MSE Trading Report for Week ending 10 November 2023

| Movement in Equity and Bond Indices: |

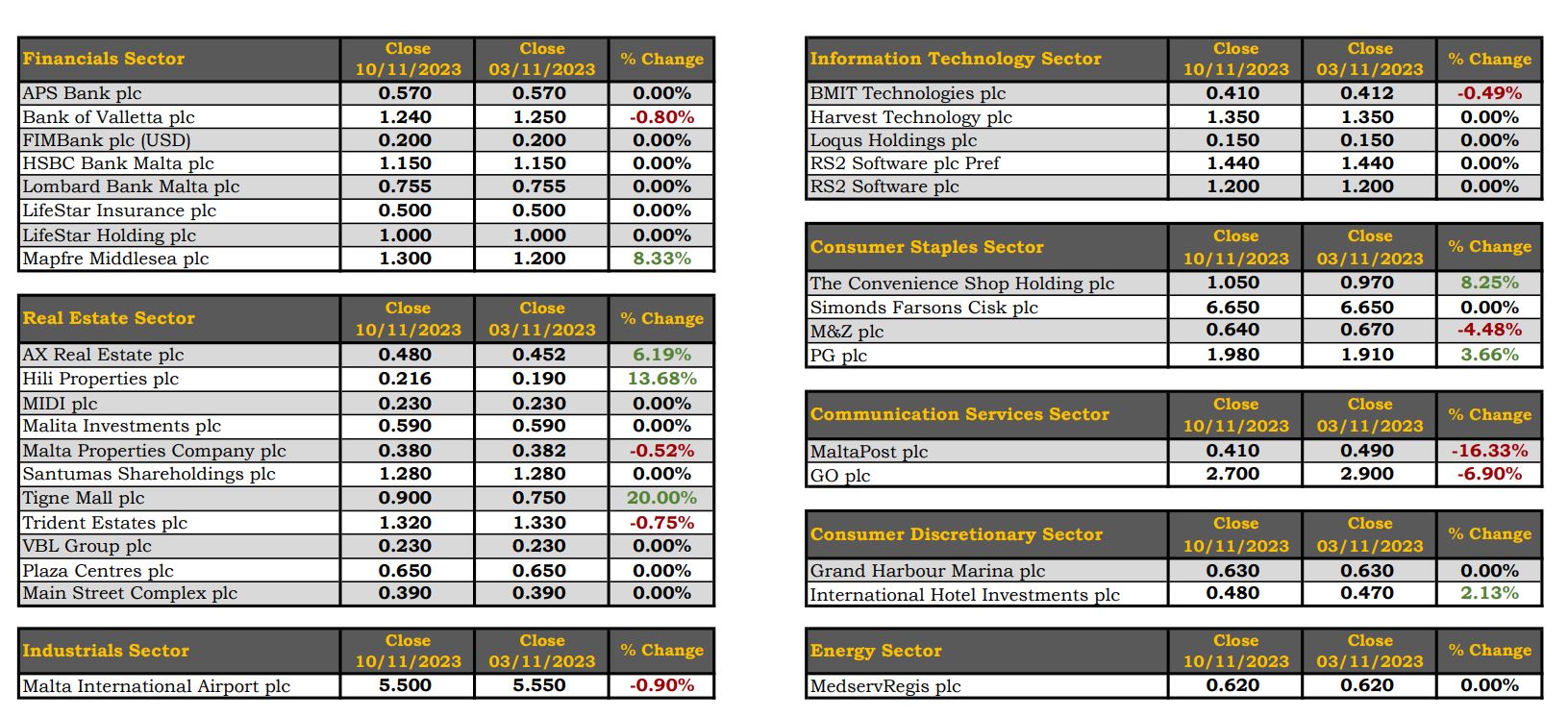

The MSE Equity Total Return Index closed in positive territory for the second week in a row, as it closed 0.2% higher at 7,713.124 points. A total of 21 issues were active, seven of which headed north while another eight closed in the opposite direction. Total weekly turnover reached €8.3m, generated across 118 transactions.

The MSE MGS Total Return Index advanced by 0.5%, as it reached 867.797 points. Out of 24 active issues, 15 increased while five closed in the red. The 3% MGS 2040 (I) headed the list of gainers, as it closed at €85, equivalent to a 4.1% change. Conversely, the 4.45% MGS 2032 (II) closed 2.4% lower at €101.50.

The MSE Corporate Bonds Total Return Index registered a 0.1% increase, as it closed at 1,150.205 points. A total of 61 issues were active, 23 of which traded higher while another 22 registered a drop. The 3.5% GO plc Unsecured € 2031 was the best performer, as it closed 5.5% higher at €95. On the other hand, the 3.8% Hili Finance Company plc Unsecured € 2029 ended the week 4.4% lower at €90.

| Market Highlights: |

The price per share of Bank of Valletta plc (BOV) shed 0.8% to end the week at €1.24. The bank’s equity traded between a weekly low of €1.22 and a weekly high of €1.26. Trading activity included the exchange of 135,100 shares spread over 28 trades. Trading turnover reached €167,340.

