MSE Trading Report for Week ending 2 February 2024

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index headed north, as it reached 8,112.816 points, reflecting a 0.5% increase. A total of 19 equities were active, six of which registered gains while another six lost ground. Total activity declined slightly to €0.4m as 109 transactions were dealt.

The MSE MGS Total Return Index advanced by 0.4% to 911.051 points. A total of 17 issues were active, as 12 registered gains while one fell. The 5.1% MGS 2029 (I) was the best performer, as it closed 1% higher to €110.35. On the other hand, the 3.40% MGS 2042 (I) lost 0.5%, ending the week at €98.

The MSE Corporate Bonds Total Return Index remained relatively flat, increasing by just 0.01% to 1,173.217 points. Out of 62 active issues, 23 advanced while another 21 closed in the red. The 3.75% Bortex Group Finance plc Unsecured € 2027 was the best performer, as it closed 4.2% higher at €99. Conversely, the 4% Exalco Finance plc Secured € 2028 headed the list of fallers, as it closed 4.5% lower at €95.

| Market Highlights: |

In the financial services sector, HSBC Bank Malta plc ended the week in the green, up by 3.1% to €1.32. HSBC was the most liquid equity during the week, as 80,928 shares spread across 16 trades generated the highest turnover of €105,076.

Its peer, APS Bank plc registered a modest 0.9% decrease in its share price, closing at €0.545. Trading activity involved eight trades of 35,368 shares and a total trading value of €19,402.

Malta International Airport plc concluded the week at a weekly high of €5.70, translating into a gain of 3.6%. The equity generated a turnover of €58,832 across 18 trades involving 10,462 shares.

International Hotel Investments plc joined the list of losers after experiencing a loss of 0.4% in its share price, closing at €0.452. Two trades of 20,300 shares worth €9,192, were executed.

RS2 Software plc Preference witnessed a 3.7% decrease in its share price, closing at €1.30. This was a result of 5,000 shares worth €5,656, spread across two deals.

In the property sector, VBL plc appreciated by 1.1% to €0.182, as a single deal of 10,000 shares was executed.

Plaza Centres plc rallied a 3.3% increase in its share price, closing at €0.62. Similarly, trading activity involved a single trade of 5,060 shares worth €3,137.

Tigne Mall plc ended the week at €0.83, an increase of 1.2%. A total of 10,000 shares changed hands across a sole transaction, generating €8,300 in turnover.

The share price of Simonds Farsons Cisk plc retracted by 1.5%, ending at a weekly low of €6.55. A total of 2,108 shares were negotiated across five deals, generating €14,046 in turnover.

Grand Harbour Marina plc faced a double-digit decline of 18.2% to €0.90, having recovered from an intra-week low of €0.89. Trading activity encompassed four trades, with a volume of 11,000 shares.

| Company Announcements |

MedservRegis plc provided a trading update based on unaudited figures for the financial year ended December 31, 2023. During 2023, the energy sector began to experience the benefits of the resurgence in energy oil prices, driving increased exploration and production activities by the International Energy Companies. Digitalization and sustainability efforts gained prominence, with a focus on ESG initiatives and carbon reduction.

In this context, the group’s unaudited revenues for 2023 are anticipated to be in the region of €73m, an increase of 9% compared to the €66.9m achieved in 2022 and an increase of 13.2% against the revenue forecast disclosed in the 2022 updated financial analysis summary. Unaudited cash and bank deposits at the end of 2023 were in the region of €16m, leaving the group well-funded for this year.

Loqus Holdings plc announced that the company’s AGM has been held on January 31, 2024 and all resolutions on the agenda were approved.

The board of Malita Investments plc announced that it has submitted an application for authorisation for admissibility to listing to the MFSA requesting approval of a prospectus in relation to the issue of rights to eligible shareholders to subscribe to up to 65,825,806 new ordinary shares of a nominal value of €0.50 per share in the Company.

