MSE Trading Report for Week ending 26 January 2024

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index ended the week in negative territory for a fourth consecutive week, closing 1% lower at 8,073.414 points. A total of 20 issues were active, three of which headed north while another 10 closed in the opposite direction. The weekly total turnover remained consistent with the previous week at €0.5m, generated across 128 transactions.

The MSE Corporate Bonds Total Return Index registered a 0.5% gain, as it closed at 1,173.091 points. A total of 69 issues were active, 37 of which traded higher while another 16 lost ground. The 4.5% Endo Finance plc Unsecured € 2029 was the best performer, as it closed 5.3% higher at €94.75. On the other hand, the 3.75% Bortex Group Finance plc Unsecured € 2027 ended the week 4.5% lower at €95.

The MSE MGS Total Return Index advanced marginally by 0.4%, as it reached 907.541 points. Out of 11 active issues, seven advanced while another three closed in the red. The 2.5% MGS 2036 (I) headed the list of gainers, as it closed at €92, equivalent to a positive 1.7% change. Conversely, the 2.1% MGS 2039 (I) closed 2.4% lower at €81.

| Market Highlights: |

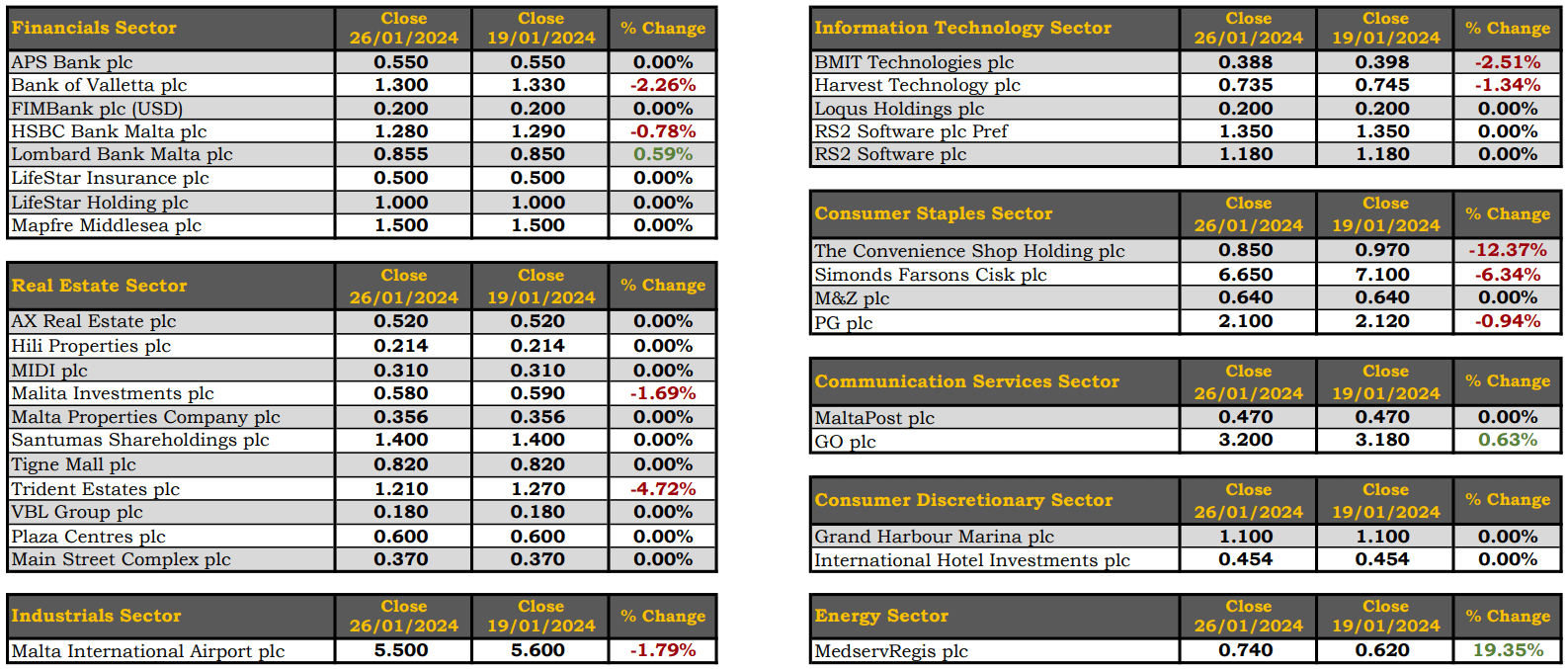

Malta International Airport plc shed 1.8% in its share price, closing at a weekly low of €5.50. Trading activity included 14 trades on a volume of 9,007 shares.

