MSE Trading Report for Week ending 15 March 2024

| Movement in Equity and Bond Indices: |

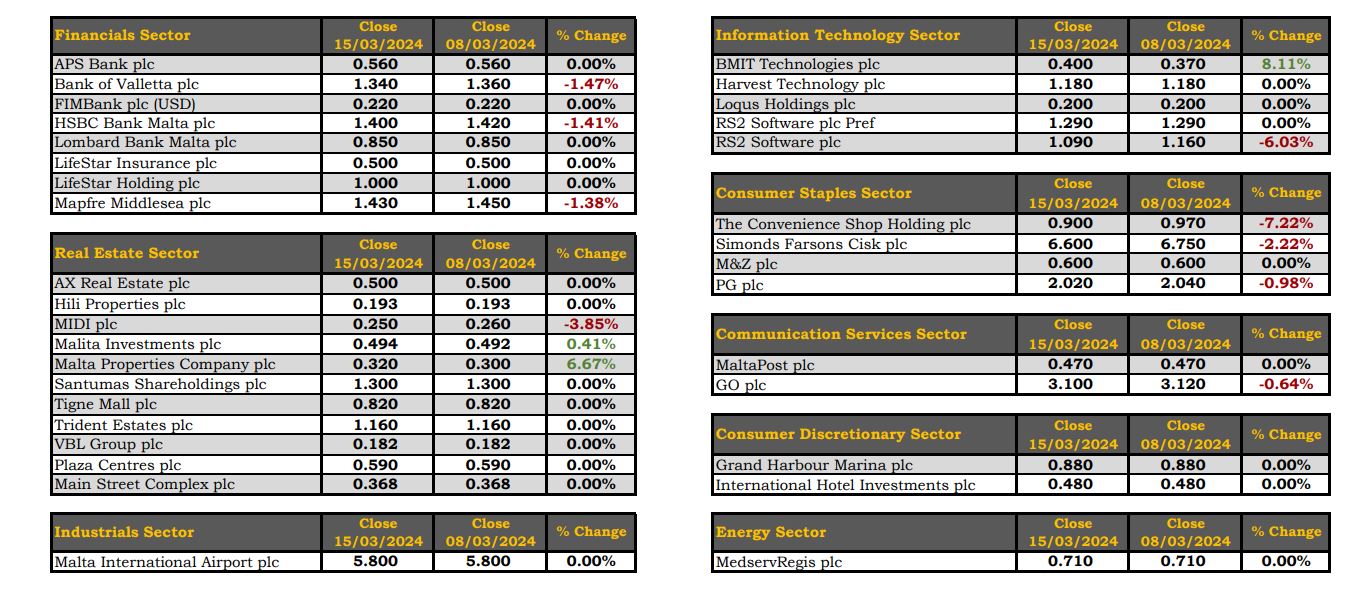

The MSE Equity Total Return Index closed in the red for the second week in a row. The index fell 0.4%, as it closed at 8,183.087 points. Total weekly turnover tallied to 133 transactions worth €1.7m. Out of 18 active equities, three closed higher while another nine ended the week in the red.

The MSE Corporate Bonds Total Return Index increased by 0.1% to close at 1,179.051 points. Out of 65 active issues, 23 headed north while another 18 closed in the opposite direction. The 3.5% AX Real Estate plc Unsecured € 2032 was the best performer, as it closed 6.1% higher at €95.50. On the other hand, the 4.5% Shoreline Mall plc Secured € 2032 ended the week 5.5% lower at €90.75.

The MSE MGS Total Return Index declined by 0.1% to close at 905.604 points. The top performer was the 4% MGS 2038 (I), as it registered a 1.6% increase, ending the week at €104.37. Conversely, the 2.9% MGS 2032 (VI) lost 1.7%, as it finished the week at the €97.36 price level.

| Market Highlights: |

Bank of Valletta plc (BOV) shares shed 1.5%, to close at €1.34, as 30 deals worth €115,150 were recorded. The bank’s equity traded between an intra-week high of €1.37 and a low of €1.34.

The equity of HSBC Bank Malta plc (HSBC) trended 1.4% lower, to end the week at €1.40. HSBC shares exchanged ownership 12 times, on a volume of 25,905 shares. Trading turnover reached €35,482.

RS2 Software plc lost 6% in market value during Tuesday’s trading session, as two trades worth €2,149 were executed. The equity did not trade for the rest of the week.

