MSE Trading Report for Week ending 11 August 2023

| Movement in Equity and Bond Indices: |

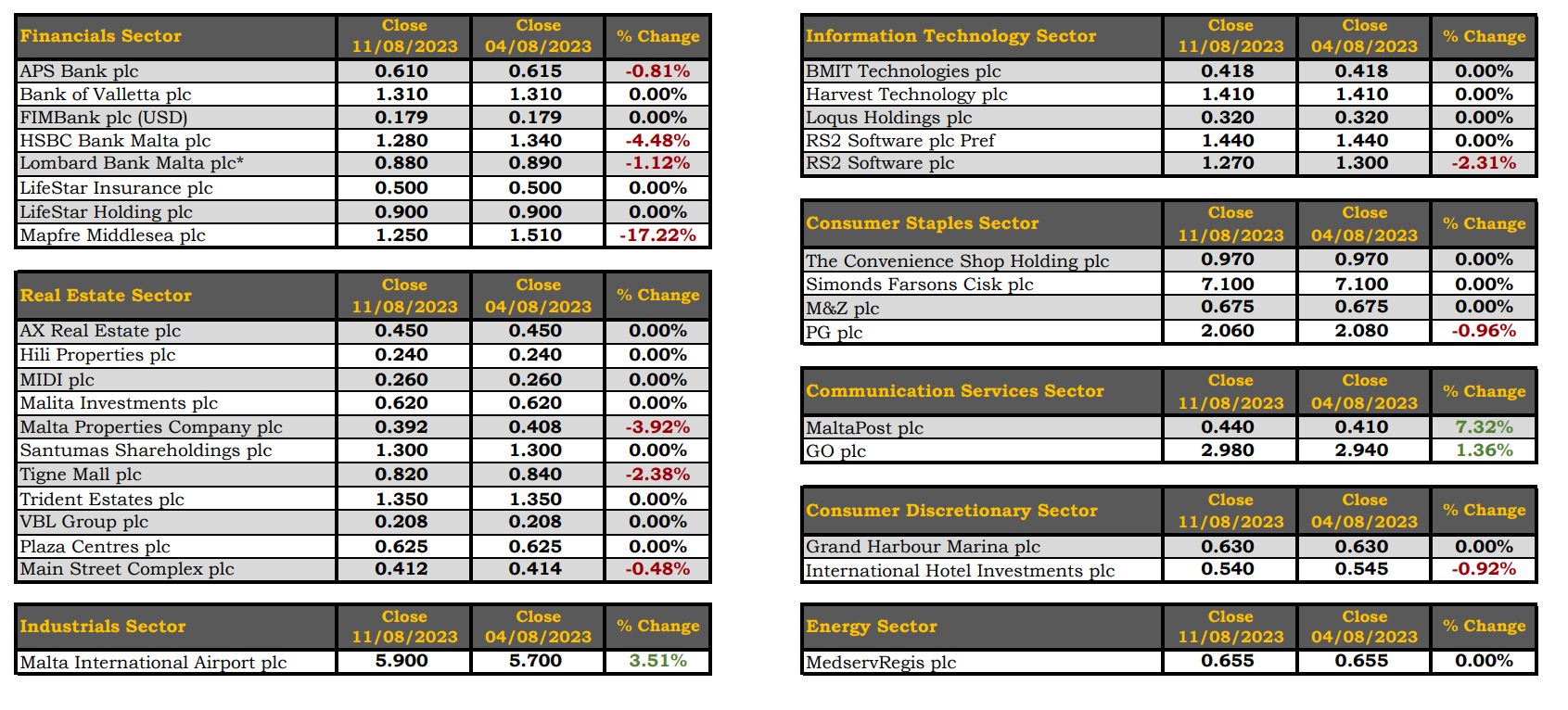

The MSE Equity Total Return Index closed in negative territory as it declined by 0.6% to 8,144.998 points. A total weekly turnover of €1.1m was generated over 148 transactions. Out of 18 active equities, three headed north, while 10 closed in the opposite direction.

The MSE MGS Total Return Index declined marginally by 0.1% to 872.424 points, as 12 issues were active – seven of which advanced, while another four traded lower. The 4.00% MGS 2043 (I) registered the best performance, as it closed 1.5% higher at €100.50. Conversely, the 4.3% MGS 2033 (I) was down by 1.4%, to close at €104.50.

The MSE Corporate Bonds Total Return Index advanced by 0.9%, as it closed at 1,163.035 points. Out of 65 active issues, 24 traded higher, while another 22 lost ground. The 3.75% Premier Capital plc Unsecured € 2026 and 5.75% MedservRegis plc Unsecured USD 2026 headed the list of gainers, as they both registered a 4.7% increase and a closing price of €99.50. On the other hand, the 4% SP Finance plc Secured € 2029 lost 5.5%, ending the week at €95.01.

| Market Highlights: |

The share value of the airport operating company, Malta International Airport plc (MIA) jumped by 3.5% to its 10-month high of €5.90 following positive traffic results for the month of July. MIA shares traded 22 times on a volume of 39,995 shares. Since January, the company’s shares advanced by 1.7%.

