MSE Trading Report for Week ending 7 September 2023

| Movement in Equity and Bond Indices: |

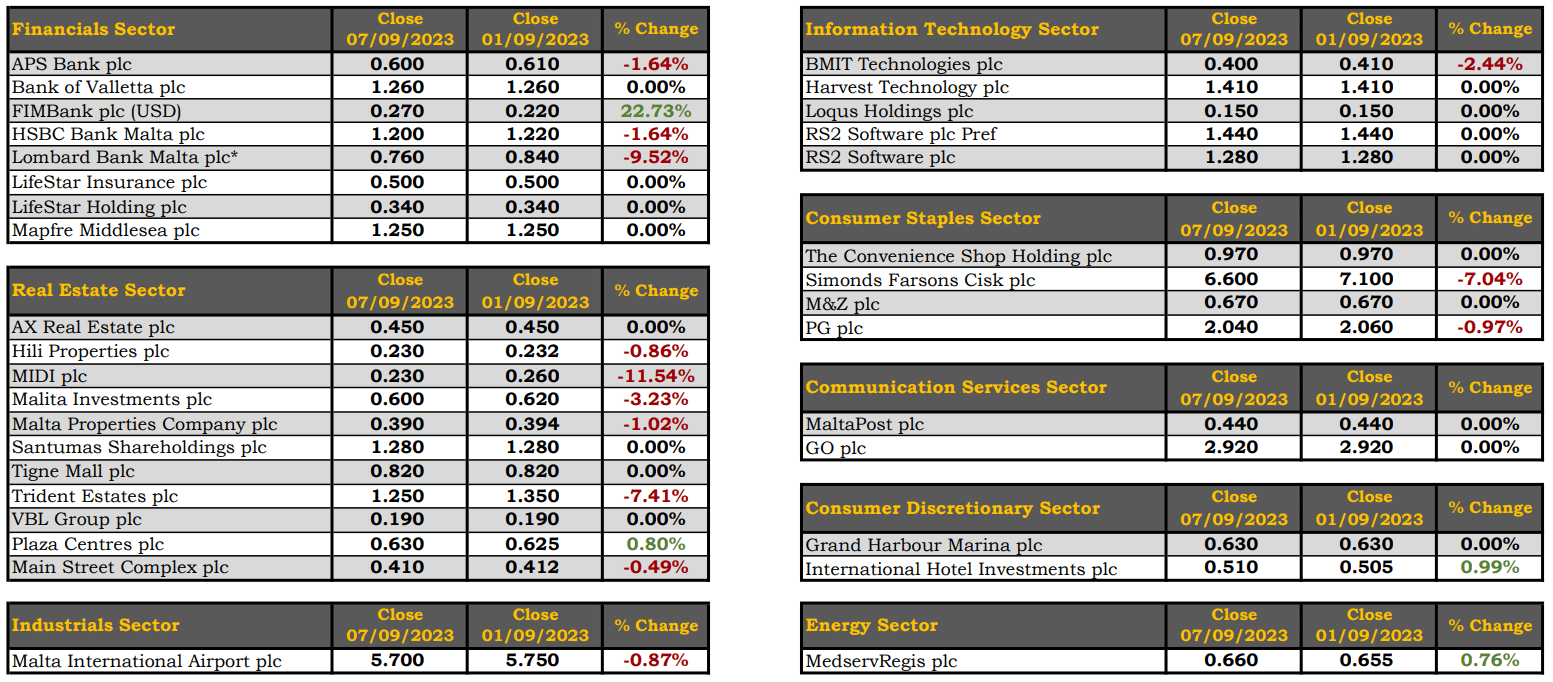

The MSE Equity Total Return Index closed the short trading week lower by 0.7% to finish at 7,923.046 points. A total of 15 equities were active, as one headed north while 11 closed in the opposite direction. Total weekly turnover amounted to €0.2m, generated across 64 transactions.

The MSE MGS Total Return Index registered a 0.13% decline, as it closed at 875.788 points. Out of 18 active issues, seven advanced while another six closed in the red. The 3.55% MGS 2026 (V) R headed the list of gainers, as it closed at €101.85, equivalent to a 0.9% change. Conversely, the 5.25% MGS 2030 (I) closed 0.8% lower at €109.20.

The MSE Corporate Bonds Total Return Index advanced by 0.3%, as it reached 1,157.608 points. A total of 52 issues were active, 18 of which traded higher while another 18 lost ground. The 5% Von der Heyden Group Finance plc Unsecured € 2032 was the best performer, as it closed 3.7% higher at €99.50. On the other hand, the 4% Shoreline Mall plc Secured € 2026 ended the week 4.1% lower at €94.01.

| Market Highlights: |

HSBC Bank Malta plc shares shed 1.6% or €0.02 to finish the week at €1.20. Four trades worth €4,445 were executed.

