MSE Trading Report for Week ending 1 December 2023

| Movement in Equity and Bond Indices: |

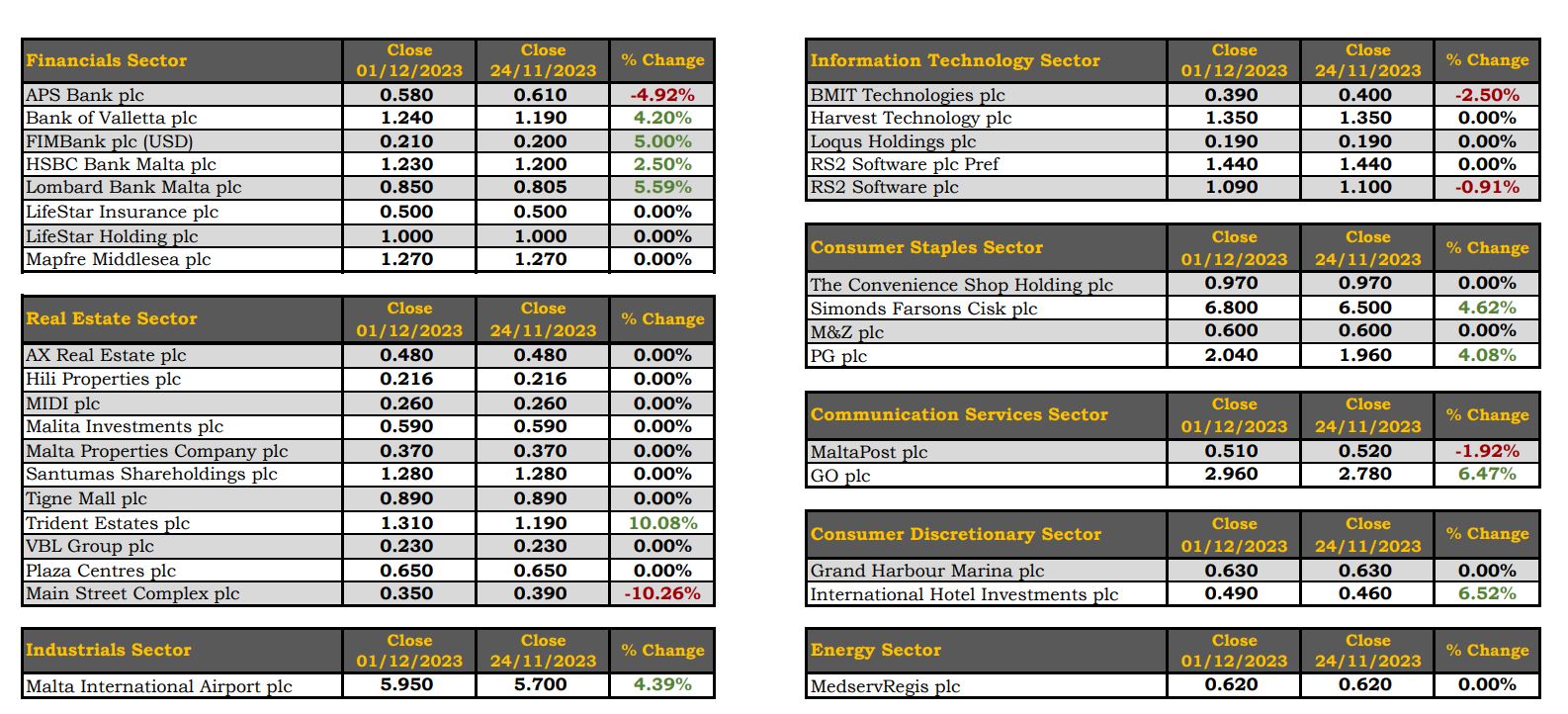

The MSE Equity Total Return Index advanced by 2.7%, to close at 7,949.793 points. During the week, 15 equities were active, as 10 increased, while five declined. Trading turnover rose to €0.7m, as a result of 100 transactions.

