MSE Trading Report for Week ending 06 April 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index performed positively, as it closed the four-day trading week at 7,404.326 points, equivalent to a 0.1% increase. A total of 16 equities were active, as five gained while eight declined. Total turnover stood at €0.6m, traded across 89 transactions.

The MSE MGS Total Return Index gained 0.5%, ending the week at 887.513 points. A total of 17 issues were active, 11 of which registered gains, while four closed in the red. The 2.3% MGS 2029 (II) headed the list of gainers, as it closed 5.3% higher at €100. On the other hand, the 1.5% MGS 2045 (I) ended the week 13.8% lower at €63.76.

The MSE Corporate Bonds Total Return Index was up by 0.1%, closing at 1,138.955 points. Out of 56 active issues, 21 registered gains, while another 11 traded lower. The best performing corporate bond issue was the 3.75% Tumas Investments plc Unsecured € 2027, as it closed 4.2% higher at €99. Conversely, the 5.9% Together Gaming Solutions plc Unsecured Callable Bonds €2024-2026 declined by 5%, to settle at €96.

| Market Highlights: |

The equity of APS Bank plc (APS) lost 3.2% to close at €0.61 as one trade involving 322,595 shares, was executed during last Monday’s trading session. Total trading turnover tallied to €196,783.

HSBC Bank Malta plc (HSBC) shed 2%, to close the week at €1. Trading activity included 14 deals worth €153,139. On a year-to-date basis, the bank’s shares are up by 40.9%.

On the other, Bank of Valletta plc gained 0.6%, to close at €0.90, as a result of 28 trades. Trading turnover was similarly high to HSBC and APS, as it reached €160,716.

The price per share of LifeStar Holding plc plummeted 77.6% to €0.202 during last Tuesday’s trading session. This sharp decline was due to two small trades with a mere trading value of €161.

RS2 Software plc (RS2) jumped 3.6%, as four trades worth €8,804 pushed the Company’s share price to €1.14. RS2 shares are 4.2% down year-to-date.

The share price of the telecommunications company GO plc, closed the week 1.4% in the green at €2.84. The Company’s shares were involved in two small trades worth €829 and a volume of 292 shares.

BMIT Technologies plc (BMIT) traded 4.4% lower, to end the week at €0.44, as 41,943 shares exchanged ownership across six trades.

One trade involving 2,000 Maltapost plc shares pushed the equity’s price €0.01 or 2.2% higher to €0.46.

International Hotel Investments plc gained 1.8%, to close the four-day trading week at €0.58, as 7,505 shares changed hands over three trades.

Hili Properties plc shares declined by 2.7%, to close at €0.22, as two trades of 27,300 shares were executed.

| Announcements: |

The Board of Directors of LifeStar Insurance plc approved the Annual Report and Consolidated Financial Statements for the financial year ended December 31, 2022. The company registered an increase in gross written premium of 1.3% when compared to the same period last year, to close off at €12.9m. Value of in-force business also saw a healthy increase of 6.4%.

The insurance business was adversely affected by the downward trend experienced in all classes of investments. The group incurred an unrealised loss on investments of €4.1m. This contributed to overall loss to the group of €3.1m (2021: profit €544,000) and generated a total loss for the year of €1.8m (2021: income of €1.9m). The loss is due to the adverse unrealised losses on investments, surrenders, maturities and a number of one-off costs. No dividends were declared for the year 2022.

Last Thursday GO plc and BMIT announced that they are in discussions for the potential assignment and transfer of certain lease rights and obligations currently enjoyed by GO plc and the passive infrastructure used for the hosting of telecommunications equipment. Negotiations are still ongoing, and the transaction is subject to a number of different variables.

