AI-Driven Bull Market Powers Second Quarter Despite Economic Headwinds

Jesmond Mizzi Financial Advisors Head of Wealth Management Colin Vella gives an update on financial markets’ performance during Q2 and looks forward to what can be expected during the tail end of the year

How would you summarize markets’ performance during quarter two?

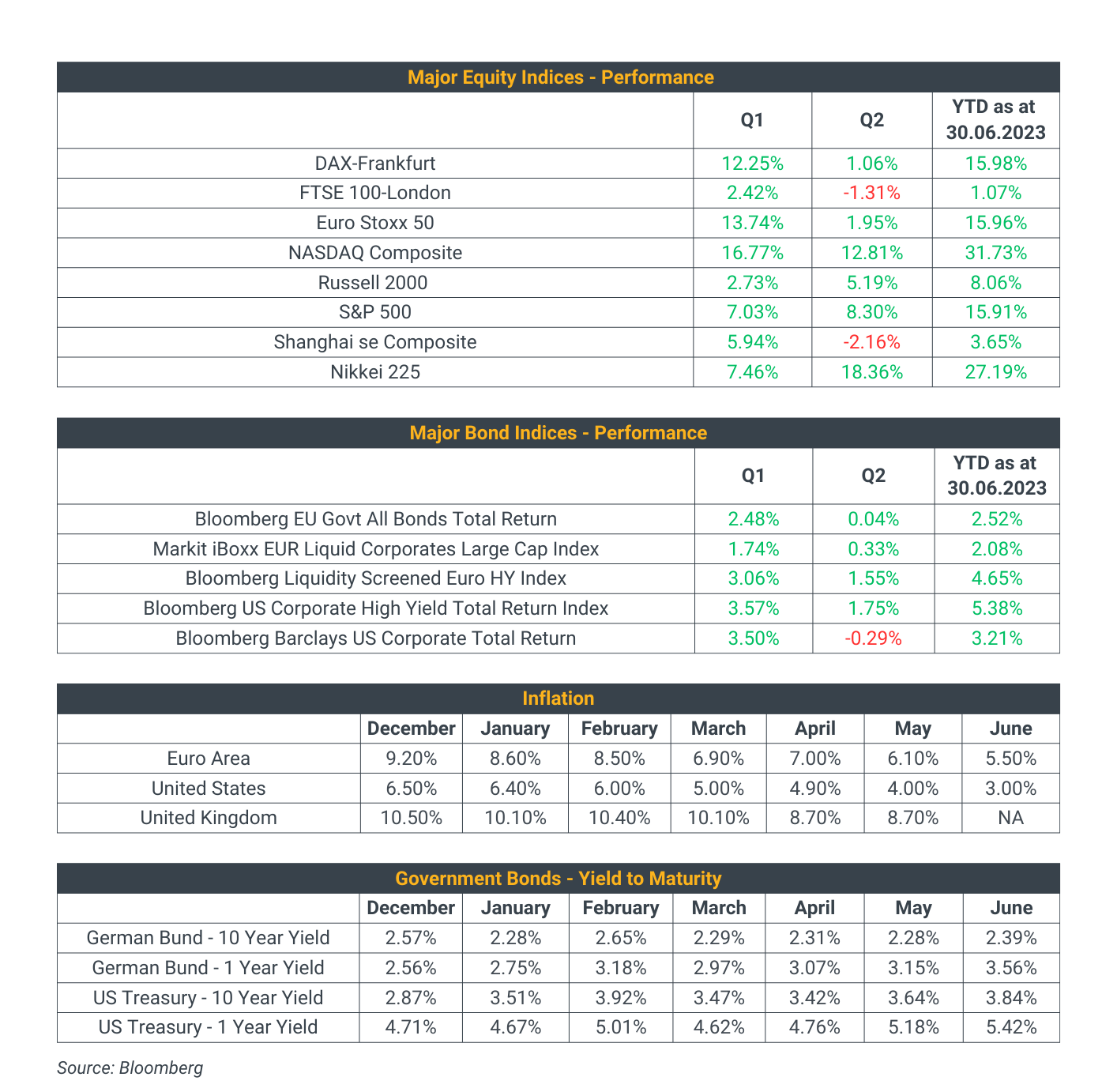

The second quarter performance was largely positive, extending the optimistic momentum from Q1. Despite the aftermath of the US banking crisis and some challenging economic indicators, trends remained generally buoyant. The resilient labour market, though usually a favourable sign, has been a concern in our current inflationary climate, as inflation, particularly core inflation, persists at high levels. The decline in headline inflation reflects the adjustment to lower energy prices, yet inflation concerning the cost of goods and services remains.

