MSE Trading Report for Week ending 22 March 2024

| Movement in Equity and Bond Indices: |

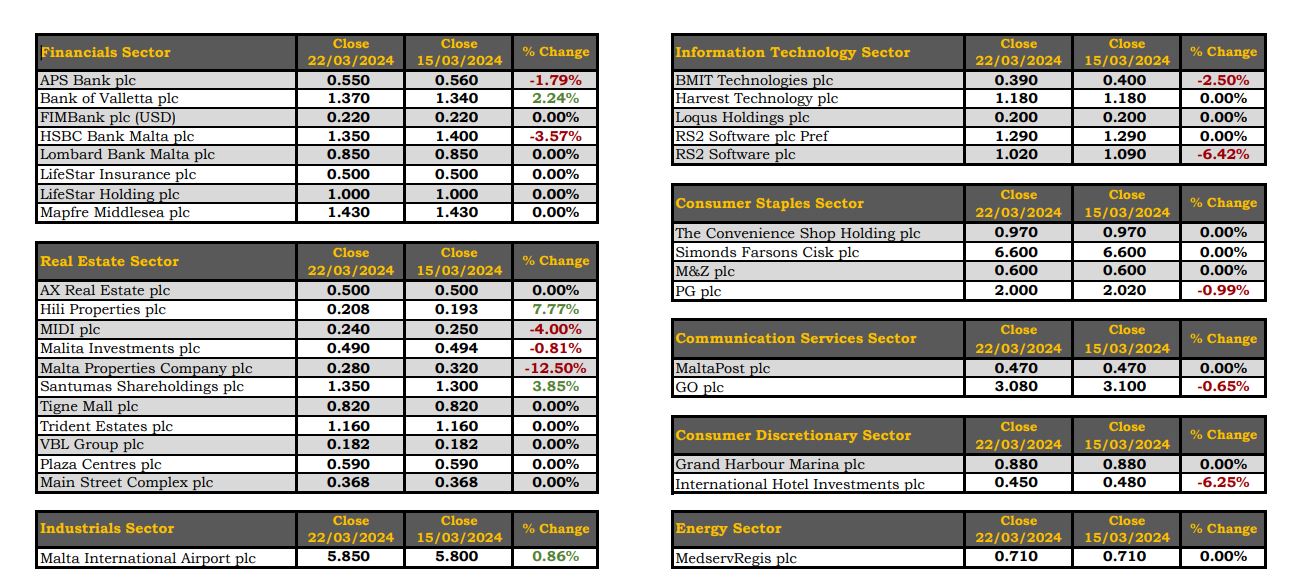

The MSE Equity Total Return Index closed in the red for the third week in a row. The index fell 0.9%, as it closed at 8,108.694 points. Total weekly turnover tallied to €747,094 across 121 transactions. Out of 16 active equities, four closed higher while another ten ended the week in the red.

The MSE Corporate Bonds Total Return Index declined by 0.3% to close at 1,175.314 points. Out of 64 active issues, 21 headed north while another 21 closed in the opposite direction. The 3.8% Hili Finance Company plc Unsecured € 2029 was the best performer, as it closed 1.6% higher at €97.50. On the other hand, the 3.5% AX Real Estate plc Unsecured € 2032 ended the week 5.8% lower at €90.

The MSE MGS Total Return Index increased by 0.2% to close at 907.027 points. The top performer was the 4.00% MGS 2043 (I), as it registered a 1.4% increase, ending the week at €103.50. Conversely, the 4.1% MGS 2034 (I) lost 1.5%, as it finished the week at the €104 price level.

| Market Highlights: |

Bank of Valletta plc (BOV) shares gained 2.2% to close at €1.37. The bank’s equity traded 36 times on a volume of 215,193 shares worth €292,920.

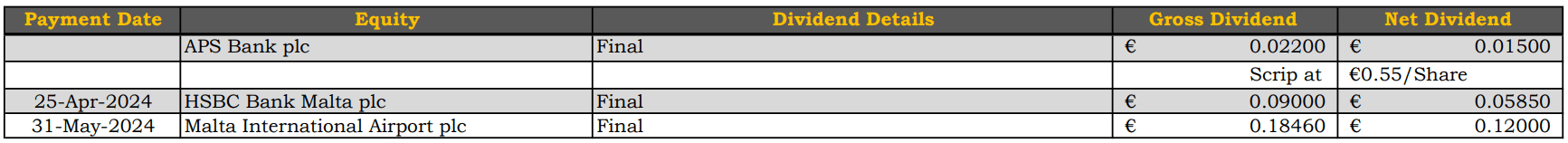

The equity value of HSBC Bank Malta plc shed 3.6% to end the week at the €1.35 level. Four trades involving the exchange of 3,653 shares were recorded. Total trading turnover tallied to €4,943.

