MSE Trading Report for Week ending 20 October 2023

| Movement in Equity and Bond Indices: |

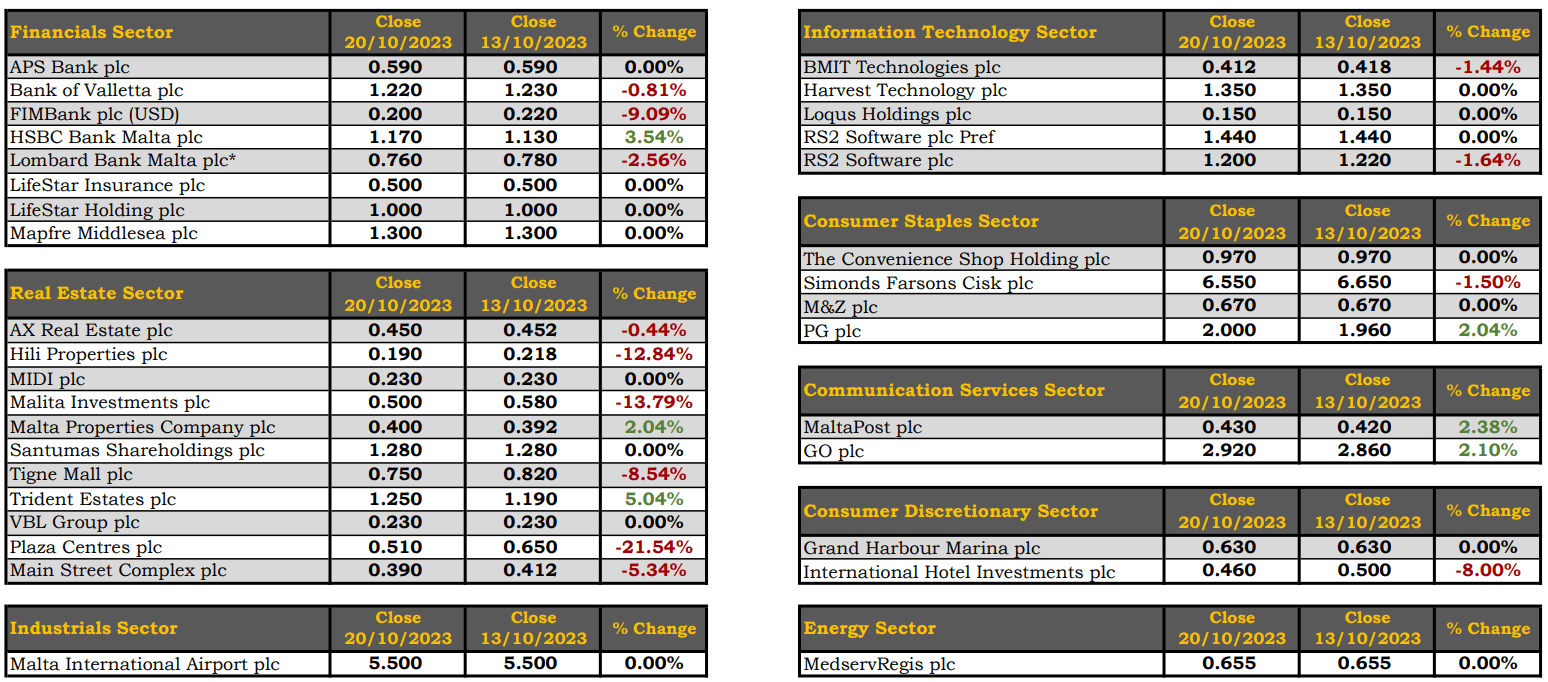

The MSE Equity Total Return Index returned to negative territory, as it closed 1.1% lower at 7,691.978 points. A total of 22 issues were active, six of which headed north while another 13 closed in the opposite direction. Total weekly turnover doubled to €1.3m, generated across 119 transactions.

The MSE MGS Total Return Index advanced marginally by 0.02%, as it reached 858.417 points. Out of 17 active issues, six advanced while another 10 closed in the red. The 3.55% MGS 2026 (V) R headed the list of gainers, as it closed at €101, equivalent to a 1% change. Conversely, the 2.60% MGS 2028 (V) closed 3.1% lower at €94.

