MSE Trading Report for Week ending 19 May 2023

| Movement in Equity and Bond Indices: |

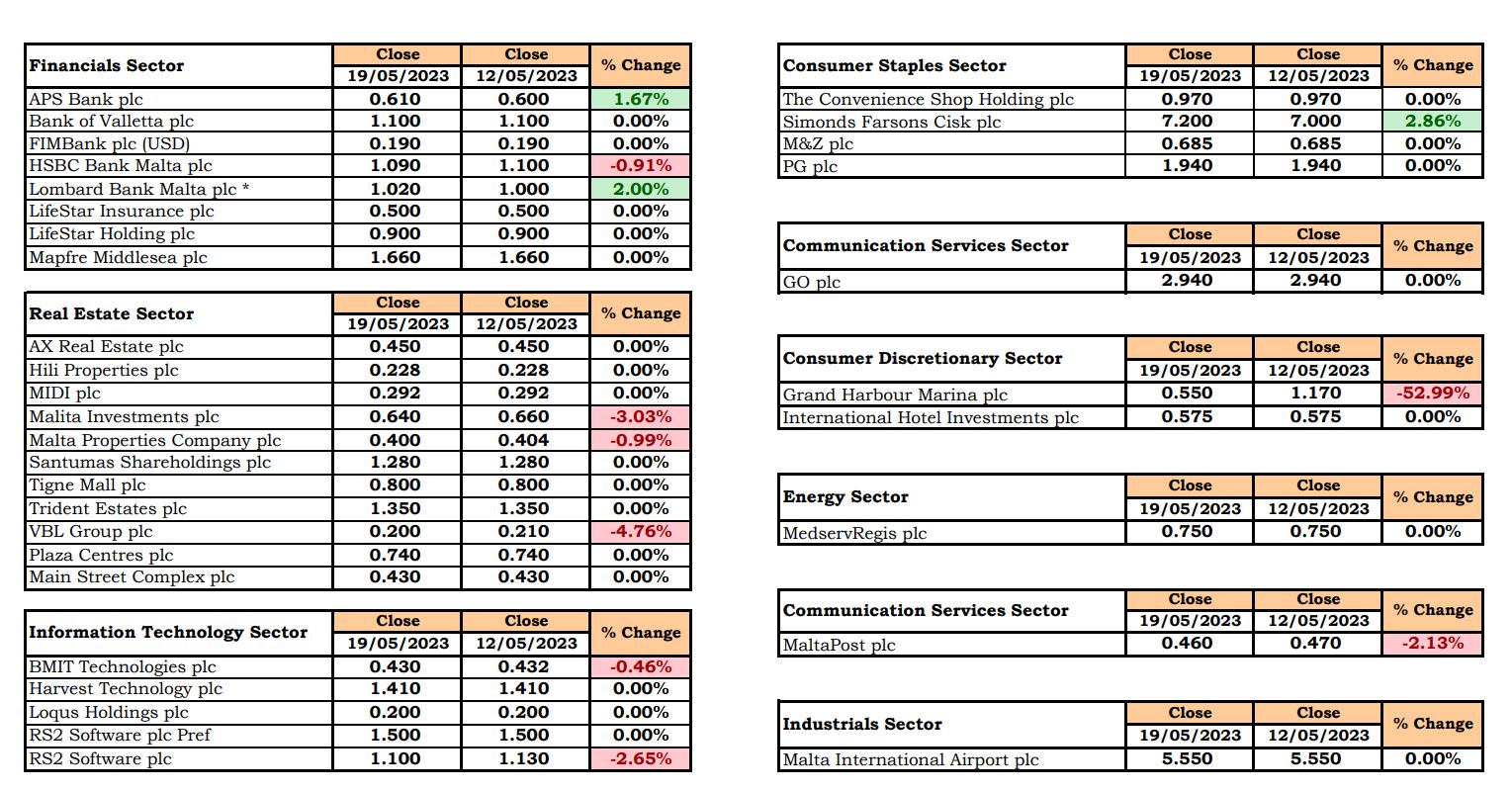

The MSE Equity Total Return Index ended in the red for the second week in a row, as it closed 0.3% lower to 7,736.986 points. Out of 19 equities, three increased, while another eight closed in the opposite direction. Total weekly turnover declined to €1.1m and was generated across 133 transactions.

