MSE Trading Report for Week ending 28 April 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index maintained its positive trend, as it reached 7,624.595 points – a 1.1% increment. A total of 19 equities were active, 10 of which registered gains while another seven lost ground. Total activity declined by €0.3m week-on-week to settle at €0.7m, as a result of 138 transactions.

The MSE MGS Total Return Index declined by 0.3% to 876.503 points. A total of 17 issues were active, as gainers and losers tallied to eight each. The 4.5% MGS 2028 (II) was the best performer, as it closed 0.7% higher at €106. On the other hand, the 2.1% MGS 2039 (I) lost 7.1%, ending the week at €78.97

The MSE Corporate Bonds Total Return Index posted a 0.8% gain to 1,150.994 points. Out of 58 active issues, 24 advanced while another 15 closed in the red. The 4% Central Business Centres plc Unsecured € 2027-2033 was the best performer, as it closed 5.2% higher at €97. Conversely, the 5.25% Bonnici Bros Properties plc Unsecured € 2033 S1 T1 headed the list of fallers, as it closed 2% lower at par.

| Market Highlights: |

Once again, Bank of Valletta plc (BOV) had a significant impact on the MSE Index after adding 4% to its share price. BOV was the most liquid equity during the week after generating €0.5m in trading turnover across 68 deals. The bank closed the week at €1.03.

Unlike its peer, HSBC Bank Malta plc ended the week in negative territory. The equity registered a 2% decline in share price, closing at €1. This was the outcome of six deals worth €34,566.

Two deals involving a total of 625 Lombard Bank Malta plc shares, pushed the price 12.1% higher. The bank closed the week at €1.02.

A total of 39,327 APS Bank plc (APS) shares, spread across nine deals, pushed the equity into positive territory. The price at Friday’s close of business read €0.62 – a 1.6% increase.

In the property sector, VBL plc was the best performer with a double-digit gain of 20%. A total of four transactions involving 17,000 shares were executed.

Five transactions of 8,410 Malta Properties Company plc shares resulted into a 5% positive price movement. The equity closed the week €0.02 higher, at €0.42.

M&Z plc ended the week in the green at €0.685 price level, a week-on-week increase of 12.3%. This was the result of four deals worth €10,587.

Simonds Farsons Cisk plc traded three times on a volume of 2,837 shares. As a result, the equity advanced by 1.5%, to close at €6.95.

GO plc ended the week 0.7% higher, as 877 shares changed ownership over three transactions. The equity closed at €2.94.

The share price of RS2 Software plc Ordinary Shares retracted to €1.13, a decline of €0.9%. This was the result of a single deal of trivial volume.

| Announcements: |

The board of Lombard Bank Malta plc approved the annual report and audited financial statements for the financial year ended 31 December 2022. Although no dividend is being proposed, the board of directors is proposing a bonus share issue of one share for every forty-five shares. The group registered a profit after tax of €17.6m for the year ending December 31, 2022.

For the first quarter under review, APS Bank plc registered a profit after tax of €5.4m for the Group and €4.6m for the Bank. These numbers further confirm a rebound from the financial markets turbulence that marked last year, as the Group continues to navigate its way through an outlook still clouded by challenges and uncertainties.

The board of M&Z plc has approved and published the annual report and financial statements for the financial year ended December 31, 2022. The Company registered a profit after tax of €1.4m. The directors are recommending the payment of a final net dividend of €0.01986 per share, over and above the interim dividend of €0.009 per share paid to shareholders in August 2022.

The board of RS2 Software plc announced that it has approved the financial statements for the financial year ended December 31, 2022. During the year under review, upon consolidating all of its activities, the Group generated revenues of €37.5m and registered a loss after tax of €0.25m. The board is not recommending any final dividends for the year ending December 31, 2022.