The MSE Corporate Bonds Total Return Index registered a 0.8% decline, as it closed at 1,150.205 points. A total of 50 issues were active, 11 of which traded higher while another 26 lost ground. The 5.3% Mariner Finance plc Unsecured € 2024 was the best performer, as it closed 2% higher at par. On the other hand, the 3.85% Hili Finance Company plc Unsecured € 2028 ended the week 4.6% lower at €93.

| Market Highlights: |

International Hotel Investments plc (IHI) started the week with a loss of 12% on Tuesday, which was partially recovered on Wednesday. IHI ended the week at €0.46, a decline of 8%. This was the outcome of two trades worth €2,989.

In the financial services sector, the share price of Bank of Valletta plc declined by0.8%, to close at €1.22. A total of 94,393 shares exchanged hands across 21 transactions, generating €113,718 in turnover. Despite the week’s negative performance, the equity remains 50% up year-to-date.

Its peer, HSBC Bank Malta plc (HSBC), registered a positive performance, posting a gain of 3.5% and closing at €1.17. A total of 10 transactions yielded €62,297 in turnover.

In the same sector, FIMBank plc (USD) was active across a single transaction worth $1,611. This resulted into a decline of 9.1%, closing the week at $0.20.

In the IT sector, RS2 Software plc experienced a decline of 1.6%, to close at €1.20, having recovered from a weekly low of €0.85. Two trades were observed, involving 364 shares.

GO plc concluded the week at a weekly high of €2.92, translating into a gain of 2.1%. Five trades of 13,200 shares were executed, resulting in a total value of €37,894.

Within the consumer staples sector, a single deal of 1,500 PG plc shares were executed. The equity advanced by 2%, finishing the week at €2.

Hili Properties plc closed the week at a weekly low of €0.19. This resulted into a double-digit decline of 12.8%. The equity saw six trades, involving 87,000 shares, translating to a total value of €16,630.

Malta Properties Company plc registered a positive 2% price movement after closing the week at €0.40. A total of six trades involving 10,151 shares generated €4,007 in turnover.

Trident Estates plc closed 5% higher, at a price of €1.25 as a result of four trades, involving a 3,800 shares.

| Announcements: |

AX Group plc announced that the bond issue has been oversubscribed and the issuer decided to close the offer period earlier on October 19, 2023. In light of the aforesaid, the intermediaries’ offer will not take place.

International Hotel Investments plc announced that the bond issue has been oversubscribed and consequently the issuer exercised its right to close the offer period for preferred applicants earlier on October 20, 2023. The offer period for maturing bondholders remained open until further notice. In furtherance of the above, the intermediaries’ offer will not take place.

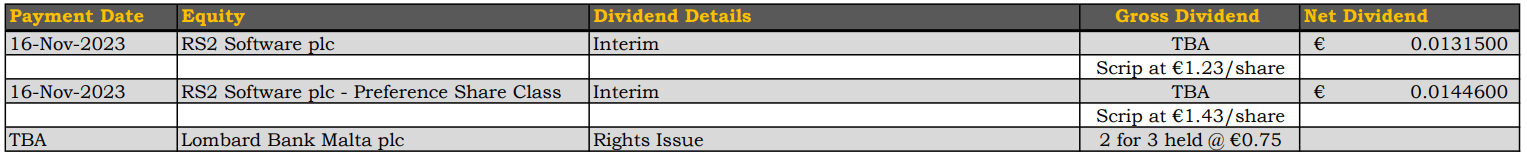

The board of directors of Bank of Valletta plc is scheduled to meet on Thursday 26th October 2023 to consider, and if thought fit, declare an interim cash dividend, subject to regulatory approval.

| Market Movers by Sector: |

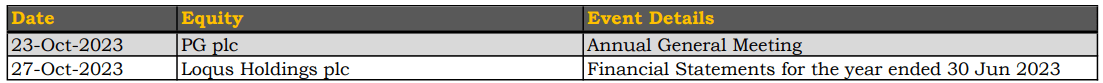

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]