MSE Trading Report for Week ending 16 June 2023

| Movement in Equity and Bond Indices: |

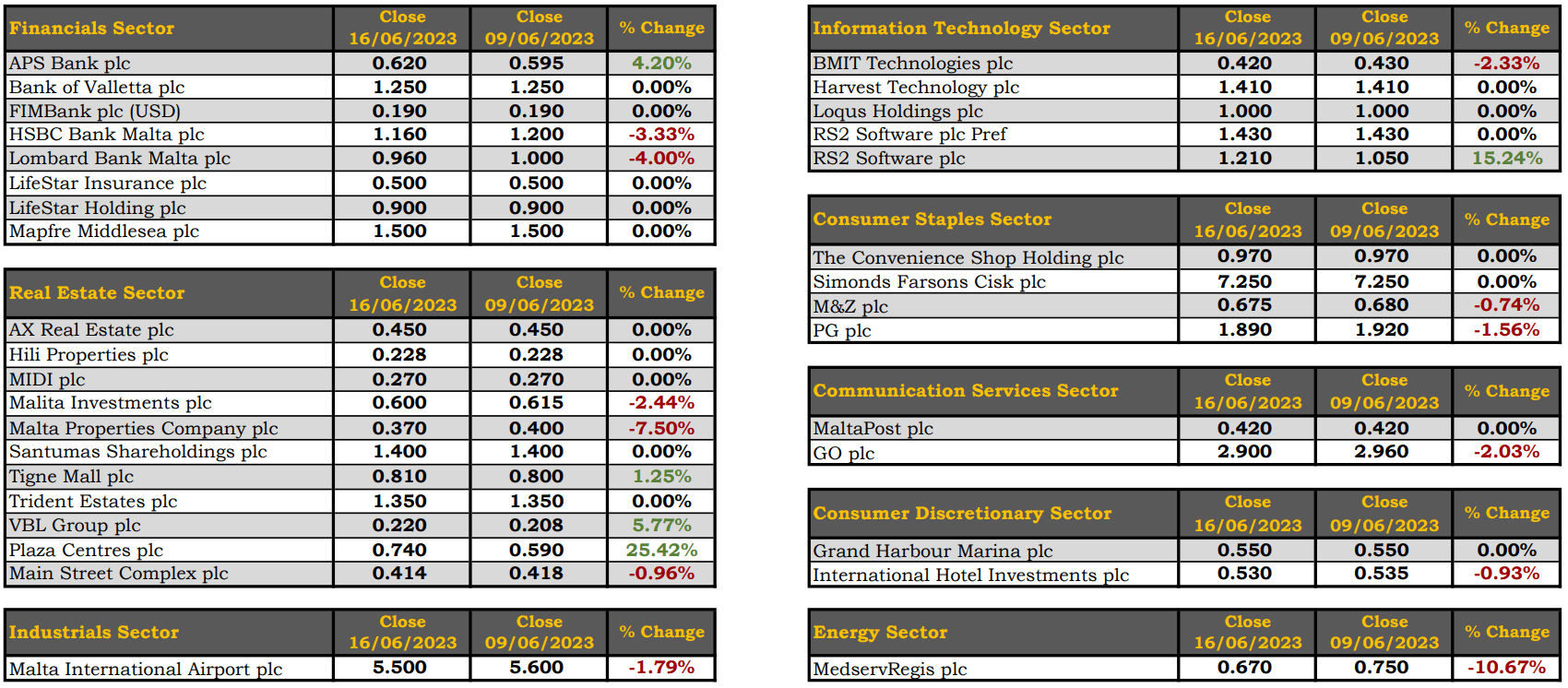

The MSE Equity Total Return Index closed off another negative week, as it dropped 0.02% lower, as it settled at 7,875.866 points. A total of 23 equities were active, five of which headed north while another 12 closed in the opposite direction. Total weekly turnover increased by €0.2m, to €1m, generated across 186 transactions.

The MSE MGS Total Return Index returned to positive territory, gaining 0.2%, as it reached 876.536 points. A total of 13 issues were active, six of which advanced while another seven lost ground. The 4.45% MGS 2032 (II) headed the list of gainers, as it closed 1.7% higher at €106.80. On the other hand, the 1.5% MGS 2027 (I) closed 11.3% lower at €92.47.

The MSE Corporate Bonds Total Return Index advanced by 0.3%, as it closed at 1,150.541 points. Out of 66 active issues, 24 closed higher while another 18 closed in the red. The best performance was recorded by the 3.65% Stivala Group Finance plc Secured € 2029, as it ended the week 5.3% higher at €100. Conversely, the 4.65% Smartcare Finance plc Secured € 2032 lost 4%, to close at €96.01.

| Market Highlights: |

RS2 Software plc Ordinary (RS2) shares were the most liquid during the week. A total of 36 deals of 263,975 shares generated a turnover of €300,284. On the other hand, the price advanced by 15.2% to €1.21.

