MSE Trading Report for Week ending 02 June 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index recovered the previous week’s loss, as it closed 2.8% higher at 7,937.214 points. Out of 21 equities, eight headed north while another four closed in the opposite direction. A total weekly turnover of €1.3 m was generated across 202 transactions – up by €0.5m from last week.

The MSE MGS Total Return Index declined further, as it closed at 878.652 points, equivalent to a 0.1% decline. A total of 13 issues were active, six of which registered gains while another six closed in the red. The 2.4% MGS 2041 (I) headed the list of gainers with a 3% change in price, to close at €80.30. On the other hand, the 2.1% MGS 2039 (I) lost 2.4%, ending the week at €83.

The MSE Corporate Bonds Total Return Index recovered 0.4%, as it ended the week at 1,155.827 points. Out of 59 active issues, 21 advanced while another 21 traded lower. The best performance was recorded by the 3.75% Bank of Valletta plc Unsecured Sub € 2026-2031, as it closed 5.7% higher at €93. Conversely, the 3.75% Tumas Investments plc Unsecured € 2027 ended the week 3.3% lower at €95.

| Market Highlights: |

HSBC Bank Malta plc headed the list of gainers with a double-digit increase of 11.6%, as it closed at a weekly high of €1.25. A total of 106,469 shares changed hands over 24 deals.

Its peer, Bank of Valletta plc, was the most liquid equity as 71 deals generated a total turnover of €562,933. The equity continued a positive trend, recording a 7% gain, to close the week at €1.23.

APS Bank plc followed suit, as 21 transactions worth €25,377, pushed the share price 7.9% higher. The banking equity finished the week at €0.62.

Lombard Bank Malta plc reached a weekly high of €1.02 but failed to maintain such level as it closed at €0.96. Despite finishing below the weekly high, the stock recorded a 1.1% week-on-week gain.

International Hotel Investments plc erased the previous week’s decline, as it advanced by 0.9%. The equity closed at €0.535, as a result of 1,912 shares spread across two deals.

Hili Properties plc was active twice on Tuesday, posting a 2.7% gain, to close at €0.226. A total of 44,500 shares changed hands.

PG plc traded three times over 500 shares. The equity closed the week 1.1% higher at €1.92.

Data Centre provider, BMIT Technologies plc, registered a positive 1.9% movement in share price, to close the week at €0.424.

Telecommunications company, GO plc, was active six times over a spread of 3,296 shares. As a result, the equity ended the week 0.7% lower at €3.00.

MaltaPost plc had a negative week with a drop of 4.3% in price. Two deals involving 16,000 shares dragged the price to the €0.45 price level.

| Announcements: |

HSBC Bank Malta plc issued the published company’s interim directors’ statement. The bank had a strong start to the year with reported profit before tax for Q1 2023 of €26.5m, an increase of €21.7m over the €4.8m profit reported in the same period last year. The increase in profitability is mainly attributable to higher interest income and improved credit quality of the bank’s loan book. Revenue was up €18.8m or 60% when compared to that reported in Q1 2022.

PG plc announced that on June 23, 2023, the board shall consider and, if deemed fit, approve the distribution of a second interim dividend for the financial year which commenced on May 1, 2022, and ended on April 30, 2023.

The board of Lombard Bank Malta plc announced that the next AGM of the company shall be held on June 22, 2023, for the consideration of the company’s ordinary resolutions. The board shall present the consideration of a bonus share issue and the authority for directors to issue new shares.

MIDI plc announced that the company’s AGM will be held on June 19, 2023, for the purpose of considering and, if thought fit, approve the audited financial statements for the financial year ended December 31, 2022, and the report of the directors and the auditors thereon as set out in the annual report.

Tigne Mall plc announced that the company’s AGM will be held on June 22. The board will consider declaring a final net dividend of €765,000, equivalent to a net dividend of €0.0136 per ordinary share, as recommended by the directors.

Mediterranean Investments Holding plc announced the issuance of €20m 5.85% Mediterranean Investments Holding p.l.c. Unsecured Bonds 2028. The Issuer will be giving preference to holders of the €20m 5.5% Mediterranean Investments Holding p.l.c. unsecured bonds 2023 (the “maturing bonds”), appearing on the bond register as of 1 June 2023, to subscribe to the new bonds by surrendering the corresponding nominal value of maturing bonds.