APS Bank plc lost 1.8% to close at €0.55. Trading activity included four deals across 9,664 shares.

The hotel operating company, International Hotel Investments plc saw its shares declined by 6.3% to the €0.45 price level. The equity changed ownership six times, as 13,070 shares were traded.

Similarly, RS2 Software plc closed 6.4% lower at €1.02, as four trades worth €119,340 were traded during Thursday’s trading session. The equity did not trade for the rest of the week. Since January, the company’s shares are down 14.3%.

The market value of Malta Properties Company plc plummeted by 12.5% to close at €0.28, as eight trades on a volume of 87,000 shares were recorded.

MIDI plc shares trended 4% lower to end the week at €0.24. Three deals worth €4,122 were executed.

Hili Properties plc jumped 7.8% or €0.015 to the €0.208 price level, as 12 trades across 77,500 shares were recorded.

The share price of PG plc declined by 1% to close at €2. This decline was a result of three trades across 9,200 shares. On a year to date, the company’s shares are down by 9.1%.

Malta International Airport plc gained 0.9%, as the airport operating company’s equity price closed the week at €5.85. Eight trades involving the exchange of 8,282 shares were recorded.

| Company Announcements |

BOV announced that their annual general meeting (AGM) will be held on May 31, 2024.

On Thursday, MedservRegis plc announced that their board of directors are scheduled to meet on April 26, 2024 to approve and publish the consolidated financial statements of the company for the period ended December 31, 2023. Furthermore, the company’s AGM will be held on May 29, 2024.

FIMBank plc announced that their board of directors are scheduled to meet on April 24, 2024 to consider and approve the group’s and the bank’s audited accounts for the financial year ended December 31, 2023.

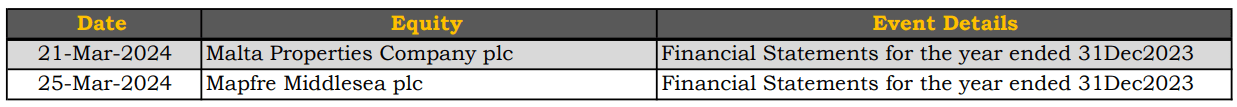

Malta Properties Company plc announced that their AGM will be held on May 22, 2024. Furthermore, the board of directors of the company approved the annual report and consolidated financial statements for the year ended December 31, 2023. The group’s total income for the year amounted to €5m resulting in an increase of 18.9% over the previous year. The group’s EBITDA saw an increase of 24.6% reaching €3.4m over that of the previous year which stood at €2.8m. Profit for the year reached €2.1m when compared to €0.14m for the year 2022, whilst earnings per share increased to €0.020 versus €0.001 in 2022. The board of directors further resolved to recommend that the AGM approves the payment of a final dividend of €0.014 net of taxation per share.

The board of directors of Midi plc announced that they are scheduled to meet on April 26, 2024. During the meeting they will consider and approve the audited financial statements for the year ended December 31, 2023 and consider the declaration of dividend, if any, to be recommended to the AGM of shareholders.

The board of directors of Tigne Mall plc announced that they are scheduled to meet on April 22, 2024, to consider, and if deemed appropriate, approve the company’s audited financial statements for the financial year ended December 31, 2023. They will also consider the declaration or otherwise of a dividend to be recommended to the company’s AGM.

The board of directors of GO plc approved the annual report and consolidated financial statements for the financial year ended December 31, 2023 and resolved that these be submitted for the approval of the shareholders at the forthcoming AGM scheduled to be held on May 30, 2024. The board of directors further resolved to recommend that the AGM approves the payment of a final dividend of €0.05 net of taxation per share. The payment of this net dividend amounts to the total sum of €5.1m.

During 2023, the GO Group registered an all-time high consolidated revenue of €235.9m, an increase of 9.9% over the previous year with an EBITDA of €88.4m resulting in 8.7% growth over 2022. Group profit recorded was of €15.5m, an increase of 27.1% over 2022.

The board of directors of Lombard Bank Malta plc is scheduled to meet on April 26, 2024 to approve the Group’s and the Bank’s final Audited Accounts for the Financial Year ended December 31, 2023 and consider the declaration or otherwise of a final dividend to be recommended to the Bank’s forthcoming AGM.

| Market Movers by Sector: |

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]