MSE Trading Report for Week ending 22 December 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index rebounded, as it ended the week 3.4% higher at 8,110.894 points. A total turnover of €1m was registered across 177 transactions, as 25 equities were active, 14 trades of which headed north while eight closed in the opposite direction.

The MSE MGS Total Return Index registered a gain of 1.7% to finish at 917.081 points. Out of the 23 active issues, five lost ground, while 16 moved higher. The 1.5% MGS 2045 (I) issue registered the best performance of 14.5%, closing at €67. The 2.1% MGS 2039 (I) registered a loss of 4.5%, concluding the week at €85.

The MSE Corporate Bonds Total Return Index saw a decline of 0.2%, closing at 1,157.567 points. A total of 67 issues were active, as 32 appreciated and 19 registered losses. The 3.75% AX Group plc Unsecured 2029 Series II gained 5.8% to close at €95.25, whereas the 4% SP Finance plc Secured € 2029 issue lost 5.6% to close at €92.01.

| Market Highlights: |

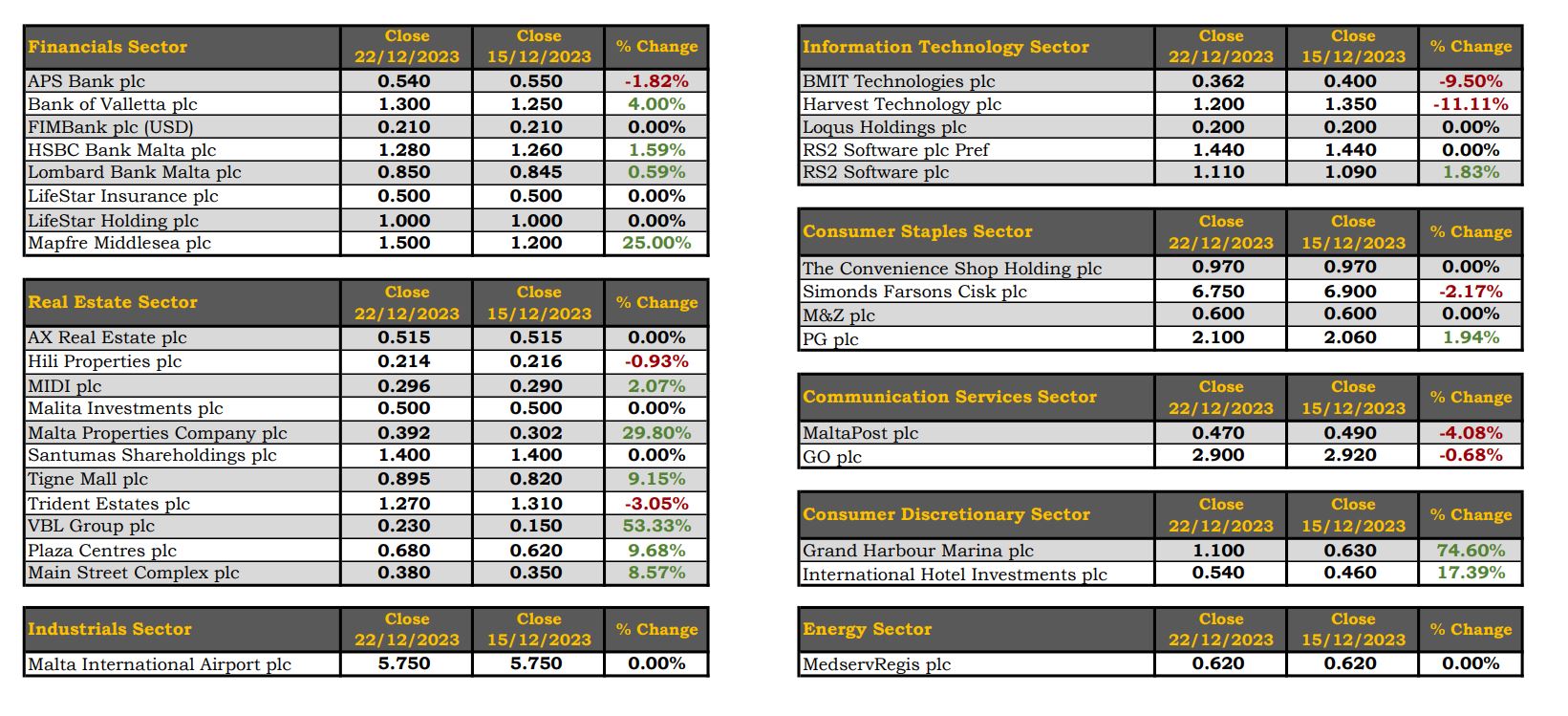

The equity of Bank of Valletta plc (BOV) gained 4% to close at €1.30. The bank’s equity exchanged ownership 45 times across 289,797 shares, as trading turnover reached €383,844. BOV shares fluctuated between an intra-week low of €1.25 and a weekly high of €1.50.

