MSE Trading Report for Week ending 19 July 2024

| Movement in Equity and Bond Indices: |

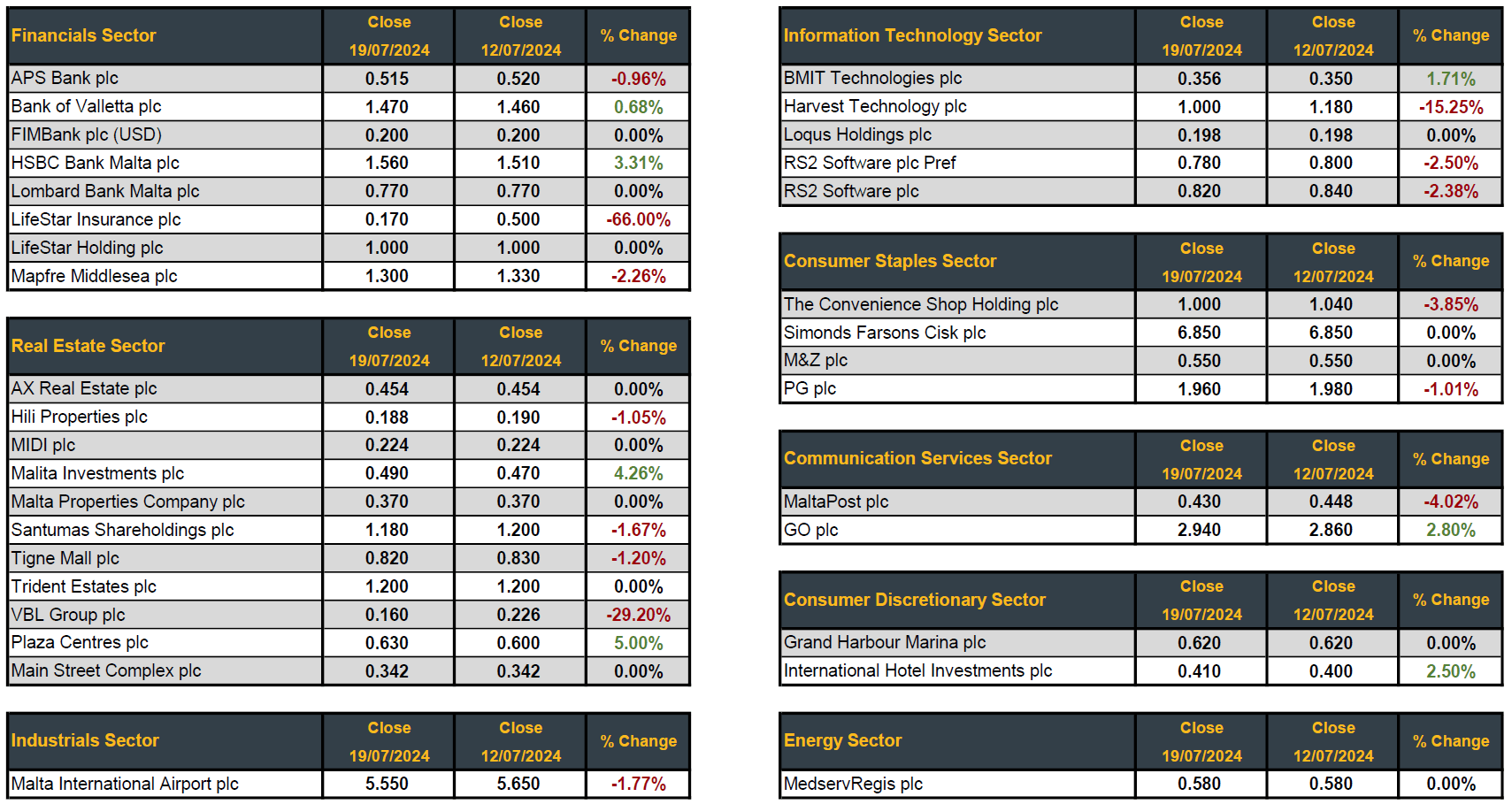

The MSE Equity Total Return Index lost a further 0.5%, as it reached 8,117.372 points. Total weekly turnover doubled when compared to the previous week, generating €0.7m across 165 transactions. Out of 27 active equities, seven closed higher while another 14 ended the week in the red.

The MSE MGS Total Return Index managed to maintain the previous week’s gain, gaining 0.6%, to close at 918.081 points. Out of 26 active issues, 22 headed north while another two closed in the opposite direction. The 2.1% MGS 2039 (I) was the best performer, as it closed 2.8% higher at €81.73. On the other hand, the 3% MGS 2040 (I) ended the week 3.2% lower at €91.