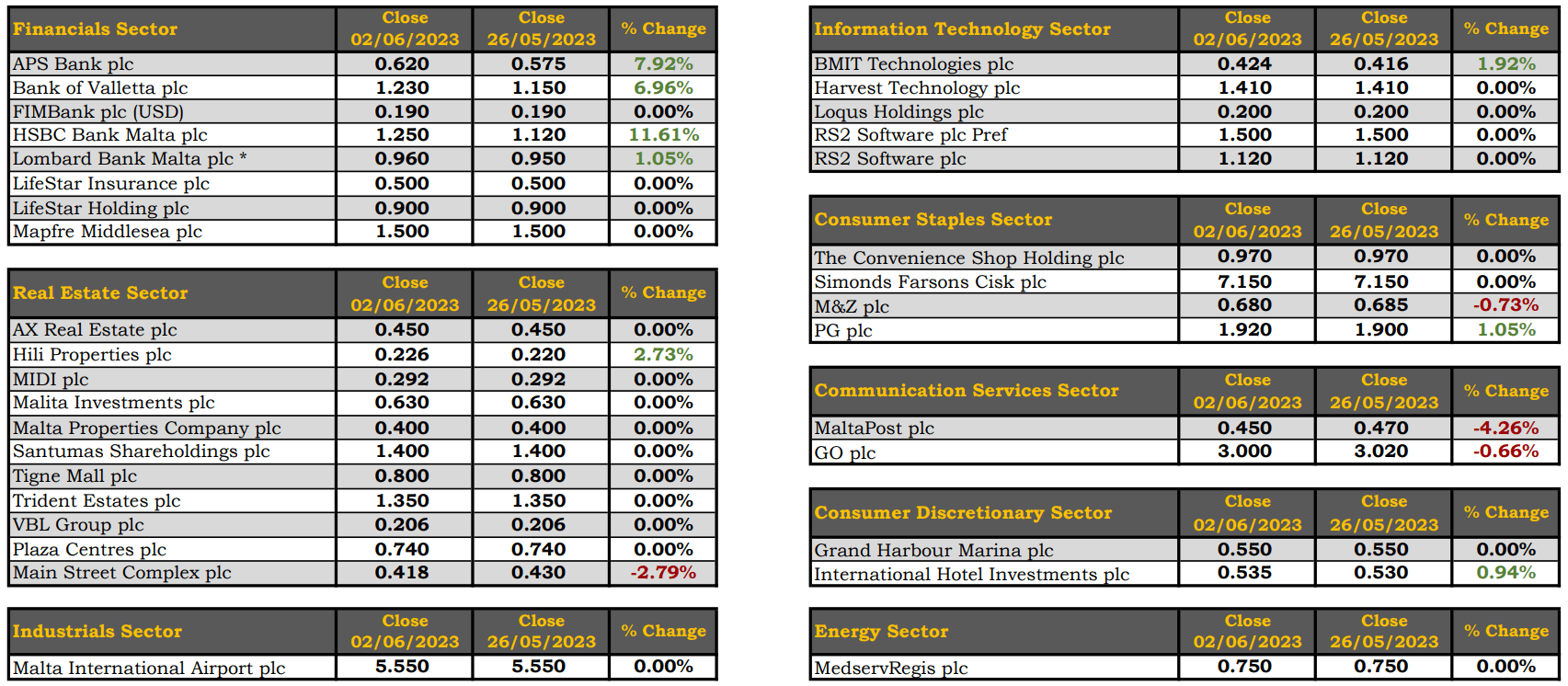

| Market Movers by Sector: |

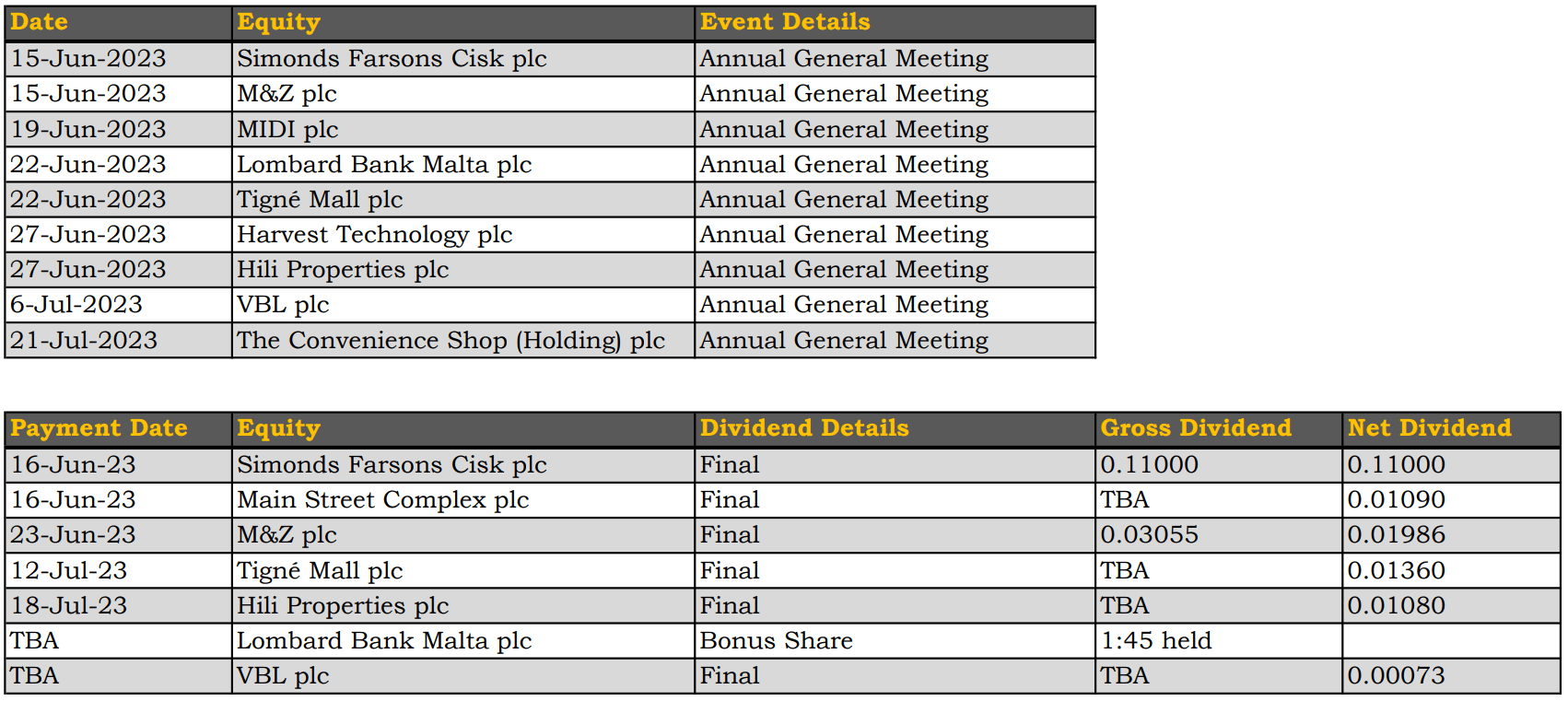

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]