FIMBank plc shares had a positive week, as the banking equity gained 22.7%. The equity closed at a high of $0.27. This was the outcome of a single trade involving 11,832 shares.

Lombard Bank Malta plc experienced a decline of 9.5% to close at €0.76 after trading at a weekly high of €0.83. Three trades worth €11,926 were executed.

APS Bank plc declined by 1.6%. The equity ended the week at the €0.60 price level, as a total of 5,348 shares exchanged hands across three deals.

Malta International Airport plc (MIA) closed at €5.70, reflecting a negative movement of 0.9%. Eight transactions involving 2,660 shares were executed, as turnover declined to €15,188.

The share price of PG plc retracted by 1%, as it closed at €2.04. Two trades, totaling 7,500 shares, were executed, with a weekly turnover of €15,300.

Simonds Farsons Cisk plc shares lost 7% to close at €6.60. Trading activity included three trades of 378 shares.

BMIT Technologies plc experienced a decline of 2.4%, ending the week at €0.40. Five deals worth €2,338 were executed across 5,750 shares.

In the property sector, MIDI plc experienced a double-digit decline of 11%, finishing the week at €0.232. Trading activity included a single trade of 5,277 shares, resulting in a turnover of €1,224.

A sole deal of 315 Trident Estates plc shares dragged the share price 7.4% lower. The equity closed the week at €1.25.

Malita Investments plc ended the week at €0.60, reflecting a negative 3.2% movement. A total of 3,000 shares were executed across a single deal.

| Announcements: |

Traffic results for MIA continued to exhibit an upward trend in August, increasing by 6.7% over 2019 to total 878,462 passenger movements. The seat load factor stood at an all-time high of 91.4%, reflecting very strong demand for travel.

Italy continued to lead the pack for yet another month with 244,322 passenger movements, while the UK ranked second as it continued to perform below 2019 levels.

The board of International Hotel Investments plc announced that it has submitted an application to the MFSA requesting admissibility to listing of unsecured bonds redeemable in 2033. Most of the proceeds will be used to redeem the existing 5.8% unsecured bonds due in 2023 and the 6% unsecured bonds due in 2024. The Company will be granting preference to holders of 2023 and 2024 maturing bonds by surrendering the corresponding nominal value of bonds held.

| Market Movers by Sector: |

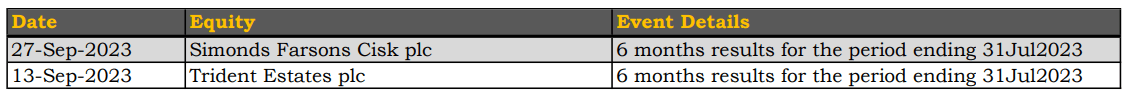

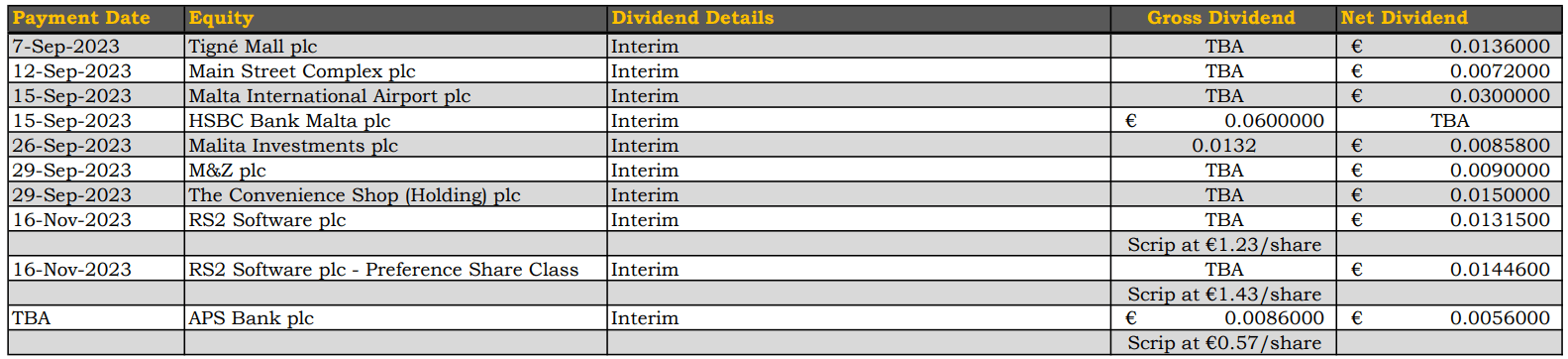

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]