The MSE Corporate Bonds Total Return Index advanced by 0.2%, as it closed at 1,182.358 points. A total of 65 issues were active, 35 of which advanced while another 11 traded lower. The top performer was the 3.75% TUM Finance plc Secured € 2029, as it registered a 6% increase, ending the week at €98.75. Conversely, the 3.5% Bank of Valletta plc € Notes 2030 S1 T1 lost 2.5%, as it settled at the €94.50 price level.

| Market Highlights: |

HSBC Bank Malta plc was the best performing equity in the banking sector, gaining 3.3% in its share price, ending the week at €1.56. HSBC was the second most liquid equity, generating €147,088 in turnover across 26 transactions.

Its peer, Bank of Valletta plc, was the most traded equity as 102,158 shares exchanged hands across 31 deals. The equity closed the week with an increase of 0.7% at a weekly high of €1.47.

LifeStar Insurance plc headed the list of losers, losing 66% in its share price and closing at €0.17. This was the outcome of a single trade worth a mere €170.

On the other hand, International Hotel Investments plc experienced a 2.5% increase in its share price, closing at €0.41. The equity traded at a weekly high of €0.42 and a weekly low of €0.40. Seven deals involving 22,206 shares worth €8,993 were executed.

Malta International Airport plc closed at a weekly low of €5.55, translating into a decline of 1.8%. A total of 24 transactions worth €102,884 were executed. From a year-to-date perspective, the equity declined by 3.5%.

The share price of RS2 Software plc retracted by 2.4%, closing off the week at €0.82. A total of 9,031 shares exchanged hands across two deals, generating €7,265 in turnover.

In the same sector, Harvest Technology plc joined the list of losers after recording a decline of 15.3% in its share price, closing at €1. This was the result of two deals worth €1,600.

VBL plc registered a double-digit decline of 29.2%, finishing the trading week at a low of €0.16. Two deals involving 65,445 shares generated €10,501 in turnover.

The share price of Malita Investments plc advanced by 4.3%, closing at €0.49. Six trades of 71,250 shares worth €33,448 were executed.

Two deals of 3,500 GO plc shares worth €10,260, pushed the equity into positive territory. The equity gained 2.8%, finishing the week at €2.94.

| Company Announcements: |

FIMBank plc announced that the board shall meet on August 28, 2024 to consider and approve the consolidated financial statements for the half-year ended June 30, 2024.

MedservRegis plc announced that the board is scheduled to meet on August 30, 2024, to consider, and if deemed appropriate, approve the unaudited half yearly report of the Company for the six months ended June 30, 2024.

The board of Malta International Airport plc will be meeting on August 1, 2024 to consider and, if deemed appropriate, approve the group’s financial statements for the period ending June 30, 2024. During the meeting, the members of the board will also be considering the payment of an interim dividend to the Company’s shareholders.

The Government of Malta will be launching a new combined issue of Malta Government Stocks. The 3.40% Malta Government Stock 2027 (VI) and the 3.50% Malta Government Stock 2034 (III) will be offered to retail investors and wholesale investors by auction. The Accountant General is offering an aggregate nominal amount of €270m in any combination of the two Stocks subject to an over-allotment option of €130m in the event of over-subscription. The prices of the bonds will be announced on Thursday, July 25, 2024.

| Market Movers by Sector: |

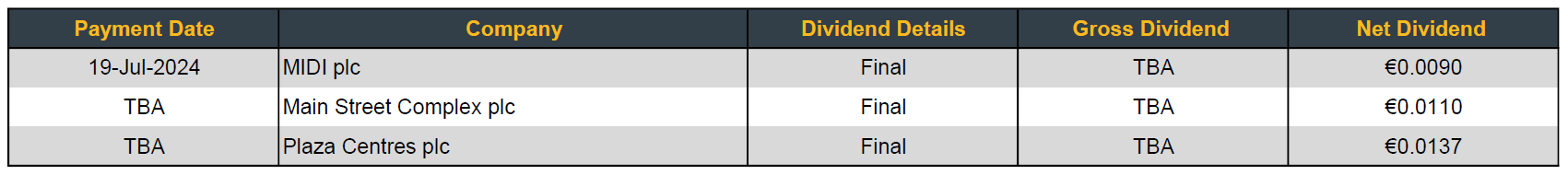

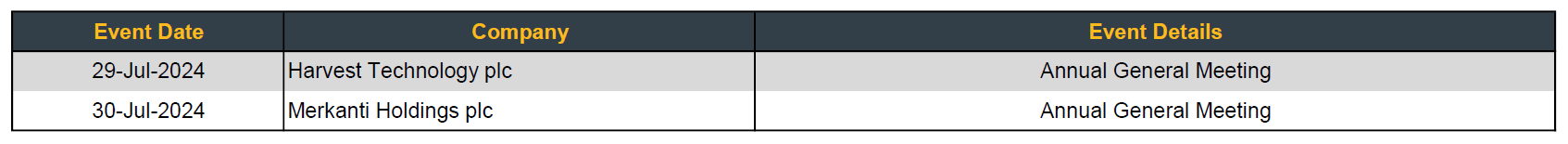

| Upcoming Events: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]