The MSE MGS Total Return Index increased by 0.9%, to end the week at 884.975 points. Out of 19 active issues, 15 posted gains while another three declined. The best performing government stock was the 3% MGS 2040 (I) which experienced an increase of 5.1%, to close at €89.50. On the other hand, the 4.00% MGS 2043 (I) suffered the biggest decline, as it dropped by 0.7%, to end the week at €98.05.

The MSE Corporate Bonds Total Return Index closed the week marginally lower at 1,152.02 points -a decline of 0.01%. A total of 57 bonds were active, as 19 issues advanced while 18 moved in the opposite direction. The 3.5% Bank of Valletta plc € Notes 2030 S1 T1 registered the week’s best performance, gaining 4.4%, to close at €93.99. On the other hand, the 3.75% Mercury Projects Finance plc Secured € 2027 suffered the biggest drop, that of 3.1%, to close at €95.

| Market Highlights: |

Bank of Valletta plc shares trended 4.2% higher, as it closed at €1.24. The bank’s share price fluctuated between a weekly low of €1.20 and a high of €1.24. Trading activity featured the exchange of 58,141 shares, worth €71,277.

Similarly, the price per share of HSBC Bank Malta plc (HSBC) increased by 2.5% to the €1.23 level. Trading turnover tallied to €39,109, as 32,025 shares exchanged ownership over 11 deals. On a year-to-date basis, HSBC shares are up by 73.2%.

Lombard Bank Malta plc shares jumped 6%, to end the week at €0.85. Three trades on a volume of 15,000 shares were recorded.

On the other hand, APS Bank plc shed 4.9% to close at €0.58. Eight trades across 24,470 shares were recorded.

The share value of the airport operating company, Malta International Airport plc (MIA), increased by 4.4%, as it closed at the €5.95 price level. MIA shares experienced the highest liquidity levels, as 22 trades worth €379,119 were executed.

International Hotel Investments plc (IHI) saw a 6.5% week-on-week increase in its share price, as two trades worth €4,895 were recorded on Monday and Tuesday. The equity did not trade for the rest of the week. IHI shares closed at €0.49.

RS2 Software plc shares declined by 0.9% to €1.09. This drop was the result of two trades on a volume of 7,832 shares.

The equity value of GO plc increased by 6.5%, as 12 trades involving the exchange of 16,101 shares pushed the telecommunications company’s share price to the €2.96 price level. Since the beginning of the year, GO plc shares have gained 3.5%.

Simonds Farsons Cisk plc saw an increase of 4.6%, as it closed at €6.80. Six trades worth €25,694 were executed.

Similarly, PG plc gained 4.1%. The company’s equity exchanged ownership 10 times on a volume of 60,755 shares. Trading turnover tallied to €119,752.

| Announcements: |

LifeStar Insurance plc announced that the board approved the unaudited half-yearly financial report of the company for the six-month period ended June 30, 2023.

The board of PG plc resolved to distribute a net interim dividend of €2.75m equivalent to €0.0254630 net per ordinary share, payable on December 11, 2023.

MIA plc has updated its investment programme for the airport campus to total €250 million for the period stretching from 2023 until 2028. This investment programme will deliver significant upgrades that will equip the company to operate more efficiently and safely, even as MIA handles record passenger numbers, whilst working towards reaching its environmental targets and continuing to develop the airport campus.

The board of JD Capital plc has applied to the MFSA requesting authorisation for the issue of a maximum of €5m 7.25% secured callable notes redeemable in 2026 (or earlier, at the discretion of the Company) of a nominal value of €1,000 per note. The notes will not be listed or traded on the Malta Stock Exchange or on any other regulated market.

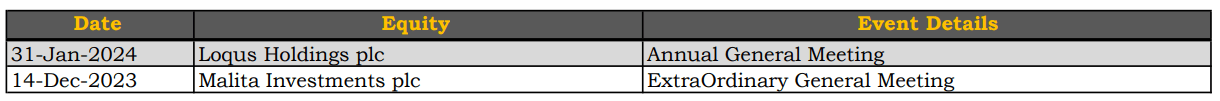

| Upcoming Events: |

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]