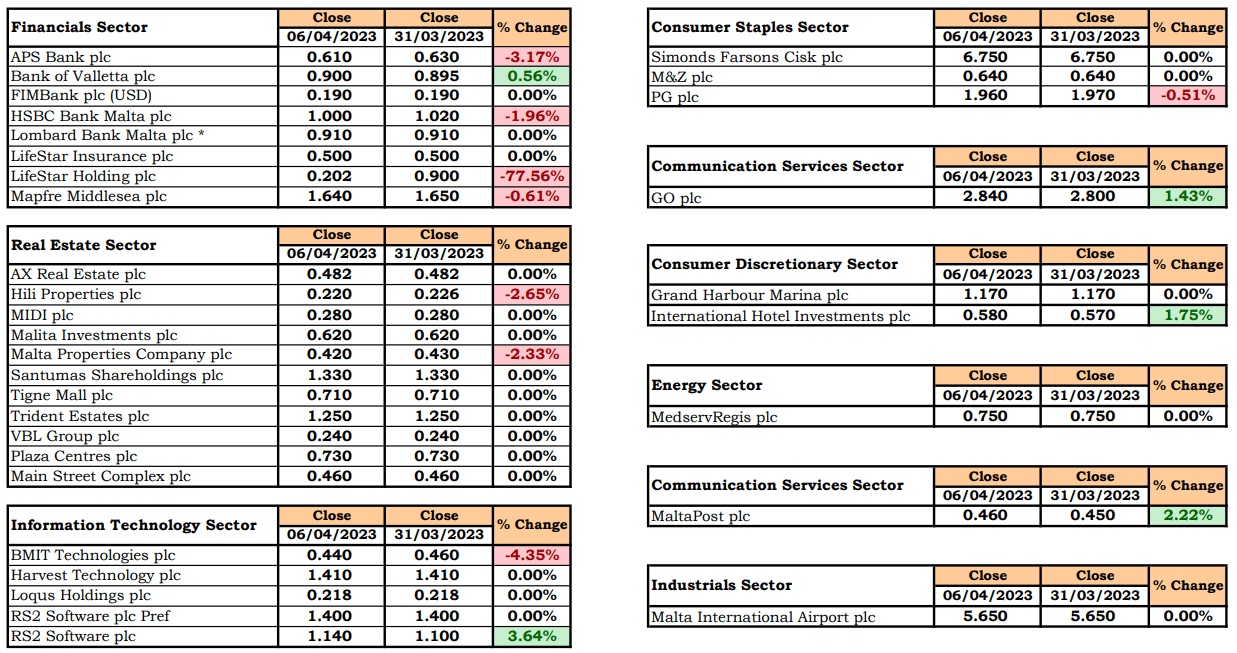

| Market Movers by Sector: |

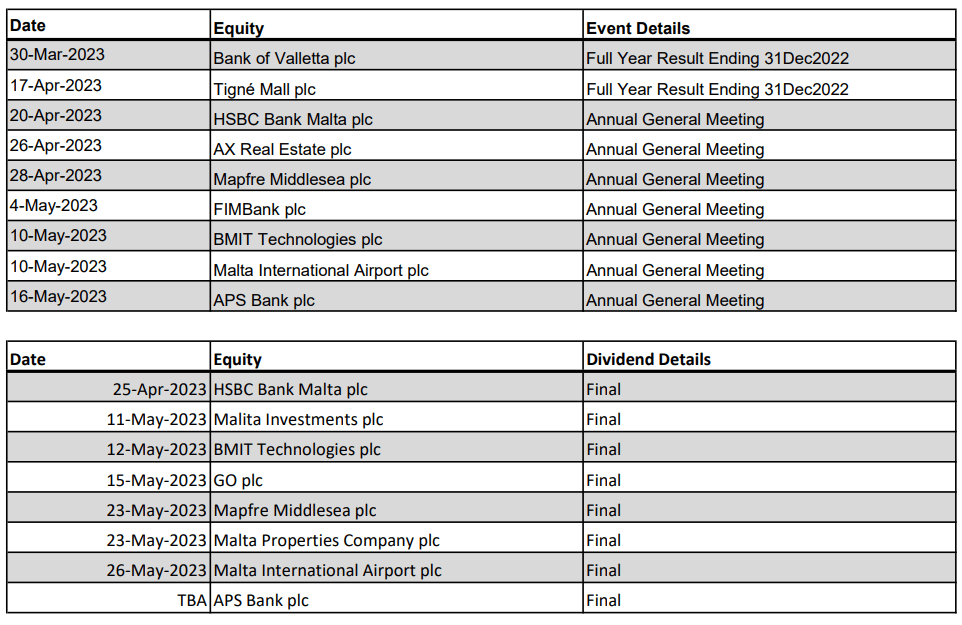

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]