MSE Trading Report for Week ending 19 January 2024

| Movement in Equity and Bond Indices: |

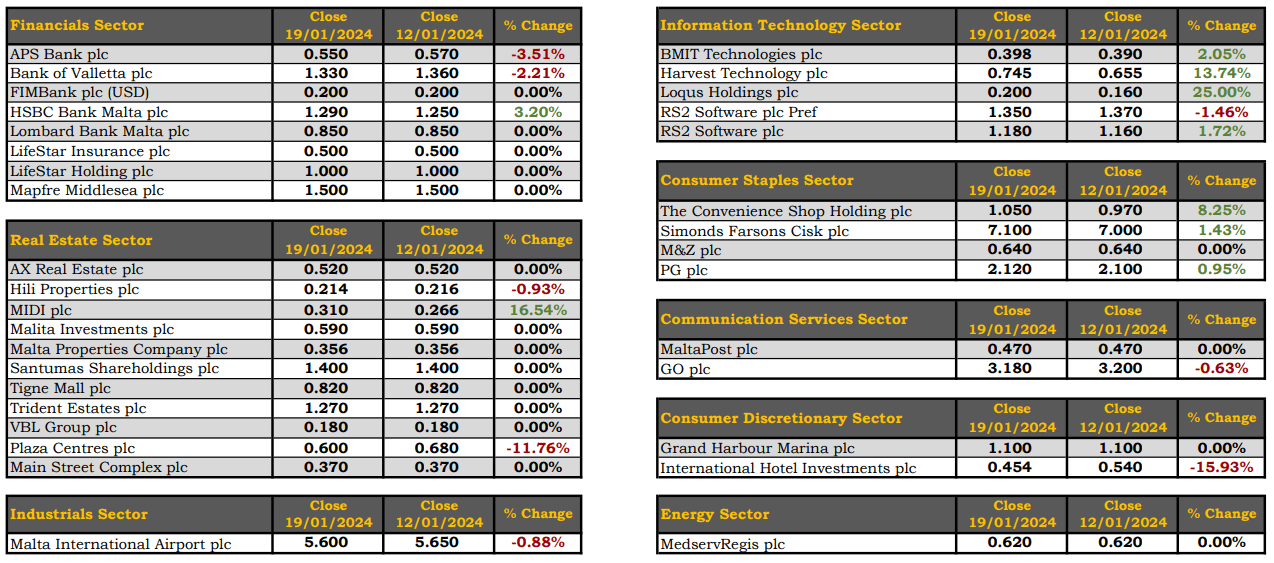

The MSE Equity Total Return Index retracted for the third consecutive week, dropping 0.7% and closing at 8,155.602 points. Twenty equities were active, with nine equities heading north and another eight closing in the red. A total of 105 deals generated a turnover of €0.4m, €1m lower week-on-week.

The MSE Corporate Bonds Total Return Index headed 0.1% north, as it settled at 1,167.818 points. Out of 64 active issues, 31 closed in the green, while another 17 closed in the opposite direction. The 4% SP Finance plc Secured € 2029 issue recorded the best performance, up by 8.1%, to close at €99.50. Conversely, the 3.5% Simonds Farsons Cisk plc Unsecured € 2027 lost 2%, ending the week at €98.

The MSE MGS Total Return Index recorded a loss of 1.2%, closing at 904.332 points. Out of 16 active issues, three appreciated while another 11 declined. The 2.3% % MGS 2029 was the most liquid issue, as a turnover of €269k led to 0.3% decline in price, to close at €95.16. Heading the list of fallers, the 2.4% MGS 2041 closed 6.7% lower, at €82.60.

| Market Highlights: |

International Hotel Investments plc faced a significant decline of 15.9% as it closed at €0.454. This was the outcome of three trades involving 6,516 shares worth €2,977.

In the IT sector, RS2 Software plc demonstrated a positive 1.7% movement in its share price, closing at a weekly high of €1.18. A total of three transactions involving 5,636 shares worth €6,552 were executed.

The share price of Bank of Valletta plc observed a 2.2% decrease, settling at €1.33. The equity traded between a weekly high of €1.36 and a low of €1.30. The banking equity was the most active listing, generating a total of €104,332 in turnover across 28 trades.

Its peer, HSBC Bank Malta plc closed off at a weekly high of €1.29. This translated into an increase of 3.2% in its share price, as a result of nine deals worth €9,936 and involving 7,843 shares.

Thirteen transactions involving 98,911 APS Bank plc shares, pushed the share price 3.5% lower, finishing the trading week at €0.55. The equity registered a turnover of €54,640.

Malta International Airport plc experienced a marginal 0.9% decline, to close at €5.60. Trading activity involved seven trades worth €17,923.

Within the property sector, MIDI plc showcased a double-digit gain of 16.5%. The equity closed the week at €0.31. A total of 40,010 shares changed hands across three transactions.

GO plc faced a modest 0.6% decrease in its share price, settling at a weekly low of €3.18. Trading activity included 12 trades of 30,285 shares worth €98,350.

Four transactions of just 742 Simonds Farsons Cisk plc shares pushed the share price 1.4% lower, to close at €7.10.

The Convenience Shop Holding plc joined the list of gainers, recording a positive 8.2% movement in its share price. Two trades of 1,225 shares exchanged ownership, generating €1,141 in turnover. The equity ended the week at €1.05.

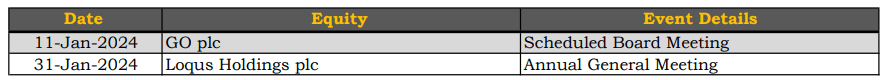

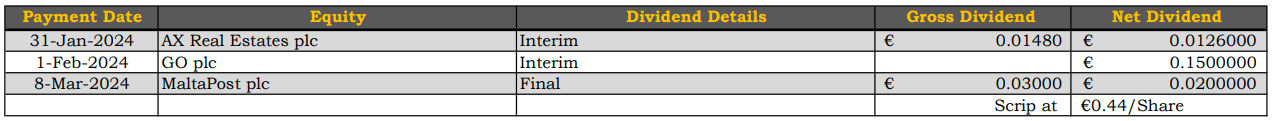

| Upcoming Events: |

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]