HSBC Bank Malta plc witnessed a 3.3% decrease in its share price to end the week at €1.16. A total of 39,578 shares were traded across 12 transactions, as the price fluctuated between a weekly low of €1.13 and a high of €1.19. Malta International Airport plc was active across 24 deals worth €107,702. The equity ended the week at €5.50, reflecting a decline of 1.8% when compared to the previous week.

MedservRegis plc started the week with a 20% decline, which was partially recovered during last Thursday’s trading session. Eventually the equity finished the week 10.7% lower at €0.67. This was the result of three transactions involving 20,952 shares.

Telecommunications Company, GO plc, concluded the week at €2.90 with its activity ranging between a weekly low of €2.88 and a high of €2.96. Throughout the week, a total of eight transactions involving 5,011 shares worth €14,676 were executed.

The share price of Lombard Bank Malta plc experienced a 4% decline, as a result of five transactions involving 14,470 shares. The banking equity’s price at the end of yesterday’s session read €0.96.

PG plc registered a negative 1.6% movement in the share price, closing the week at €1.89. This was the result of 70,739 shares spread across four deals.

International Hotel Investments plc began the week on a positive note, but failed to sustain it, as five trades involving 17,696 shares saw the price fall by 0.9%, to close at €0.53.

Bank of Valletta plc achieved a relatively substantial turnover through the execution of 44 deals worth €199,536. Despite dropping to a weekly low of €1.20, the stock ended the week unchanged at €1.25.

During yesterday’s trading session, three transactions involving 11,000 APS Bank plc shares yielded a 4.2% increase in the share price. The equity closed the week at the €0.62 price level.

| Announcements: |

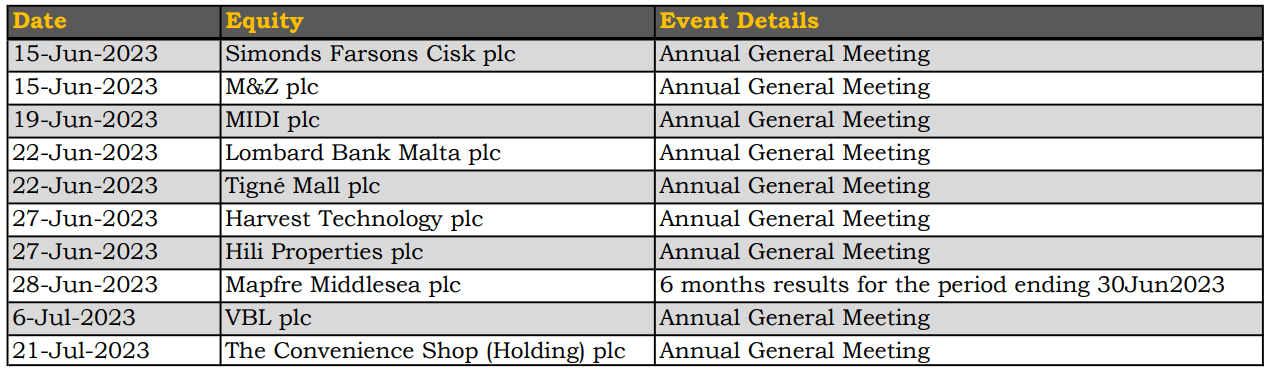

RS2 Software plc and M&Z plc both held their respective AGMs on June 15, 2023, in which all resolutions on their agenda were approved.

The board of Main Street Complex plc announced that the company’s AGM was held on June 12, 2023 and all resolutions were approved.

International Hotel Investments plc held its 23rd AGM, where all resolutions on the agenda were approved.

Plaza Centres plc held its 23rd AGM of the company on June 14, 2023, whereby the shareholders considered and approved all resolutions on the agenda.

| Market Movers by Sector: |

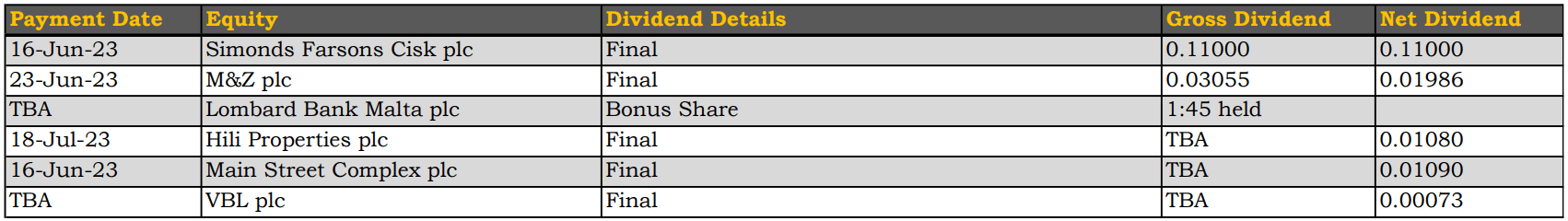

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]