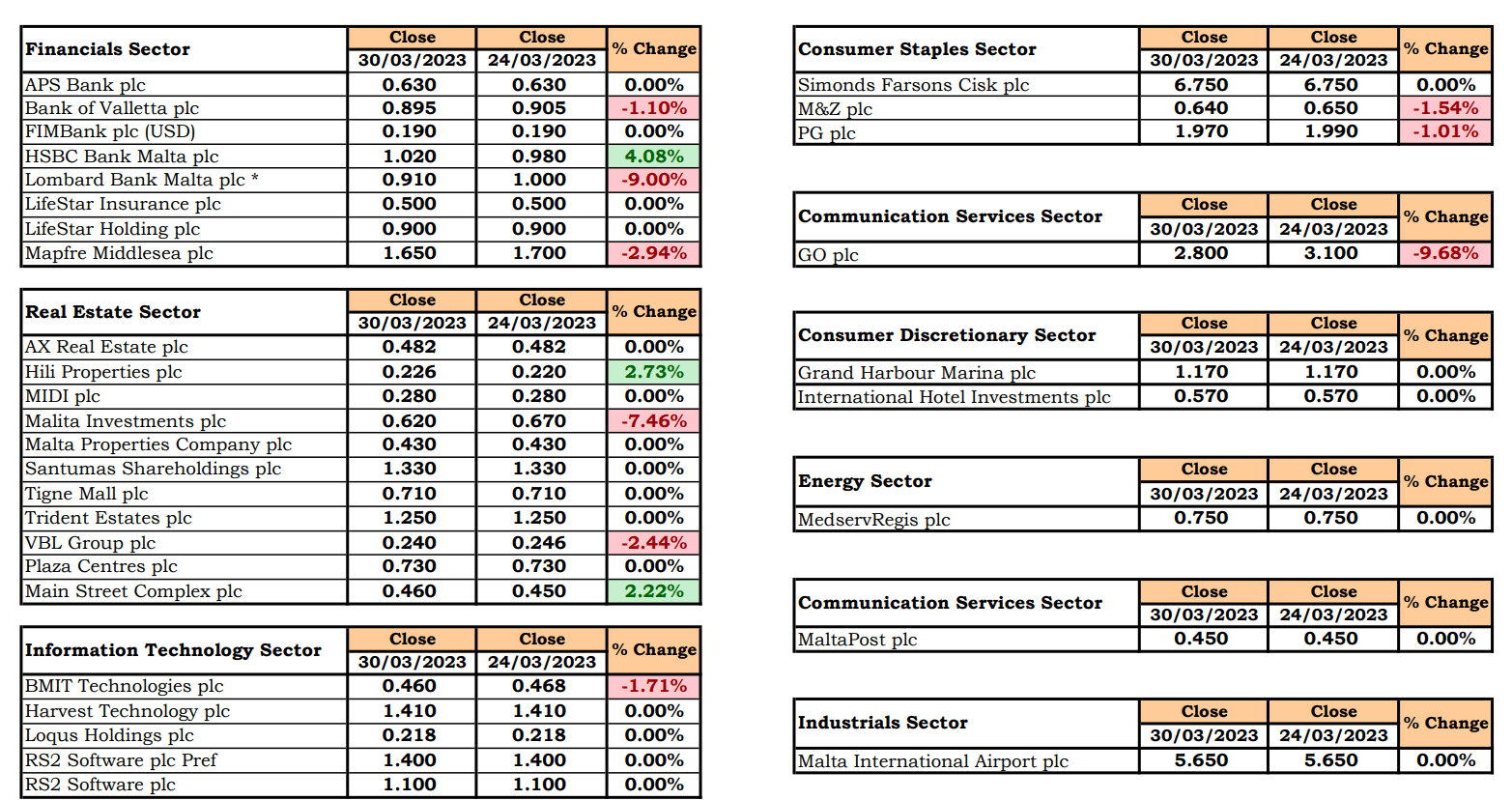

The MSE Equity Total Return Index extended its recent declines, as it closed the short trading week at 7,393.911 points, equivalent to a 1% change. A total of 17 equities were active, as three headed north while another nine closed in the opposite direction. Total turnover stood at €0.5m, traded across 94 transactions.

The MSE MGS Total Return Index posted a positive 0.2% movement, ending the week at 883.178 points. A total of nine issues were active, four of which registered gains, while another two closed in the red. The 3% MGS 2040 (I) headed the list of gainers, as it closed 1.1% higher at €92. On the other hand, the 4% MGS 2043 (I) R ended the week 1.9% lower at €101.50.

