MSE Trading Report for Week ending 29 September 2023

| Movement in Equity and Bond Indices: |

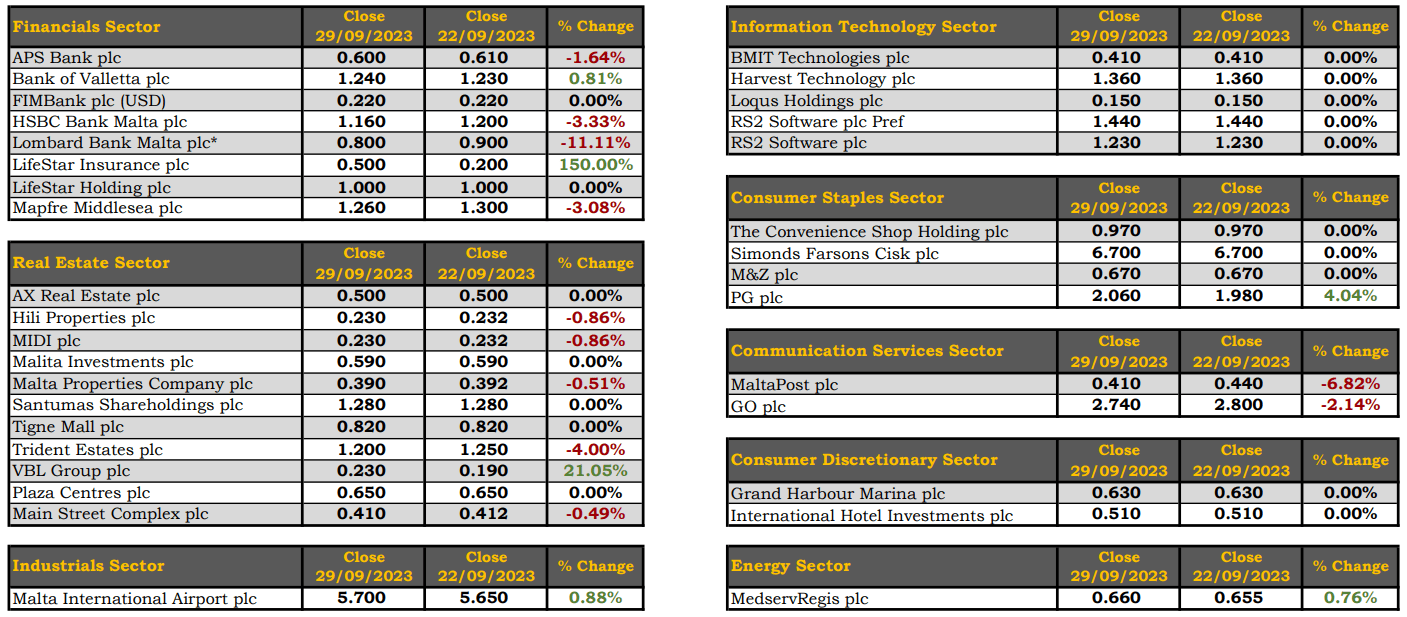

The MSE Equity Total Return Index ended the week 0.2% higher, reaching 7,862.523 points. A total of 19 equities were active, of which, five registered gains and eight declined. During the week activity declined by €0.2m as total turnover amounted to €0.3m, generated across 100 transactions.

The MSE Corporate Bonds Total Return Index retracted by 0.2%, as it settled at 1,159.754 points. Out of 59 active issues, 22 headed north, while another 21 closed in the opposite direction. The 4% Malta Properties Company Plc Sec € 2032 S1/22 T1 issue recorded the best performance, up by 3.1%, to close at €99. Conversely, the 3.5% Bank of Valletta plc € Notes 2030 S2 T1 lost 9%, ending the week at €81.

