MSE Trading Report for Week ending 7 July 2023

| Movement in Equity and Bond Indices: |

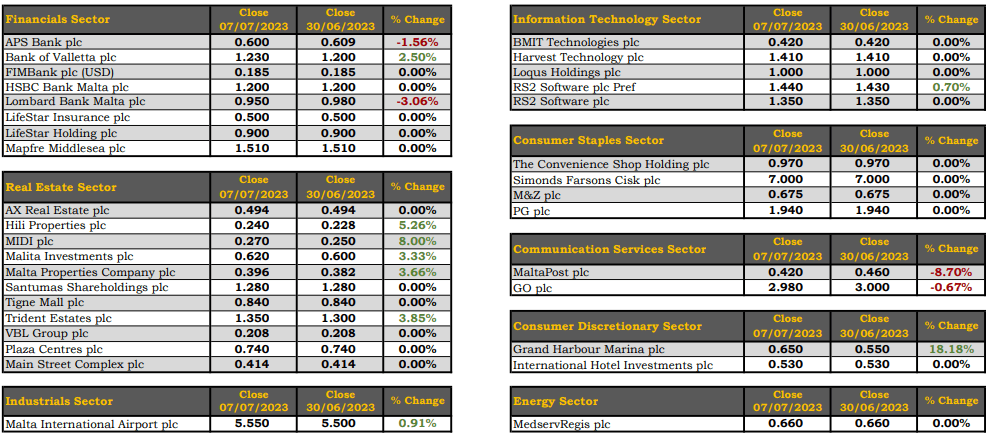

The MSE Equity Total Return Index closed the week 0.7% higher at 7,973.446 points. Out of 18 equities, nine headed north while another four closed in the opposite direction. Total weekly turnover jumped to €1.6m, generated across 180 transactions.

The MSE MGS Total Return Index headed south, declining by 0.5%, as it closed at 871.601 points. A total of 11 issues were active, as one advanced while another eight closed in the red. The 3.3% MGS 2024 (I) headed the list of gainers with a marginal 0.02% increase, as it closed at €100.02. Meanwhile, the 4% MGS 2043 (I) lost 2%, ending the week at €99.

The MSE Corporate Bonds Total Return Index recorded a positive 0.1%, as it reached 1,148.137 points. Out of 51 active issues, 15 headed north while another 16 closed in the opposite direction. The top performer was the 3.65% International Hotel Investments plc Unsecured € 2031, as it closed 4.1% higher at €93.73. On the other hand, the 6% Pharmacare Finance plc Unsecured € 2033 lost 1.9%, to close at €101.

| Market Highlights: |

Bank of Valletta plc had a significant impact on the MSE Index, after recording a gain of 2.5%. The banking equity closed at a weekly high of €1.23 after trading at a low of €1.17. A total of 304,133 shares were active across 56 deals. Since the beginning of the year the equity is up by 52%.

APS Bank plc traded 1.6% lower, as 43,418 shares changed hands across 10 transactions. The equity closed the week at the €0.60 price mark.

Five deals of 250,100 Lombard Bank Malta plc shares pushed the share price 3.1% lower at the €0.95 price level.

In the property sector Hili Properties plc gained 5.3% to finish the week at €0.24. Trading volume reached 211,000 shares across seven deals.

The share price of MIDI plc gained 8%, reaching the €0.27 share price. A total of 8,900 shares exchanged hands across three deals. From a year-to-date perspective, the equity is down by 8.2%.

Trident Estates plc closed the week with a positive 3.9% movement in the share price, ending the week at €1.35. This was the outcome of seven transactions involving 6,974 shares.

Malta International Airport plc (MIA) registered the highest turnover, after 21 transactions worth €577,045 were executed. MIA shares advanced by 0.9%, to close at €5.55.

Grand Harbour Marina plc registered a double-digit gain of 18.2%, as three deals of 8,300 shares were executed. The equity closed the week at €0.65.

The share price of MaltaPost plc retracted by 8.7% to the €0.42 price level. Thirteen deals worth €16,170 were involved.

The share price of GO plc fell by 0.7% from the previous week’s closing price of €3. The equity finished the week at €2.98, as 27,962 shares were executed across nine deals.

| Announcements: |

Last Thursday the Treasury announced the fixed prices of the new 3.55% Malta Government Stock 2026 (V) and the 4% Malta Government Stock 2038 (I). Both bonds will be issued at the price of €100. Applications open on Monday, July 10 and close on July 12.

The board of HSBC Bank Malta plc is scheduled to meet on August 1, 2023 to consider and approve the group’s and the bank’s interim accounts for the half-year ending June 30, 2023. The board will also consider declaring an interim dividend.

VBL plc announced that it held its AGM on July 6, 2023, at which all resolutions on the agenda were approved. The board approved a total final net dividend of €180,000 which is equivalent to €0.000726 per ordinary share.

| Market Movers by Sector: |

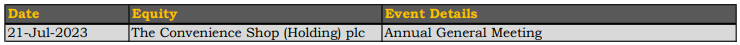

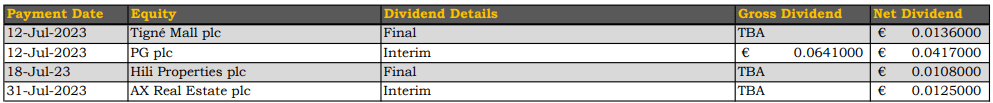

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]