Simonds Farsons Cisk plc shares declined by 2.2% to close at the €6.60 price level. Trading activity included nine deals worth €8,377 on a volume of 1,249 shares.

Similarly, PG plc dropped by 1% to close at €2.02, as eight trades involving the exchange of 10,307 shares were executed.

BMIT Technologies plc (BMIT) shares jumped 8.1% to close at €0.40. The company’s shares exchanged ownership 12 times, with trading turnover reaching €94,228.

The equity value of GO plc lost 0.6%, as eight trades worth €20,704 were executed. GO plc shares closed at €3.10.

Malta Properties Company plc advanced by 6.7% to end the week at €0.32. Five trades involving the exchange of 8,250 shares were registered.

MIDI plc saw its share value decline by 3.9%, to close at €0.25. The Company’s shares were involved in four trades worth €14,331.

Malita Investments plc gained 0.4% to close at €0.494. Two trades worth a mere €988 were executed on Wednesday. The equity did not trade for the rest of the week.

| Company Announcements |

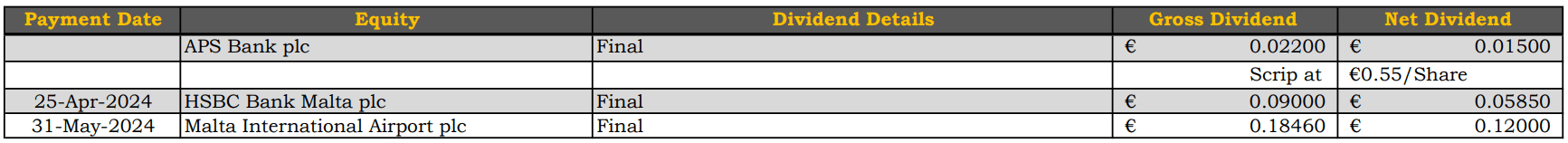

APS Bank plc announced that its forthcoming annual general meeting (AGM) is scheduled for May 9, 2024.

The board of directors of BOV announced that they are scheduled to meet on March 27, 2024, to consider and approve the Group’s and the Bank’s Audited Financial Statements for Financial Year ended 31 December 2023; and to consider the declaration of a final cash dividend to be recommended to the Bank’s AGM, subject to the due regulatory approvals being forthcoming in due course.

On Monday, Malta International Airport plc (MIA) welcomed a record total of 474,404 passengers in February 2024. The company posted a 25.1% rise in passenger traffic compared to the previous year with an increase of 21.9% in aircraft movements. The seat capacity deployed by airlines climbed 25.3% over 2023, while the seat occupancy remained aligned with 2023 volumes, as load factor registered a marginal reduction of 0.1% to stand at 82.5%.

During the week, the board of directors of BMIT Technologies plc met and approved the annual report and consolidated financial statements of the company for the year ended December 31, 2023. The board of directors further recommended the declaration of a final net dividend of €0.02456 per ordinary share, representing a total net dividend of €5,000,000.The shareholders will have the option that such dividend will be paid in cash or by the issue of new shares. The new shares will have an attribution price of €0.351 per new ordinary share.

The Company announced that the upcoming AGM will be held on May 29, 2024. The company’s performance in 2023 was stable and in line with the objectives set. Revenues were up, reaching €28.7 million, an increase of 11% over 2022. Earnings before Interest, tax, depreciation, and amortisation (EBITDA) were down to €10m from €10.7m in 2022. These results incorporate the consolidated results of all the subsidiary companies within the BMIT Technologies Group. Cost of sales, administration, and related costs tallied to €20.7m, whilst profit before tax amounted to €7.7m, representing a decrease of 8%.

Malita Investments plc announced that the in view of ongoing discussions with certain potential investors including institutional investors which may be interested in participating in the rights issue, the board of directors has elected to extend both the placement date and the closing date of the offer period from March 15, 2024 to April 5, 2024.

| Market Movers by Sector: |

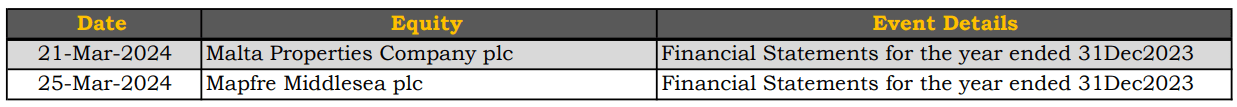

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]