MSE Trading Report for Week ending 7 December 2023

| Movement in Equity and Bond Indices: |

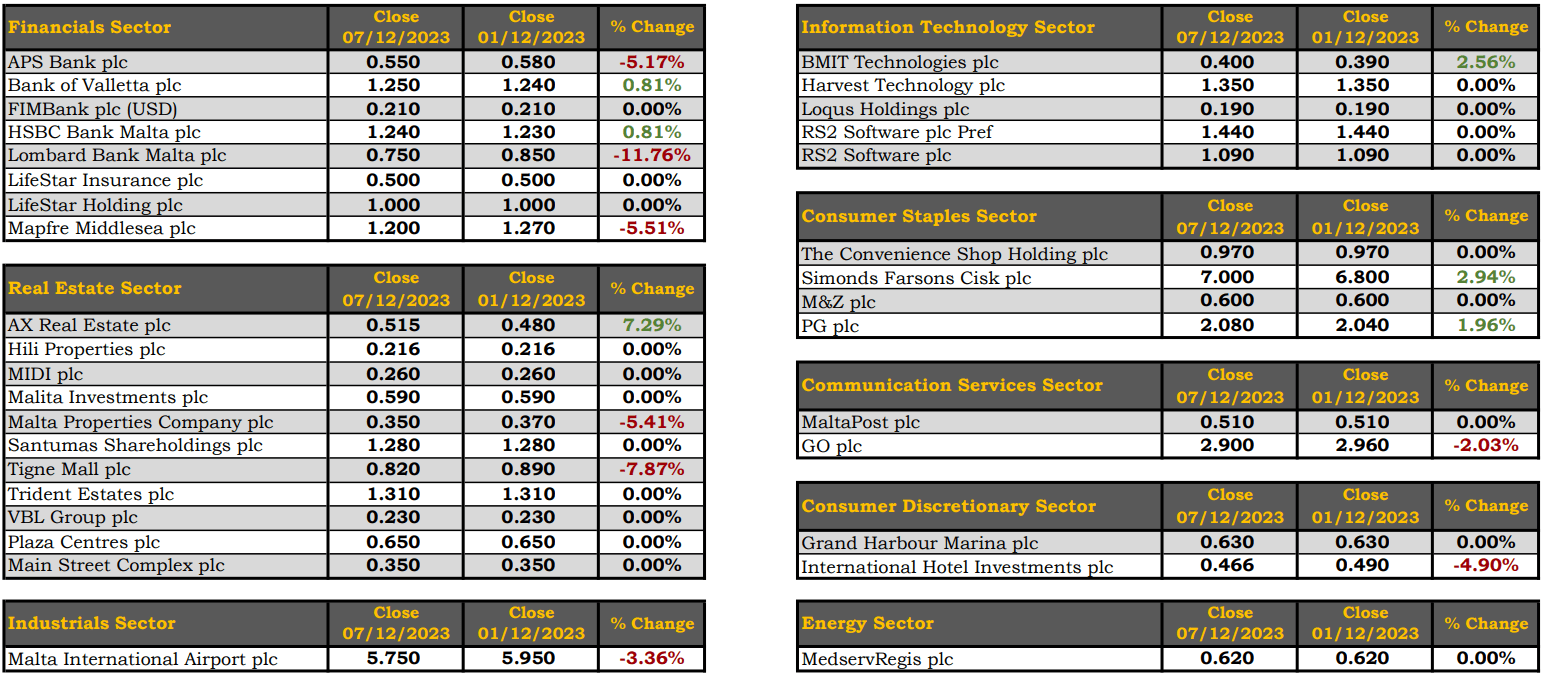

The MSE Equity Total Return Index closed the week in negative territory with a 1.2% decline, to close at 7,857.616 points. A total of 17 equities were active, of which six headed north while another eight closed in the red. Total weekly turnover reached €1.4m, generated across 105 transactions.

