MSE Trading Report for Week ending 13 October 2023

| Movement in Equity and Bond Indices: |

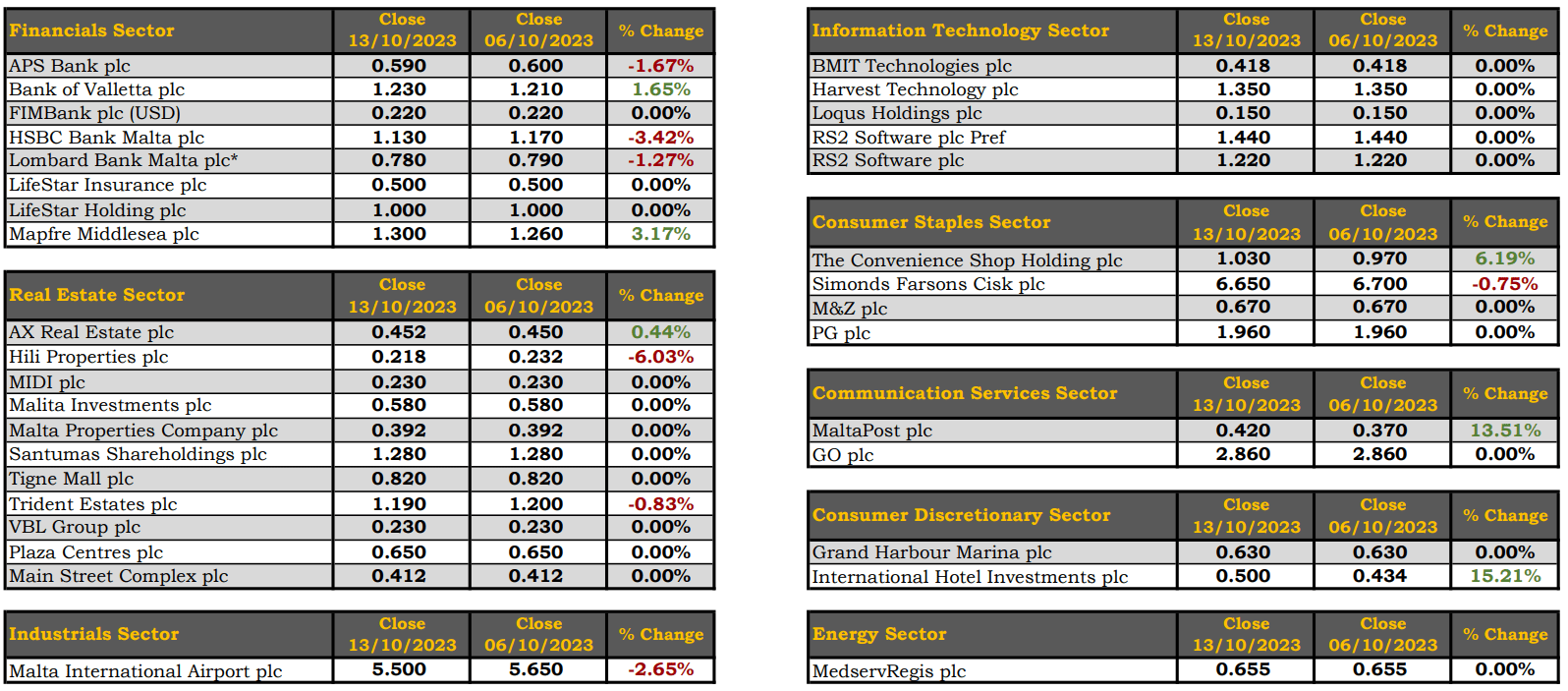

The MSE Equity Total Return Index headed north, as it reached 7,774.633 points, reflecting a 0.5% increase. A total of 15 equities were active, six of which registered gains while another seven lost ground. Total activity declined significantly to €0.6m, as a result of 109 transactions.

The MSE MGS Total Return Index advanced by 0.1% to 858.276 points. A total of 35 issues were active, as 20 registered gains while 12 fell. The 2.4% MGS 2041 (I) was the best performer, as it closed 1.5% higher at €74.53. On the other hand, the 2% MGS 2051 (II) lost 43%, ending the week at €59.39.

