MSE Trading Report for Week ending 1 March 2024

| Movement in Equity and Bond Indices: |

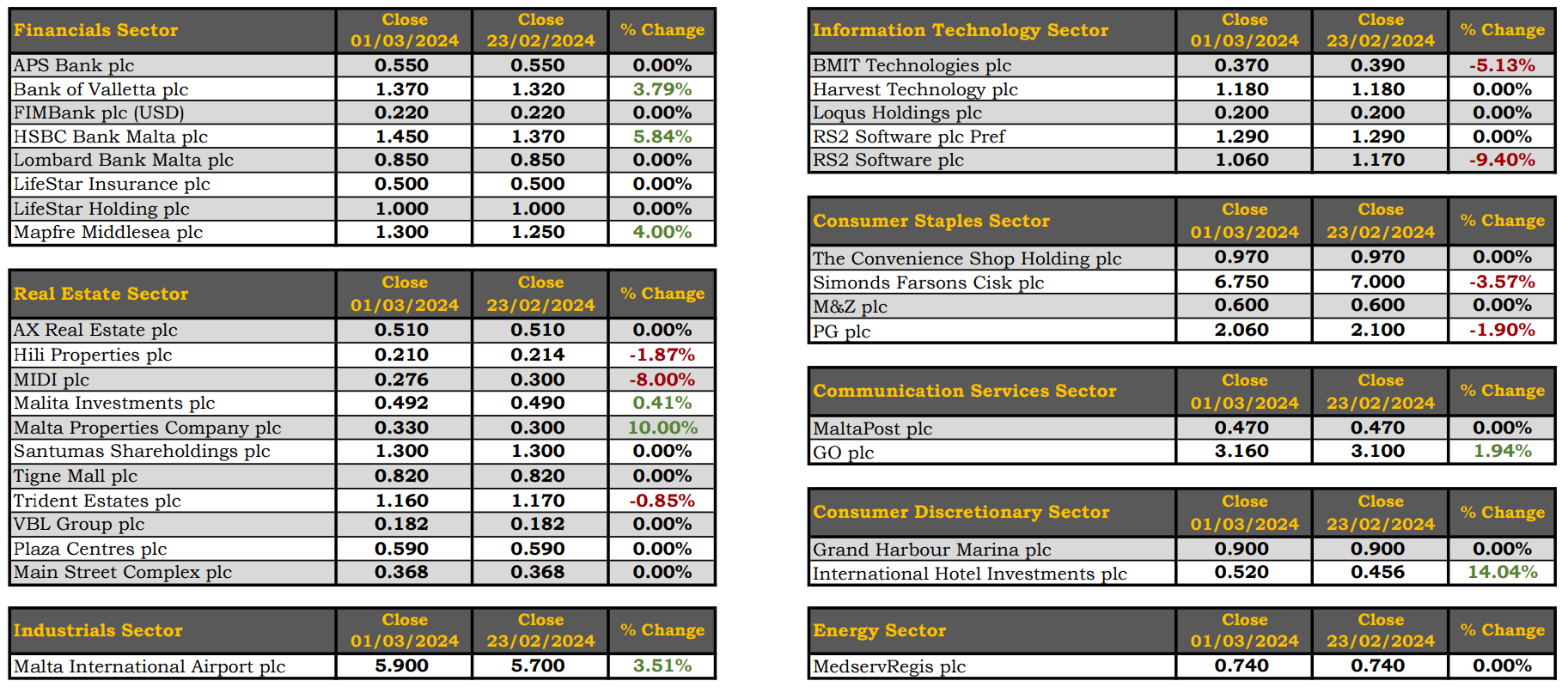

The MSE Equity Total Return Index closed in positive territory for the second week in a row, as it increased by 1.8% to end at 8,273.316 points. A total of 20 issues were active, eight of which headed north while another seven closed in the opposite direction. Total weekly turnover reached €5.4m, generated across 254 transactions.

The MSE Corporate Bonds Total Return Index advanced by 0.6%, as it reached 1,179.718 points. Out of 62 active issues, 36 increased while 13 closed in the red. The 3.5% AX Real Estate plc Unsecured € 2032 headed the list of gainers, as it closed at €95, equivalent to a 5.6% change. Conversely, the 4% Exalco Finance plc Secured € 2028 closed 4.5% lower at €96.25.

The MSE MGS Total Return Index registered a 0.4% increase, as it closed at 900.731 points. A total of 20 issues were active, 14 of which traded higher while another four registered a drop. The 1.8% MGS 2051 (I) was the best performer, as it closed 17.3% higher at €78. On the other hand, the 0.3% MGS 2024 (IV) ended the week 3.7% lower at €98.30.

| Market Highlights: |

International Hotel Investments plc (IHI) was the best performing equity during the week, as it gained 14%. IHI was active across four deals worth €2,871, ending at a high of €0.52.