The MSE MGS Total Return Index rose by 0.3% to close at 881.838 points. A total of 11 issues were active, as the 4.00% MGS 2043 (I) was the most liquid issue with trading turnover reaching €232,703 and ending the week at €99.34.

The MSE Corporate Bonds Total Return Index increased by 0.9%, as it closed the week at 1,156.202 points. A total of 56 active issues were executed, with the 3.75% Premier Capital plc Unsecured € 2026 being the most liquid corporate issue, with turnover reaching €197,960 and closing at €98.

| Market Highlights: |

The share price of Simonds Farsons Cisk plc had the biggest impact on the MSE equity index, as eight deals on a volume of 9,686 shares pushed the equity price 2.9% higher to the €7.20 level. Total turnover tallied to €68,333. Since the beginning of the year, the company’s share price rose by 5.1%.

HSBC Bank Malta plc declined by 0.9% to the €1.09 price level. Trading activity included eight trades across 120,639 shares.

APS Bank plc share value trended 1.7% higher over the week to close at €0.61. This increase was the result of the exchange of ownership of 30,839 shares, worth €18,729.

On the other hand, Lombard Bank Malta plc was up 2%, as 6,908 shares were exchanged across two deals. This increase ensured that the bank’s share price closed at €1.02. On a year-to-date basis, the bank’s equity is down by 3.8%.

The equity of Grand Harbour Marina plc plummeted by 53%, following six-months of inactivity, to end the week at €0.55. A single trade of 6,000 shares was executed.

Two trades of VBL plc shares during Tuesday and Thursday’s trading session dragged the property company 4.8% lower to €0.20. This decline was due to two deals, with a trading value of €5,550.

The price per share of Malta Properties Company plc declined by 1% to the €0.40 level, as a result of five trades on a volume of 34,800 shares.

The equity of the postal service operating company, MaltaPost plc slid by 2.1% to €0.46 during Monday’s trading session. Two trades worth €4,000 were recorded. The equity did not trade for the rest of the week.

RS2 Software plc suffered a decline of 2.7% in its share value, to close at €1.10. Two trades worth €9,900 were executed.

BMIT Technologies plc shares closed 0.5% in the red, as nine trades on a volume of 205,300 shares were transacted. The equity closed the week at €0.43.

| Announcements: |

Malta International Airport plc (MIA) disclosed the financial results of the group for the first quarter of 2023. The group’s financial performance for the first three months registered a marked improvement over the same period in 2022, with revenues increasing by 75% to total to €18.9m. This increase was largely driven by strong traffic results for the first quarter of 2023 as passenger numbers rose by 85% over the same quarter in 2022, to amount to 1.2m. The group’s profit before tax amounted to €6.5m, marking a fivefold increase compared to the profit for Q1 2022.

International Hotel Investments plc (IHI) announced that Corinthia has signed a hotel management agreement to operate a luxury resort in the Maldives. The developer of the luxury resort to be operated by Corinthia is Maarah Pvt Ltd, a Maldivian entity, affiliated with Maarah Holdings Ltd, a United Arab Emirates company registered within the Dubai International Financial Centre.

On Wednesday, the board of directors of MaltaPost plc approved the unaudited condensed consolidated financial statements for the six-month period ended March 31, 2023. The group registered a profit before tax of €0.7m, up from €0.6m in 2022. This was achieved on the back of a total revenue of €20.5m and a total expenditure of €19.8m, compared to revenue generated of €15.6m in 2022. Expenditure rose pro-rata to total revenue due to higher cost of airport handling, airfreight and terminal dues, coupled with the general impact of inflation.