The MSE Corporate Bonds Total Return Index fell by 0.1% to 1,158.858 points. Out of 53 active issues, 12 advanced while another 27 closed in the red. The 3.75% Bank of Valletta plc Unsecured Subordinated € 2026-2031 was the best performer, as it closed 2.7% higher at €93. Conversely, the 4.5% Hili Properties plc Unsecured € 2025 headed the list of fallers, as it closed 4.5% lower at €95.51.

| Market Highlights: |

International Hotel Investments plc topped the list of gainers with a double-digit gain of 15.2%, as the equity closed the week at €0.50. Four trades worth €9,289 were executed, involving a total of 18,313 shares.

The share price of MaltaPost plc followed suit, as a result of 84,408 shares exchanging hands across eight transactions. The equity jumped 13.5%, finishing the week at a high of €0.42.

Malta International Airport plc (MIA) faced a dip in its share price of 2.7%, closing at €5.50. MIA was active across 12 trades of 5,893 shares, generating €32,416 in turnover.

In the financial sector, the share price of Bank of Valletta plc (BOV) advanced to the €1.23 price level, a gain of 1.7%. BOV was the most liquid equity during the week, recording a total turnover of €320,069 across 41 transactions of 264,399 shares.

Its peer, HSBC Bank Malta plc (HSBC) shares shed 3.4%, as the banking equity closed at a weekly low €1.13. HSBC saw five trades during the week of 8,441 shares which resulted in a weekly turnover of €9,628.

Similarly, the share price of APS Bank plc recorded a loss of 1.7%, ending the week at €0.59. Five trades of 14,858 shares were executed.

Mapfre Middlesea plc experienced a positive price movement of 3.2%. The equity finished the week at €1.30 as a result of a single trade of trivial volume.

In the Real Estate Sector, Hili Properties plc experienced a drop of 6%. The Company’s share price retracted to the €0.218 price level as 78,800 shares were spread across 13 deals. Turnover tallied to €15,029.

In contrast, AX Real Estate plc had a relatively stable week, recording a slight increase of 0.4%. This was the outcome of a single trade worth €1,674 as it ended the week at the €0.452 price level.

The share price of Simonds Farsons Cisk plc declined marginally to the €6.65 price level, translating into a 0.7% decline. A single transaction of 6,000 shares worth €39,900 was executed.

| Announcements: |

BOV announced that it is in advanced negotiations to sell a portfolio of longstanding non-performing loans with a view to strengthening its capital and liquidity buffers.

The board of APS Bank plc has approved the base prospectus in respect of a bond issuance programme, and an application requesting admissibility to listing on the Malta Stock Exchange.

Subject to regulatory approval, the bank will be issuing the first series of unsecured subordinated bonds under the programme, which consists of an issue of up to €50m, at a coupon of 5.8%, and which will mature between 2028 and 2033.

On Wednesday, MIA announced that the traffic results for September tallied to 812,176 passenger movements, translating into an increase of 6.5% over 2019 figures. This was the third consecutive month during which MIA saw more than 800,000 passengers. This growth was registered on the back of an increase of 3% in seat capacity compared to 2019.

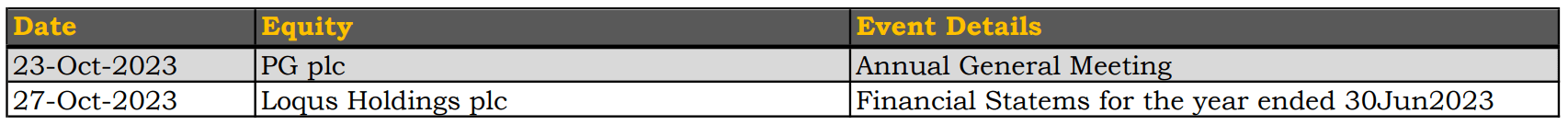

The board of Loqus Holdings plc announced that it is scheduled to meet on October 27, 2023 to consider and, if thought fit, approve the company’s financial statements for the financial year ended June 30, 2023.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]