Similarly, HSBC Bank Malta plc shares trended 1.6% higher to the €1.28 level, as 16 deals were executed on a volume of 44,118 shares. On a year-to-date basis, the bank’s share price is up 80.3%.

The price per share of PG plc rose 1.9% to the €2.10 price level. Trading activity included 14 trades across 68,800 shares. Total trading turnover tallied to €144,317.

Simonds Farsons Cisk plc shed 2.2%, as four trades worth €34,681 were recorded. The company’s equity closed at €6.75. Since January, the equity is down 1.5%.

RS2 Software plc gained 1.8% to end the week at €1.11. The company’s shares exchanged ownership seven times, with trading turnover reaching €18,506.

BMIT Technologies plc plummeted 9.5% to close at €0.362 on Wednesday, as 4,970 shares exchanged ownership over three trades.

International Hotel Investments plc shares generated a positive 17.4% at €0.54, as 126,272 shares exchanged ownership over 12 trades.

The shares of Grand Harbour Marina plc traded 10 times on Tuesday to close at €1.10, as 126,233 shares were traded. This trading activity caused the company’s share value to register a week-on-week increase of 74.6%.

The equity value of VBL plc jumped 53.3% to €0.23 during Monday’s trading session, as one small trade worth €69 was recorded. The equity did not trade during the rest of the week.

Malta Properties Company plc shares rose 29.8% to close at €0.392, as eight trades on a volume of 29,306 were recorded.

| Company Announcements |

Further to their previous announcement, BOV announced that it has entered into an assignment agreement pursuant to which it has assigned its rights, title, interest and benefits to the portfolio to a third-party acquirer for a consideration of €26m. The consideration reflects, amongst other things, the reduced creditworthiness of the underlying borrowers, the recovery risk inherent in the portfolio and the cost to acquire and manage the portfolio over the recovery period.

On Monday, PG plc announced that the board of directors approved the Company’s unaudited financial statements and interim directors’ report for the six months ended October 31, 2023. Profit before tax amounted to €10.1m as compared to €8.5m the previous year. After deducting tax, the group registered a profit after tax of €7.2m compared to €6.1m the previous year, an increase of 18.2%.

M&Z plc announced that on the December 19, 2023 it has received a notification of major holdings from BOV, on the behalf of the Wealth Management Discretionary Customers, where the Company was notified that the proportion of voting rights in the Company held by BOV as at March 14, 2022 was 5.53%, with the relevant threshold having been crossed following the allocation of shares during the company’s Initial Public Offering.

During the week, the board of directors of Santumas Shareholdings plc approved the interim unaudited financial statements for the six months ended October 31, 2023. The profit before tax for the period under review was €436,006 while the company reported a profit after tax of €271,936 compared to 368,222 in 2022.

On Tuesday, the board of directors of MaltaPost plc announced that they approved the Annual Financial Report and the Consolidated Financial Statements for the financial year ended September 30, 2023 and resolved that these statements be submitted for approval at the forthcoming Annual General Meeting (AGM) to be held on February 9, 2024.

The company reported a pre-tax profit of €2.3m, an increase of €1.7m over the previous year’s profits. Earnings per share rose to €0.02, allowing the board to propose a final net dividend of €0.02 per nominal share of €0.125, payable in cash or by way of scrip at the AGM.

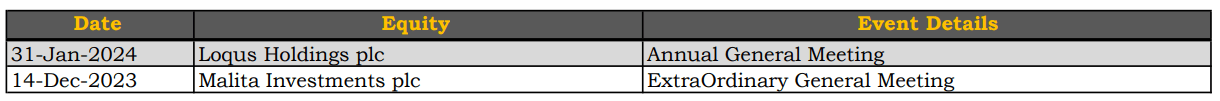

| Upcoming Events: |

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]