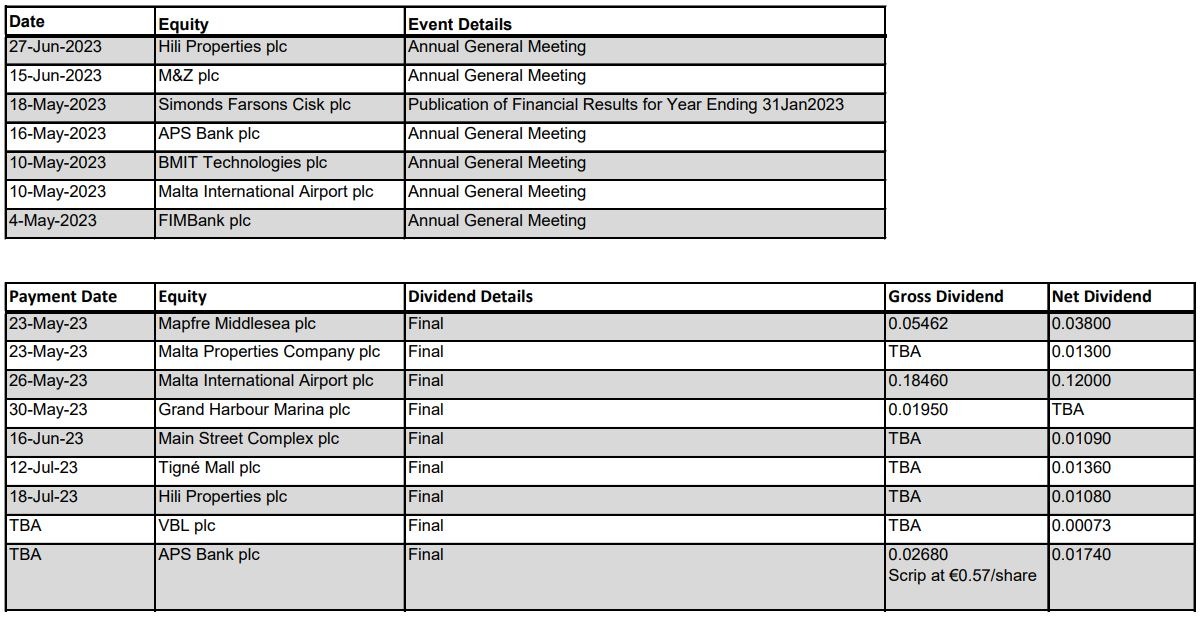

The board of directors of Main Street Complex plc announced that the next annual general meeting (AGM) of the company is scheduled to be held on June 12, 2023.

APS Bank plc announced that its AGM was held on May 16, 2023 at The Hilton Malta, and that all proposed resolutions as published in their previous announcement on April 25, 2023, were approved.

Malta Properties Company plc announced that it held its AGM on May 17, 2023 where all the resolutions on the agenda were approved.

The board of directors of Simonds Farsons Cisk plc on May 18, 2023 met and approved the annual report and financial statements of the company and the group for the year ended January 31, 2023. The group turnover reached a record of €118.2m, an increase of 28.8% from last year’s figure of €91.8m. Group profit before taxation also reached a record of €15.3m, up from €12.2m in the financial year 2022.

The board proposed a final dividend of €3.96m, equivalent to €0.11 per share, to the shareholders for approval at the forthcoming AGM. This will add up to a total dividend of €5.58m or €0.155 per share for the year ended January 31, 2023.

On Friday, the board of directors of Trident Estates plc approved the annual financial report for the year ended January 31, 2023. Revenues for the group amounted to €2.4m, more than double the turnover figure reported for the previous year (FY2022: €1.1m). This was mostly the result of new rental income as tenants gradually move into Trident Park.

Operating profits for the year amounted to €1.3m (FY2022: €323,000). As a result of a fair value gain of €6.7m (FY 2022: nil) on their investment property portfolio, profit before taxation for the year amounted to €7.5m (FY2022: €141,000). The tax charge for the year amounted to €912,000 (FY2022: €78,000) and includes a deferred tax charge on the fair value gain of €675,000.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]