MSE Trading Report for Week ending 21 April 2023

| Movement in Equity and Bond Indices: |

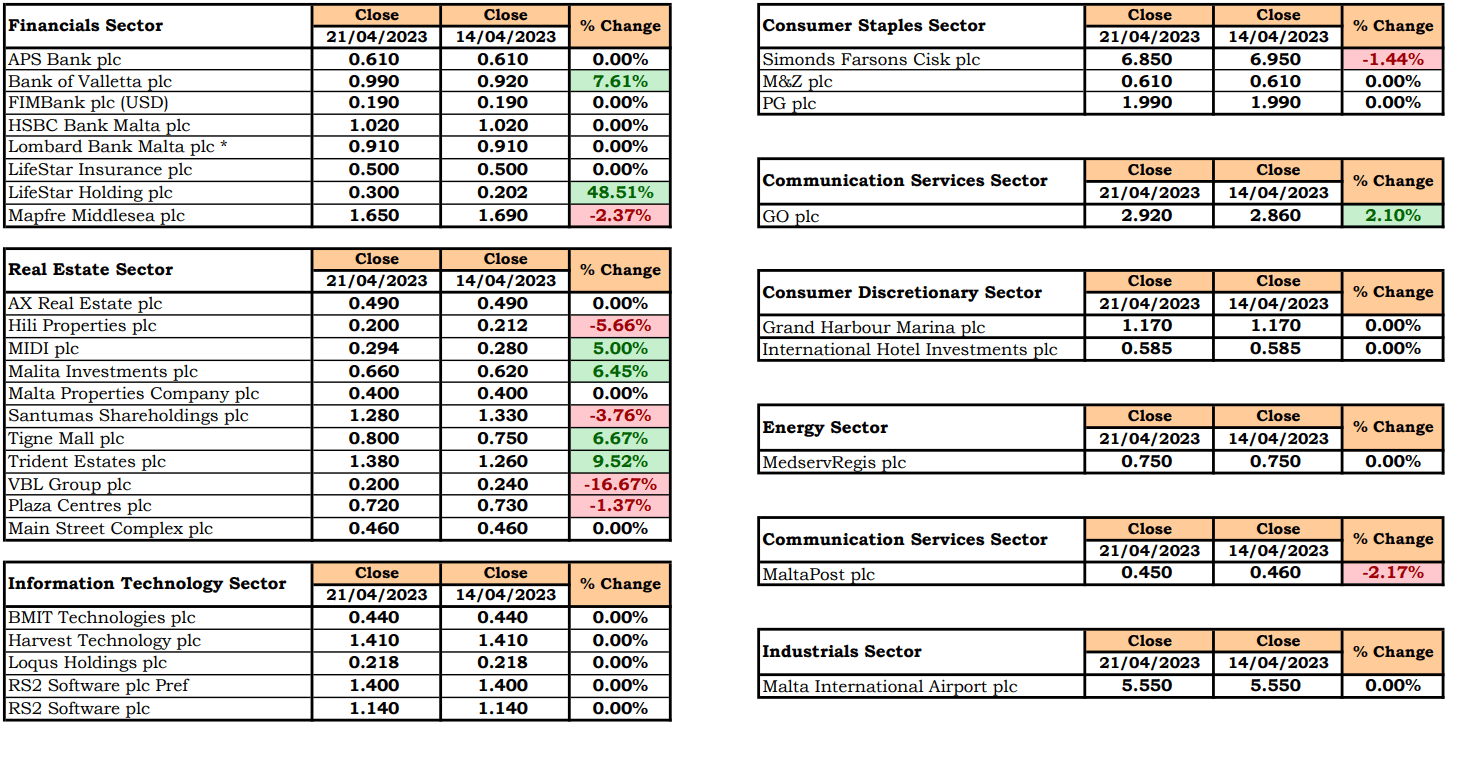

The MSE Equity Total Return Index ended the week in positive territory for a third consecutive week. The Index reached 7,540.169 points, equivalent to a 0.9% weekly increase. A total of 23 equities were active, of which gainers and losers tallied to seven-a-piece. During the week activity increased by €0.4m as total turnover amounted to €1.03m, generated across 146 transactions.

The MSE Corporate Bonds Total Return Index recovered by 0.4%, as it reached 1,142.119 points. Out of 59 active issues, 23 headed north, while another 22 closed in the opposite direction. The 4% MeDirect Bank (Malta) plc Sub Unsecured € 2024-2029 issue recorded the best performance, up by 5.6% to close at €94. Conversely, the 4% Central Business Centres plc Unsecured € 2027-2033 lost 4.9%, ending the week at €92.25.

The MSE MGS Total Return Index retracted further, closing 0.4% lower at 878.830 points. Out of 19 active issues, two headed north while another 16 closed in the opposite direction. The 2.1% MGS 2039 (I) headed the list of gainers, as it closed 4.9% higher at €85. On the other hand, the 2.10% MGS 2032 (IV) closed 5.4% lower at €88.65.

| Market Highlights: |

Bank of Valletta plc was the most liquid equity during the week as 637,574 shares were dealt across 61 deals. The equity returned to the €0.99 price mark, reached at the beginning of January this year, following a 7.6% gain in its share price.