Bank of Valletta plc joined the list of positive movers, gaining 3.8% to its share price. The banking equity closed at €1.37, as 62 trades of 433,804 shares worth €577,630 were executed.

In the same sector, HSBC Bank Malta plc jumped 5.8% to the €1.45 level. This was an outcome of 35 trades involving 195,077 shares, generating €270,383 in turnover.

The airport operating company Malta International Airport plc (MIA) also registered a gain during the week. The equity saw 170,440 shares exchange hands across 25 deals, pushing the share price 3.5% higher to €5.90.

The share price of GO plc advanced by 1.9% to the €3.16 price level. A total of 32,683 shares exchanged ownership across 13 transactions.

A total of three deals involving 4,775 Mapfre Middlesea plc shares pushed the share price 4% higher. The equity closed at €1.30

Tigne Mall plc was the most liquid equity during the week, as five deals generated €1.6m in trading turnover. The equity reached a weekly high of €0.825 on Wednesday but failed to sustain this gain and ended the week flat at €0.82.

On the other hand, RS2 Software plc witnessed a significant decrease in its share price of 9.4%. The equity saw 17 deals on a volume of 240,005 shares. The company’s share price closed at €1.06.

In the consumer staples sector, Simonds Farsons Cisk plc recorded a negative 3.6% movement in its share price, closing at €6.75. This was the result of eight trades worth €570,006.

PG plc saw a 1.9% decrease in its value, closing at a weekly low of €2.06. Seven trades of 63,500 shares were executed, generating €132,060 in turnover.

| Company Announcements |

The board of MIA held a meeting on Thursday, during which they approved the group’s financial results for the year ended on December 31, 2023.

MIA closed 2023 with a record 7.8m passenger movements, as traffic volumes increased by 33.4% over 2022. Following the attainment of these positive results, MIA announced that the group’s total revenue generated in 2023 amounted to €120.2m.

The group’s net profit for the year amounted to €40.3m compared to a net profit of €38.9m, inclusive of a tax credit of €12m, reported in 2022.

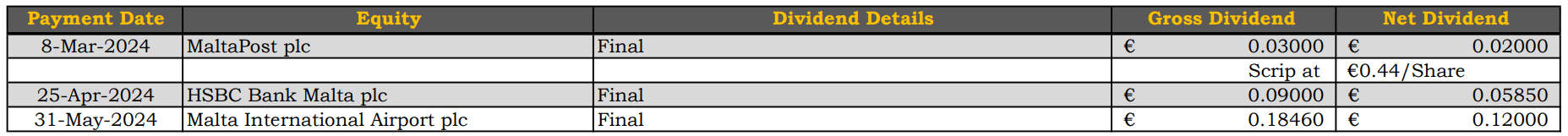

The board is recommending the payment of a final net dividend of €0.12 per share. The board scheduled the AGM of the company for May 15, 2024.

Malita Investments plc announced the recent completion of the third of four social housing projects in Kirkop. The site is due to be fully occupied in the coming weeks. A further four sites in Kirkop, Msida, Qrendi and Siġġiewi are now expected to be completed in or around March 2024. The company will keep the market informed of further developments relating to the Affordable Housing Project.

The board of BMIT Technologies plc is scheduled to meet on March 11, 2024 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2023. The declaration of a final dividend is to be recommended to the company’s AGM.

Loqus Holdings plc announced that the directors have approved the half-yearly report of the company for the six months ended December 31, 2023. The period saw the group maintaining and improving on its record revenues achieved in the prior period. The group is however reporting a loss after tax, for the period, of €610,298 compared to a profit of €561,280 in the same period in 2022. This loss is attributable to upfront expenditure brought about by the onboarding of new clients.

| Market Movers by Sector: |

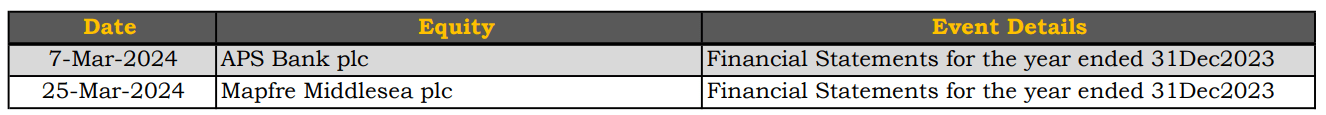

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]