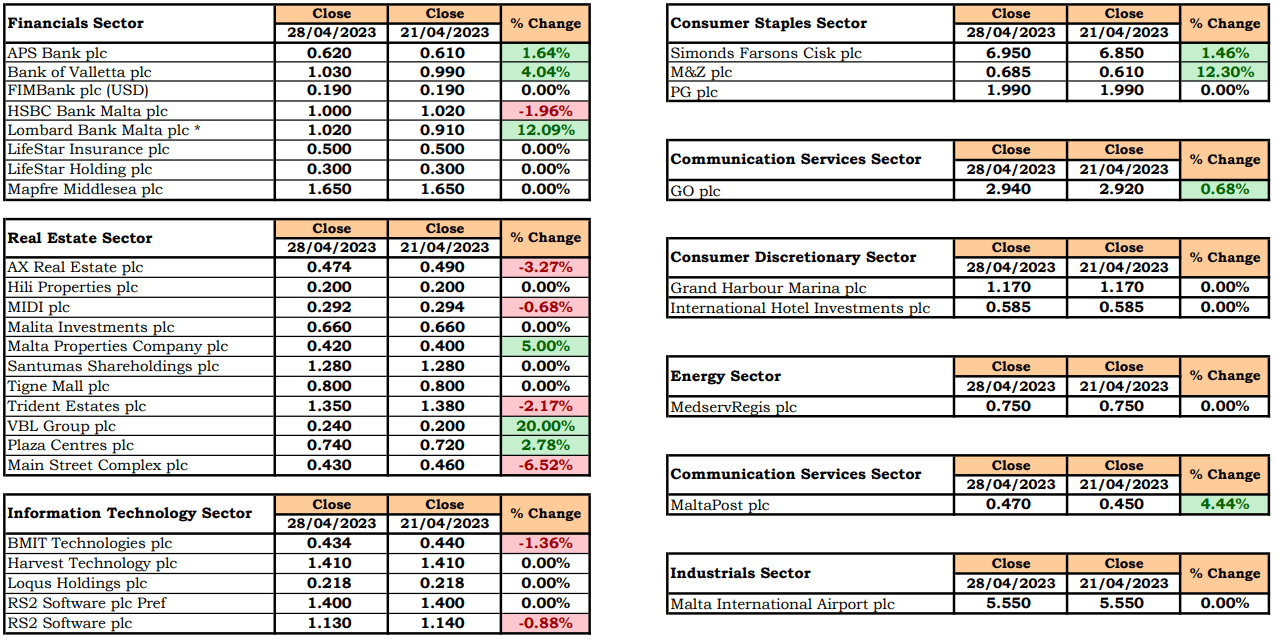

| Market Movers by Sector: |

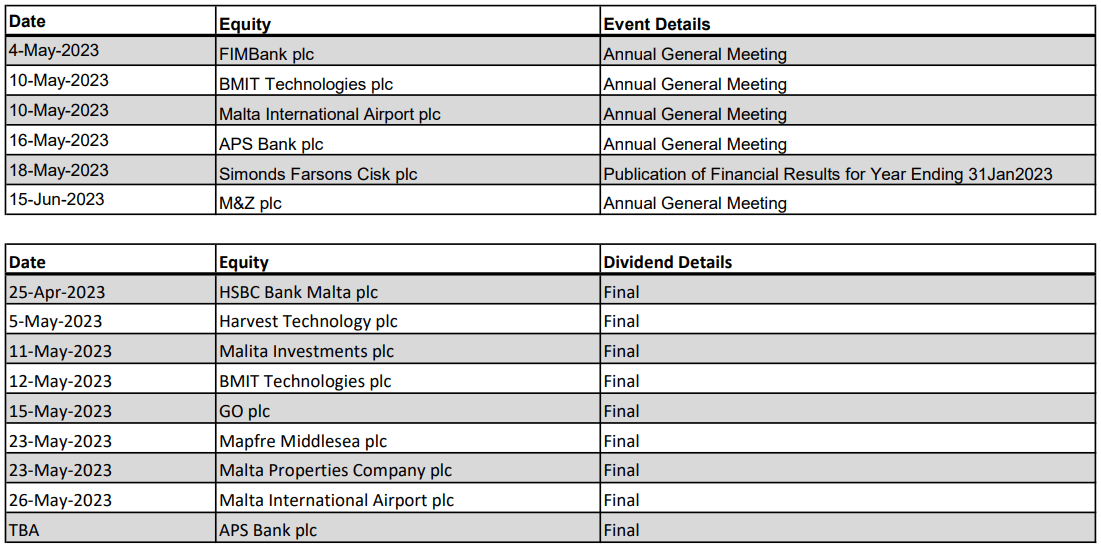

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]