The MSE Corporate Bonds Total Return Index added to the previous week’s gains, closing at 1,137.303 points, higher by 0.3%. Out of 64 active issues, 33 registered gains, while another 11 traded lower. The best performance of 11.7% was recorded by the 4.5% Shoreline Mall plc Secured € 2032, as it closed at €94.99. Conversely, both the 4.5% MedservRegis plc Unsecured € 2026 and the 4.35% SD Finance Unsecured € 2027 declined by 1%.

| Market Highlights: |

GO plc registered the worst performance, as the share price of the telecoms company declined by 9.7% to finish at the €2.80 price level. This was the outcome of 6,050 shares executed across six deals on Monday. On a year-to-date basis, the equity is down by 2.1%.

In the banking sector, Bank of Valletta plc (BOV) shares shed 1.1%, as 20 deals involving 125,424 shares dragged the share price to €0.895. During the first quarter BOV shares gained 10.5%.

On the other hand, HSBC Bank Malta plc (HSBC) partially recovered the previous week’s loss, as 12 deals involving 200,223 shares were recorded. The equity gained 4.1%, ending the week at €1.02. HSBC was the most liquid equity, as turnover totaled €205,173.

The share price of Lombard Bank Malta plc retracted by 9%. The equity traded at a weekly low of €0.90 and a high of €1, but ultimately ended the week at €0.91. Six deals of 39,299 shares were executed.

A sole deal of 5,000 MAPFRE Middlesea plc shares, pushed the share price 3% lower to the €1.65 price level. Despite the week-on-week decline, the equity has advanced by 3.1% since the beginning of the year.

PG plc finished the week at €1.97, as five deals worth €11,820 dragged the share price 1% lower.

BMIT Technologies plc was active across a single trade involving 3,029 shares. The share price ended the week 1.7% lower at €0.46.

VBL plc declined by 2.4%. The equity ended the week at €0.24 as 20,500 shares were spread across two deals.

Malita Investment plc joined the list of negative movers, as a single transaction worth €1,240 dragged the share price 7.5% lower. The equity ended the week at €0.62.

Hili Properties plc headed north as a result of a single deal of 2,970 shares. The equity gained 2.7% to end the week at €0.226.

| Announcements: |

Bank of Valletta plc (BOV) published the 2022 financial results, recording a profit before tax of €48.7m compared to €80.7m achieved in the previous year. Net interest income improved by 29% to €202m, as interest on loans and advances increased while the bank’s interest expense declined. BOV’s operating income during the 2022 financial year stood at €293m up from €243m the previous year. Operating profit before litigation settlement charge improved to €149.8m, as operating costs declined while the Bank booked a net impairment reversal of €49m.

If one were to exclude the impact of the one-off net settlement of €103m Deiulemar litigation, the adjusted profit before tax was €151.7m, an increase of €71m, or 88% higher when compared to the results in 2021. The board did not declare any interim dividends and is not proposing any dividend for the year.

The board of MedservRegis plc announced that the company’s AGM will be held on May 26, 2023.

| Market Movers by Sector: |

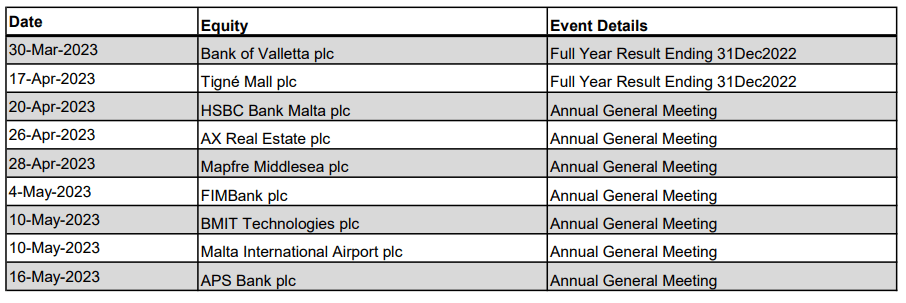

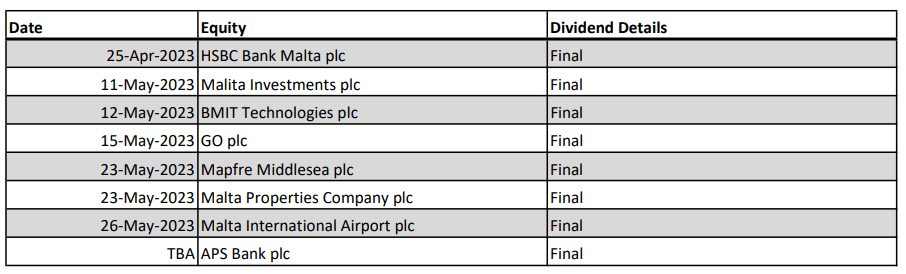

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]