The MSE MGS Total Return Index retracted further, closing 0.1% lower at 864.084 points. Out of 32 active issues, seven headed north while another 21 closed in the opposite direction. The 2.1% MGS 2039 (I) headed the list of gainers, as it closed 6.3% higher at €85. On the other hand, the 0.4% MGS 2026 (II) closed 12.5% lower, at €90.35.

| Market Highlights: |

Malta International Airport plc closed at €5.70, marking a modest week-on-week increase of 0.9%. Trading activity saw 15 trades, involving 10,463 shares, contributing to a total turnover of €58,706.

In the financial sector, Bank of Valletta plc recorded a minor uptick of 0.8% in its share price, closing at €1.24, as 78,757 shares changed hands. The equity was the most liquid during the week, generating €95,869 in turnover.

Conversely, Lombard Bank Malta plc faced a downturn during the week, closing at €0.80 – a decline of 11.1%. Trading activity stood at €1,754, as two trades of 2,193 shares were recorded.

Meanwhile, HSBC Bank Malta plc also observed a dip in its share price, closing at €1.16 – a decline of 3.3%. Fourteen trades involving 13,399 shares, contributed to a turnover of €15,735.

APS Bank plc shed 1.6%, closing at €0.6, as six trades of 20,893 shares, worth €12,648, were recorded.

LifeStar Insurance plc jumped 150%, ending the week at €0.50. This was the outcome of a sole deal of 1,000 shares worth just €500.

Mapfre Middlesea plc closed at €1.26 – a drop of 3.1%. A singular deal of 300 shares worth €378 was registered.

PG plc delivered a positive performance, as it closed at €2.06, reflecting a 4% upside movement. Trading activity involved eight transactions of 31,600 shares and a combined turnover of €63,217.

In the real estate sector, two deals of 18,000 VBL plc shares pushed the equity to the €0.23 price level. This resulted into a double-digit gain of 21%, generating a turnover of €4,140.

Telecommunications company, GO plc, closed at €2.74 – a negative 2.1% movement in its share price. Three trades encompassing 1,100 shares contributed to a turnover of €2,994.

| Announcements: |

The board of International Hotel Investments plc announced that the company has been granted approval by the MFSA for the admissibility to listing the issue of €60m 6% unsecured bonds 2033.

The board of AX Group plc announced that the company has been granted approval by the MFSA for the admissibility to listing the issue of €40m 5.85% unsecured bonds 2033.

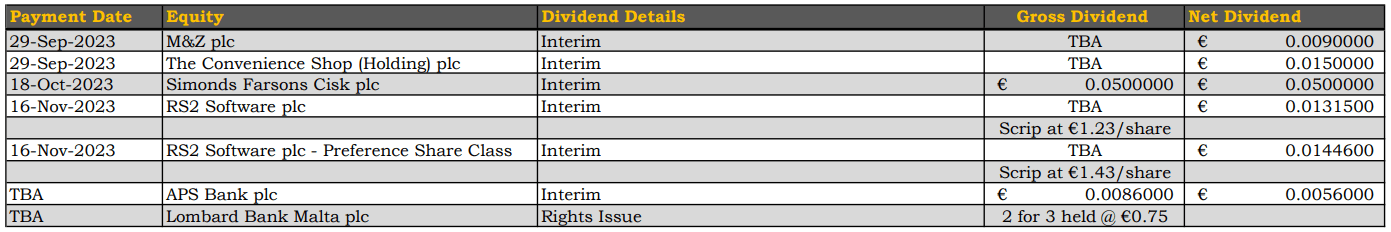

The board of Simonds Farsons Cisk plc approved the group’s unaudited financial statements and interim directors’ report for the six months ended July 31, 2023. The board also resolved to distribute, out of tax-exempt profits, an interim dividend of €1.8m equivalent to €0.05 per ordinary share. This dividend will be paid on October 18, 2023.

The board of BMIT Technologies plc announced that the resolution for the proposed transaction with GO plc, was passed by a majority of 99.99% of the shareholders present and voting.

BMIT plans to acquire cellular towers across the Maltese Islands located on third-party properties including maintenance functions and related agreements from GO, as part of an operational restructuring. This restructuring aims to centralize these assets within a separate service provider company, allowing GO to focus on its core business while BMIT handles the telecom assets.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]