In the communication services sector, GO plc traded at a weekly high of €2.94 and a low of €2.84, finishing the week at €2.92 – a week-on-week gain of 2.1%. This was the outcome of six deals worth €23,784.

Life Star Holdings plc was the best performing equity for the week, increasing by 48.5% to the €0.30 price level. This was a result of two deals worth just €86.

On the other hand, Mapfre Middleasea plc was active on Thursday, as 723 shares changed ownership over three deals. As a result, the equity lost 2.4% to close at €1.65.

MIDI plc was active on Monday across five deals involving 100,000 shares. The share price advanced by 5% to close at a 15-week high of €0.294.

On a similar note, Trident Estates plc registered a 9.5% rise in price, as it ended the week at €1.38. Six deals involving 6,144 shares were executed.

VBL plc was the worst performing equity as its share price dropped by 16.7% to finish the week at €0.20. This was the outcome of a single transaction of 10,000 shares.

Hili Properties plc followed suit as a total of 61,700 shares changed hands across six deals. The equity ended the week at €0.20, lower by 5.7%.

In the consumer staples sector, three trades of 350 Simonds Farsons Cisk plc shares dragged the share price by 1.4% to €6.85.

MaltaPost plc shaved 2.2% off its price, as a single transaction involving 5,840 shares was executed at the €0.45 price mark.

| Announcements: |

The board of Grand Harbour Marina plc (GHM) approved the annual financial report for the year ended December 31, 2022. Total revenue at GHM increased from €3.62m in 2021 to €3.90m, while profit after tax increased by €0.11m to €0.22m. The group’s share of revenues at IC Cesme increased to €2.29m in 2022, while profit after tax increased by €2.23m from a loss of €0.88m registered in 2021 to end the year at €1.35m. Total profit after tax for the group totaled to €1.57m.

The board of International Hotel Investments plc (IHI) approved the annual financial report for the year ended December 31, 2022. Total revenue for the year under review increased to €238.2m from €129.3m of last year, an increase of 84%. Total revenue represents 89% of 2019 revenue figures. The Group registered a loss after tax of €2,342m in 2022 against a loss of €30,328m registered in 2021.

HSBC Bank Malta plc held its AGM on April 20, 2023 where all the resolutions were approved.

The board of VBL plc approved the annual financial report for the year ended December 31, 2022. Overall, the financial performance of the company resulted in total revenues of €672,392, compared to €413,904 in 2021 and an EBITDA of €7.1m, higher by €0.5m when compared to 2021. Profit after tax on the company’s activities for the year increased by €0.4m to €6.3m. A final dividend of €180,000 is proposed by the directors for the year 2022, equivalent to €0.000726.

| Market Movers by Sector: |

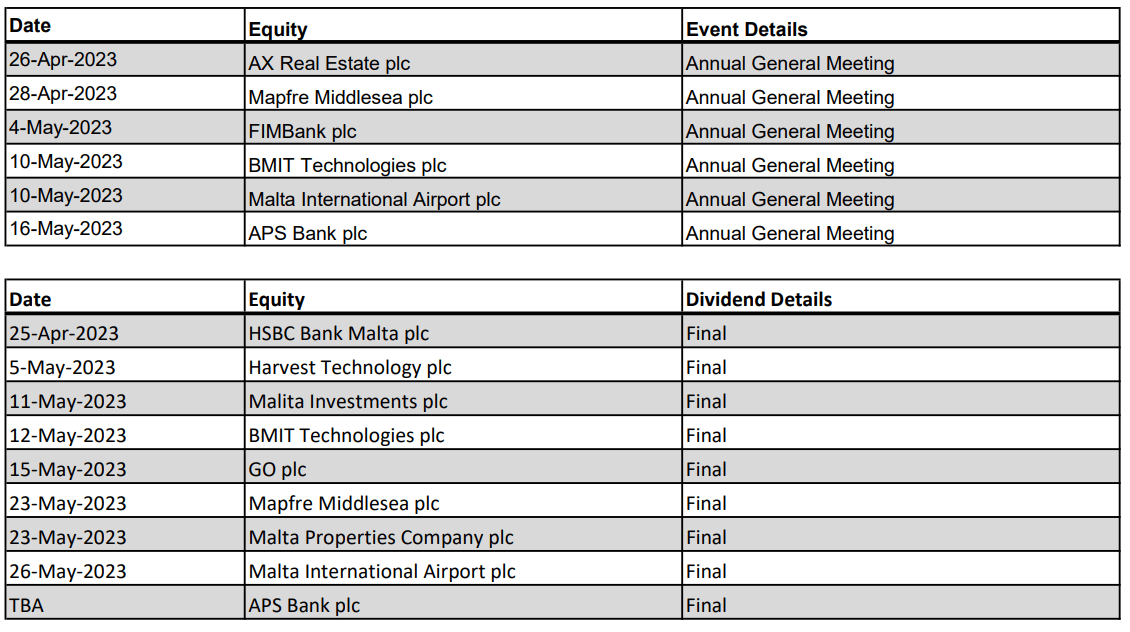

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]