The price per share of HSBC Bank Malta plc lost 4.5%, as it slid to the €1.28 price level. Trading activity included 18 deals worth €186,946 across 144,136 shares. During the week, the equity traded at an intra-week low of €1.27 and an intra-week high of €1.34.

In the same sector, APS Bank plc shares declined by 0.8% to €0.61, as 108,650 shares changed ownership over 29 transactions. On a year-to-date basis, the equity is still in positive territory (+1.9%).

The shares of Bank of Valletta plc closed unchanged at €1.31. The bank’s equity accounted for a fifth of the overall trading turnover, as 48 trades involving 173,231 shares were recorded. Trading turnover reached €224,820.

The equity of Mapfre Middlesea plc plummeted by 17.2% during Tuesday’s trading session to €1.25 and did not trade for the rest of the week. This was recorded over a mere volume of 4,000 shares, which changed ownership over one trade.

International Hotel Investments plc declined by 0.9% to close at €0.54, as one trade worth just €540 was recorded.

The equity price of the telecommunications company GO plc gained €0.04, or 1.4%, as it ended the week at the €2.98 level.

On Monday, one trade involving the exchange of 100,000 RS2 Software plc shares dragged the company’s price 2.3% lower to €1.27.

PG plc shares slipped 1% to €2.06, as one trade worth €4,944 was recorded.

MaltaPost plc jumped 7.3% during the week, as four trades across 21,766 shares ensured that the equity closed higher at €0.44.

| Announcements: |

MIA announced July’s traffic results. MIA welcomed 848,716 passengers in July. This total beat the airport’s previous monthly record registered in August 2019, by more than 25,000 passenger movements. Aircraft movements during the month remained in line with July 2019 levels, while seat capacity saw an increase of 3.8% as a result of larger aircraft being operated on flights to Malta. Despite the increase in the number of seats available, the monthly seat load factor rose by 2.1% over pre-pandemic levels to reach 89.1%, as demand for travel remained very strong for yet another month.

The board of Trident Estates plc is scheduled to meet on September 13, 2023 in order to consider and approve the company’s condensed consolidated interim financial statements for the six months ended July 31, 2023. The company also announced that together with other lease agreements executed to date, Trident Park has reached 77% occupancy.

The board of Malta Properties Company plc is scheduled to meet on August 30, 2023, to discuss the group interim unaudited financial statements for the six-month period ended June 30, 2023.

The board of Harvest Technology plc approved the company’s interim financial statements for the six-month period ended June 30, 2023. The unaudited consolidated net profit before tax of the group in H1, 2023 amounted to just under €0.3m. Based on updated forecasts, and as detailed during the company’s annual general meeting, the group is expected to achieve higher revenues in 2023 than the prior year. The profit before tax for the year ending December 31, 2023 is expected to be circa €1.4m.

The board of M&Z plc shall be meeting on August 29, 2023 in order to consider and approve the company’s unaudited financial statements for the six months ended June 30, 2023. During the meeting, the board of directors shall also consider the payment of an interim dividend to the company’s shareholders.

Grand Harbour Marina plc announced that the board of directors are scheduled to meet on August 25, 2023 to consider, and if thought fit approve the half-yearly report of the company for the six months ended June 30, 2023.

The board of GO plc approved the group interim unaudited financial statements for the six-month period ended June 30, 2023. The group generated total revenue amounting to €120.5m, an increase of €14.5m, or 13.7% compared to the first half of 2022. Revenue from local telecom services registered an increase of €5.5m or 8.6%, driven by growth in GO’s fixed broadband and mobile subscriptions, growth in roaming and other international wholesale business, and comparatively higher levels of supply and maintenance of hardware and telecoms equipment.

On Friday, MIDI plc announced that the board of directors is scheduled to meet on August 30, 2023 to consider and approve the interim financial statements of the company for the six-month period ended June 30, 2023.

The board of directors of Tigne Mall plc considered and approved the unaudited interim financial statements of the company for the six-month period ended 30 June 2023. During the first half of 2023, the company registered a profit after tax of €1.9m compared to €1.6m for the same period in 2022. The company’s operating profits amounted to €2.6m, an improvement of over 10% over the same period in 2022. The board is declaring an interim net dividend of €765,000 (2022: €750,000). This will be paid on September 7, 2023 to shareholders on the company’s register at the Central Securities Depositary of the Malta Stock Exchange at close of business on August 25, 2023.

| Market Movers by Sector: |

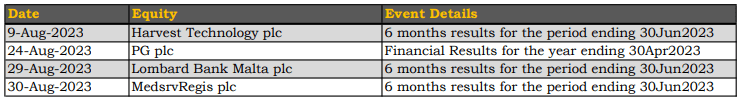

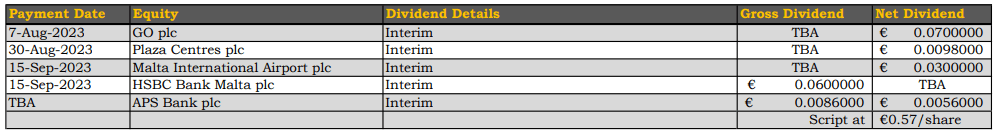

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]