In the financial sector, Bank of Valletta plc (BOV) experienced a 2.3% decline in its share price. Despite reaching a weekly high of €1.33, the equity closed at €1.30. BOV generated the highest turnover of €94,704, as a result of 25 trades across 72,706 shares.

Similarly, HSBC Bank Malta plc recorded a marginal loss of 0.8% in its share price, closing at €1.28. The bank’s equity fluctuated between a weekly high of €1.29 and a weekly low of €1.26. A total of 22,349 shares exchanged hands over nine deals.

A sole deal involving 5,710 Lombard Bank Malta plc shares, pushed the bank’s price 0.6% higher, to close the week at €0.855.

The share price of Simonds Farsons Cisk plc declined by 6.3%, closing at €6.65. Eight deals of 4,270 shares worth €29,144 were recorded.

GO plc shares saw a positive 0.6% movement in their value, finishing the trading week at a high of €3.20. Seven deals worth €13,076 were executed.

Harvest Technology plc retracted by 1.3%, closing at €0.735. Trading activity included four trades, on a weekly volume of 13,000 shares and a total trading value of €9,394.

The equity value of MedservRegis plc jumped 19.4%, closing at a weekly high of €0.74. This was the outcome of 85,000 shares worth €52,396, spread across 13 transactions.

The Convenience Shop Holding plc plummeted by 12.4%, closing at €0.85. Two deals of 2,841 shares generated a turnover of €2,415.

Malita Investments plc headed south as a result of 103,040 shares traded over a single deal. The equity fell to the €0.58 price level, translating to a 1.7% decline.

| Company Announcements |

FIMBank plc announced that as part of a streamlining initiative and corporate restructuring exercise, the bank’s board has recently resolved to approve a merger by acquisition between the bank, as the acquiring company, and FIM Business Solutions as the company being acquired. The bank has obtained regulatory approval from the MFSA in relation to the proposed Merger. Upon the Merger taking effect, the Bank shall succeed to all the assets, rights, liabilities, and obligations of FIM Business Solutions, which in turn, shall cease to exist.

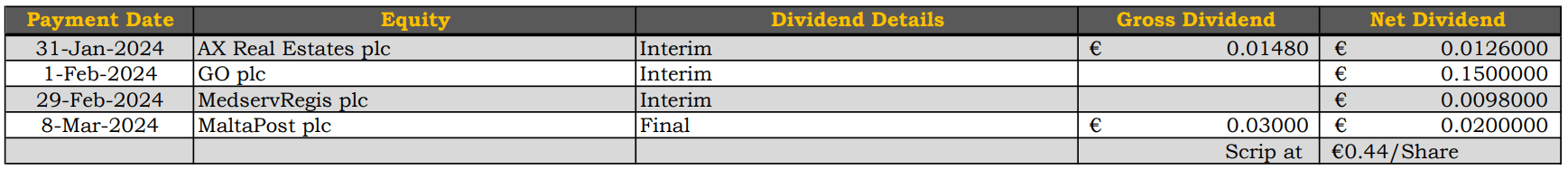

MedservRegis plc announced that the board has resolved to distribute an interim dividend of €1m, representing an interim dividend of €0.0098389 per share. The dividend shall be payable on all shares settled as at close of business on February 8, 2024 and shall be paid by no later than February 29, 2024.

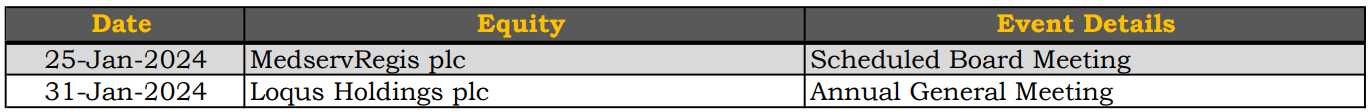

| Upcoming Events: |

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]