Following a pause in rate hikes by the US Federal Reserve, when should we anticipate a halt or even a reduction?

Given the minimal movement in core inflation despite a significant decrease in headline inflation, the full impact of central banks’ interest rate hikes seems yet to materialize. As confirmed by Fed chair Jerome Powell, following ten consecutive rate hikes with a pause in June, more increases are projected. We need further time to assess the influence of these hikes on the economy, considering several other economic variables which may affect global trade and supply chains. As such, it appears unlikely that we will see a cessation of hikes this year.

At what point might the market begin to show signs of frustration?

In the mid-term, the alignment between market expectations and central banks’ projections becomes hazy. The market foresees that rate hikes will be capped by year-end, possibly leading to reductions next year. The assumption is that further hikes may detrimentally impact the economy, causing excessive instability and being counterproductive if they fail to curb inflation. The fact that Europe is technically in a recession, characterized by economic slowdown amidst high inflation, supports this perspective. The prevalent market sentiment, as reflected by the upward trend in financial markets since Q4 last year, suggests we might be reaching the end of this cycle. The year’s double-digit upward trend, particularly in growth-based equities like tech, substantiates this belief.

Did other sectors mirror this performance?

Not exactly, or at least not to the same extent. The positive sentiment pervading the market does not mirror the economic realities faced by many companies. The recent bull market and excitement around AI have been driven primarily by a handful of industry-leading firms. Given that an index is calculated based on companies’ market caps, larger companies carry more weight, potentially eclipsing smaller players. For example, the S&P 500, if equally weighted, would have demonstrated marginal or zero gains. Understanding the sources of this rally is key, as it doesn’t uniformly impact all companies.

Could the ongoing success of these high-performing companies benefit the broader market?

Indeed, if the economic deceleration is primarily outside these high-performing sectors, it could expedite the end of interest rate hikes, thereby aiding valuations. Presently, we’re navigating a slowdown rather than a full-blown recession. Central banks will grapple with determining how close to a recession economies can be nudged without inflicting substantial damage. The interest rate accumulation over the past year equips central banks to manage a potential recession. As mentioned earlier, the market sentiment is that the worst is over, and the economy can be stimulated through rate cuts if necessary. The bond market reflects this sentiment, with rising yields on short-dated bonds and lower yields on medium and long-term bonds, signalling market expectations for a future reduction in interest rates.

Earlier, you mentioned AI as a driving factor for this quarter’s performance. Will this continue for the remainder of the year?

I anticipate AI will remain a significant economic driver. However, as we transition into the latter half of the year, I expect a more widespread recovery. If interest rate hikes taper off and eventually halt, we could see a boost in market sentiment and increased company valuations. We’ve already begun to see this trend in June, where positive performance was more broadly distributed across the market than earlier in the quarter.

What potential threats exist?

Market performance is always susceptible to unforeseen macroeconomic data. For instance, an unexpected surge in inflation or a slower-than-expected reduction could prompt negative market responses. Any significant pronouncements regarding the Fed’s intentions could similarly impact markets. Other factors include geopolitical tensions and potential escalation in the Ukraine conflict. Although this war has been ongoing long enough to be factored into market prices, any substantial escalation could shift this status quo.

How about markets outside the US?

Europe seems to be on a similar trajectory, though slightly lagging. China’s economic recovery after the end of its “zero COVID-19” policy hasn’t met expectations, and the nation grapples with multiple economic challenges, including tensions with the US and decoupling from the West. Japan, on the other hand, stands out as the best-performing Asian market, maintaining an expansionary monetary policy, and experiencing growth levels unseen since the 1990s. Despite recent slowdowns, continued growth is anticipated.

Have any opportunities emerged in the bond market?

The bond market’s recovery trajectory differed from equities, registering negligible gains, particularly with short-dated bonds. Longer-dated government bonds experienced a minor recovery, hinting at an inverted yield curve, a condition indicative of a looming recession or slowdown. Corporate bonds fared slightly better but remained just slightly positive. Riskier bonds did marginally better due to their correlation with the equity market, but the risk of default rises with potential future rate hikes. Given that the bond market’s recovery this year has been modest compared to last year’s decline, significant upside in long-dated bonds could be expected if interest rates are anticipated to decrease sooner. Despite current challenges, these bonds may still warrant consideration for portfolio inclusion, although the most enticing opportunities currently seem to be in the equity market.

This interview is held with Mr Colin Vella – Head of Wealth Management at Jesmond Mizzi Financial Advisors Limited (JMFA). This interview does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA, under the Investment Services Act. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]