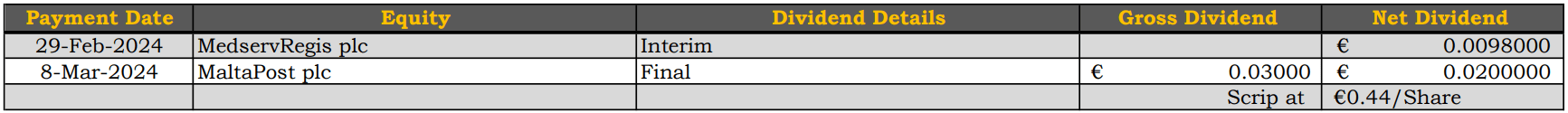

| Upcoming Events: |

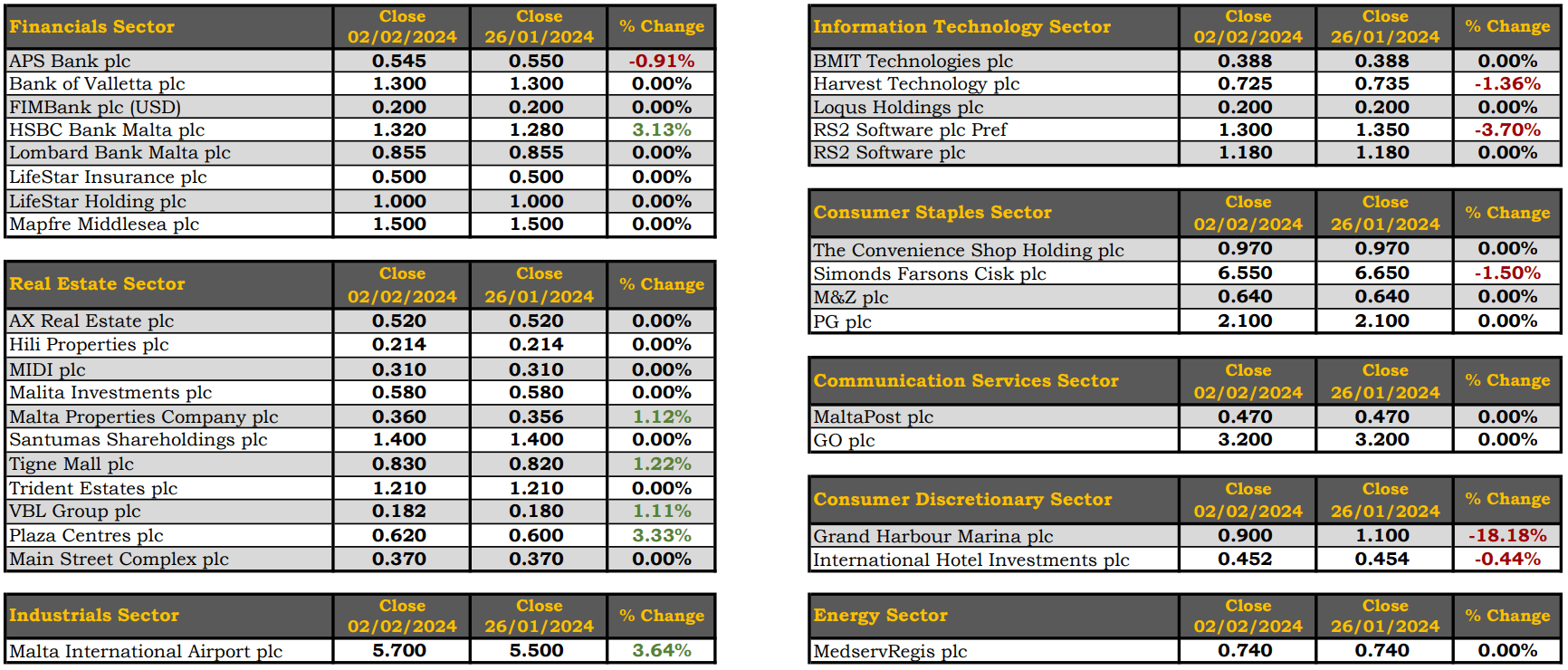

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]