The equity of Mapfre Middlesea plc trended 8.3% higher to close at €1.30, as 1,080 shares changed ownership over three trades.

The share price of GO plc declined by 6.9%, as two trades worth €2,520 were recorded. The company’s share price closed at €2.70.

Malta International Airport plc (MIA) shares were also active during the week, as 17 trades across 15,508 shares were exchanged. MIA shares closed at €5.50, a week-on-week decline of 0.9%.

PG plc closed in positive territory, as the company’s equity ended 3.7% higher at the €1.98 price level. Trading activity included eight trades across 8,250 shares.

Hili Properties plc shares jumped 13.7% to the €0.216 level on Tuesday, as one trade on a volume of 109,000 shares was executed. The equity did not trade for the rest of the week.

The price per share of Tigne’ Mall plc shot up by 20% to close at €0.90. This price appreciation was the result of 10 trades on a volume of 9,536,317 shares. This increased activity was a result of the disposal of shares owned by Bank of Valletta plc and the subsequent purchase of these shares by Marsamxett Properties Ltd – more details in the company announcements section below.

The postal service operator MaltaPost plc saw its equity value plummet by 16.3% on Thursday’s trading session to close at €0.41. Three trades worth €3,562 were recorded.

The equity of the hotel operating company International Hotel Investments plc increased by 2.1%, to close at €0.48. Five deals worth €10,040 were recorded.

Similarly, AX Real Estate plc saw its price per share increase to €0.48, a week-on-week increase of 6.2%. This increase was a result of three small trades across 3,704 shares.

| Announcements: |

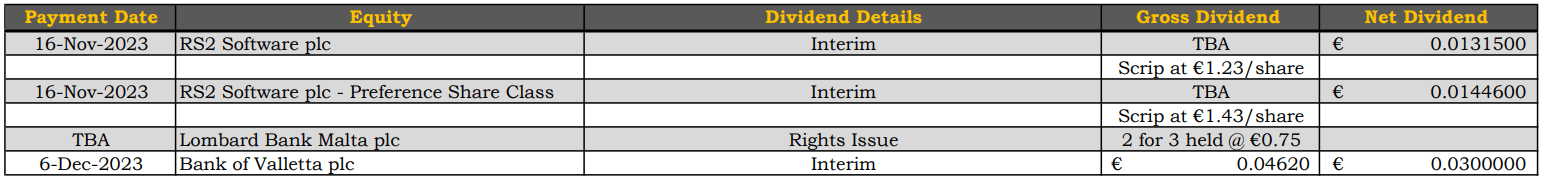

BOV announced that the declared payment of an interim cash dividend of €0.03 net of tax per share was approved by the regulator. The dividend will be paid on December 6, 2023 to those appearing on the bank’s register of members as at the close of business of November 21, 2023.

The board of directors of PG plc announced that it shall be convening on November 29, 2023 in order to consider and, if deemed fit, approve the distribution of an interim dividend for the financial year ending April 30, 2024.

The board of directors of Plaza Centres plc announced that during the month of October, the company redeemed a total of €30,000 in the 3.9% unsecured bonds 2026 and that the company extends the offer to stand in the market to repurchase a further €470,000 until December 31, 2023 at a maximum price of €0.984 per Bond.

Tigne’ Mall plc announced the receipt of a notification of major holdings from Bank of Valletta plc. By virtue of the notification dated November 6, 2023, the company was notified that the proportion of voting rights held by Bank of Valletta plc in the company was reduced from 16.714% to 0% as a result of the disposal of 9,426,767 ordinary shares. The company also announced the receipt of a notification of major holdings from Marsamxett Properties Ltd. By virtue of the notification dated November 6, 2023, the company was notified that the proportion of voting rights held by Marsamxett Properties Ltd in the Company increased from 14.9% to 31.63% as a result of the acquisition of 9,435,567 ordinary shares.

On Tuesday, MIA published its October traffic results together with the group’s financial results for Q1-Q3 2023 following the approval of the latter by the company’s board of directors. Marking the end of summer for the aviation industry, October brought 771,253 passengers through Malta International Airport’s doors. This total represents an increase of 9.6% over 2019 figures. In parallel, seat capacity saw an increase of 6.4%. Despite this increase, strong travel demand throughout October resulted in a monthly seat load factor of 84.7%. Between January and September 2023, the Group generated revenues amounting to €91.6m, marking an increase of 38% over the previous year. This figure also exceeded 2019 levels. The company’s net profit for the first nine months of 2023 stood at €32.3m.

The board of directors of MaltaPost plc will be meeting on December 19, 2023 to consider and approve the financial statements for the year ended September 30, 2023.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]