MSE Trading Report for Week ending 4 August 2023

| Movement in Equity and Bond Indices: |

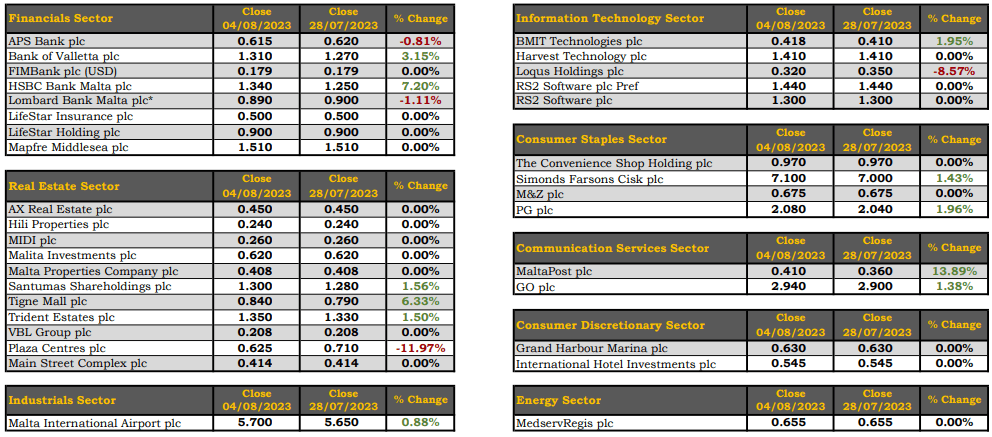

The MSE Equity Total Return Index recorded the third consecutive weekly gain, as it closed 1.7% higher at 8,193.494 points. A total weekly turnover of €1.1m was generated over 171 transactions. Out of 19 active equities, 11 headed north while another four closed in negative territory.

The MSE MGS Total Return Index headed south, declining by 0.6%, as it reached 872.968 points. A total of 20 issues were active, nine of which advanced while another 10 traded lower. The 3.55% MGS 2026 (V) R registered the best performance, as it closed 1% higher at €101. Conversely, the 3% MGS 2040 (I) was down by 9.1%, to close at €90.

The MSE Corporate Bonds Total Return Index was down by 0.3%, as it closed at 1,152.598 points. Out of 67 active issues, 26 traded higher while another 25 lost ground. The 4.65% Smartcare Finance plc Secured € 2031 headed the list of gainers with a 4.2% increase, to close at €99. On the other hand, the 3.75% Premier Capital plc Unsecured € 2026 lost 4%, ending the week at €95.

| Market Highlights: |

HSBC Bank Malta plc (HSBC) shares jumped by 7%, impacting positively the MSE index, as the banking equity closed at €1.34. Total turnover reached €159,485. From a year-to-date perspective, the equity is up by nearly 90%.

Positive sentiment followed in the share price of Bank of Valletta plc, ending the week with a 3.2% increase at €1.31, after trading at a weekly low of €1.23. A total of 53 deals were executed, generating the highest trading turnover of €554,231.

Malta International Airport plc (MIA) advanced by 0.9%, as 32 deals worth €184,386 were executed. MIA ended the week at €5.70. Since January, the equity declined by 1.7%.

MaltaPost plc registered a double-digit gain of 13.9% as a result of a single deal of 1,372 shares. The equity ended the week at €0.41, higher by €0.05.

The telecommunications operator, GO plc registered a positive 1.4% increase, ending the week at €2.94. A total of 19,358 shares worth €56,737 exchanged hands across eight transactions.

Two deals of 1,600 PG plc shares pushed the share price 2% higher to €2.08.

Simonds Farsons Cisk plc enjoyed a positive 1.4% increase in the share price as a result of a single deal of 100 shares. The equity closed the week at €7.10.

Five deals involving 27,550 BMIT Technologies plc shares pushed the share price into positive territory. The equity gained 2%, closing the week at €0.418.

Tigne Mall plc was active on Tuesday across four transactions involving 20,000 shares. The share price gained 6.3% to finish the week at €0.84.

The share price of Trident Estates plc added 1.5% or €0.02 to the previous week’s gains, ending the week at €1.35. Two deals of 5,900 shares were recorded.

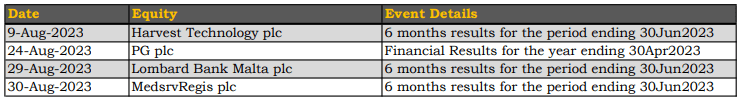

| Announcements: |

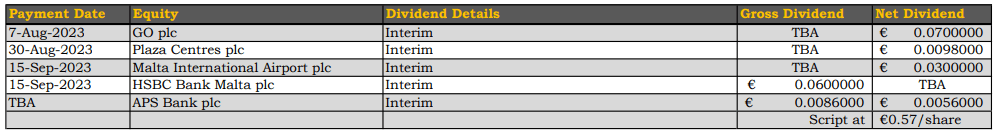

MIA announced that the group’s revenue for the first six months increased by 43.8% over 2022 to a total of €53.6m. This growth was mainly driven by a record first half, during which traffic surpassed 2019 highs by 5.6% and totaled 3.43m passengers. The board of directors also approved an interim net dividend of €0.03c per share.

Last Tuesday, the board of HSBC approved the Group’s and Bank’s interim condensed financial statements for the six-month financial period ending June 30, 2023. Profit before tax increased by 238% to €59.3m, mainly driven by higher income on the placement of excess liquidity, better performance reported by the insurance subsidiary and lower reported costs. The directors recommended an interim gross cash dividend of €0.06 per share.

The board of Plaza Centres plc approved its interim financial statements for the six months ended June 30, 2023. The directors have also resolved to declare an interim net dividend to shareholders of €250,000 equivalent to €0.0098 per share.

The board of PG plc announces that it shall be meeting on August 24, 2023 in order to consider and, if thought fit, approve its annual report and the audited financial statements for the year ended April 30, 2023.

The board of MedservRegis plc is scheduled to meet on August 30, 2023, to consider, and if deemed correct, approve the unaudited half yearly report of the company for the six months ended June 30, 2023.

The board of Harvest Technology plc announced that it is scheduled to meet on August 9, 2023 to consider and, if thought fit, approve the interim financial statements of the Company for the six-month period ended June 30, 2023.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]