The MSE MGS Total Return Index increased further by 0.9%, to settle at 893.213 points. Out of 21 active issues, 17 posted gains while another two lost ground. The 2.90% MGS 2032 (VI) was the best performer, closing 4.3% higher at €96.56. A marginal loss of 0.1% was recorded in the 2.4% MGS 2041 (I) and the 3.55% MGS 2026 (V) issues, to close at €84 and €101.50 respectively.

The MSE Corporate Bonds Total Return Index closed the week 0.6% higher to 1,162.150 points. A total of 66 issues were active, of which 24 registered gains, while another 20 declined. The top performer was the 3.75% Bortex Group Finance plc Unsecured € 2027, with a 3.6% increase in price, to close at €100. On the other hand, the 3.75% Tumas Investments plc Unsecured € 2027 declined by 3.6%, to close at €96.

| Market Highlights: |

The share price of Malta International Airport plc retracted by 3.4% during the week, closing at a weekly low of €5.75. This was the outcome of six trades involving 16,190 shares totaling €93,136.

International Hotel Investments plc encountered a 4.9% decrease in its share price, closing at €0.466. A total of 10 trades saw 100,890 shares changed hands, generating €44,648 in turnover.

In the banking industry, Bank of Valletta plc saw a modest 0.8% increase in its share price. The equity ended the week at a high of €1.25, despite reaching a weekly low of €1.21. A total of 267,127 shares were negotiated across 26 deals, generating the second largest weekly turnover of €332,582.

Its peer, HSBC Bank Malta plc, recorded a positive 0.8% movement in its share price, ending the week at €1.24. The equity recorded five trades, involving a total of 7,953 shares worth just €9,837.

A single transaction of 28,855 Lombard Bank Malta plc shares dragged the price lower by 11.8% to close at the €0.75 price level.

APS Bank plc experienced a 5.2% decrease in its share price as a result of six deals involving 32,685 shares. The equity closed the week at €0.55.

The share price of Mapfre Middlesea plc dropped by 5.5% to €1.20 as two trades of 5,138 shares were dealt.

A total of 813,335 Tigne Mall plc (TML) shares exchanged hands on Wednesday across eight deals. As a result, the equity was the most liquid, generating €666,935 in turnover. The share price of TML dropped by 7.9% to close at €0.82.

Within the consumer staples sector, Simonds Farsons Cisk plc recorded a 2.9% increase in its share price, closing at €7. Eleven trades of 9,182 shares generated €63,184 in turnover.

PG plc witnessed a 2% increase in its share price, closing at €2.08. This was a result of a sole transaction involving 862 shares.

| Announcements: |

The board of PG plc will be convening on December 18, 2023 to consider, and if deemed fit, approve the interim unaudited financial statements for the six month financial period ending October 31, 2023.

The board of Bank of Valletta plc has recently approved a policy whereby a Director of the Bank who has ongoing legal proceedings against the Bank or any of the Bank’s subsidiaries, while s/he is still in office, shall immediately withdraw from participating in Board meetings of the Bank whilst his/her case against the Bank is still ongoing.

Malta International Airport plc (MIA) registered 528,923 passenger movements in November, marking an increase of 7.2% over 2019 traffic figures. November traffic peaked four days into the month on the weekend of the school mid-term holidays, with more than 25,000 passengers travelling through the airport that day. Strong demand resulted in a seat load factor of almost 85%, which was 6.8% higher than 2019 levels.

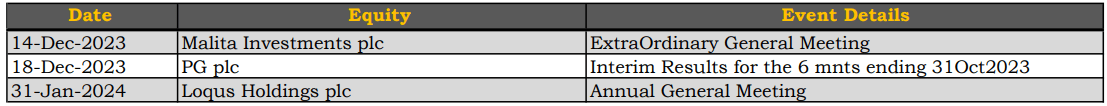

| Upcoming Events: |

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]