MSE Trading Report for Week ending 19 September 2025

| Movement in Equity and Bond Indices: |

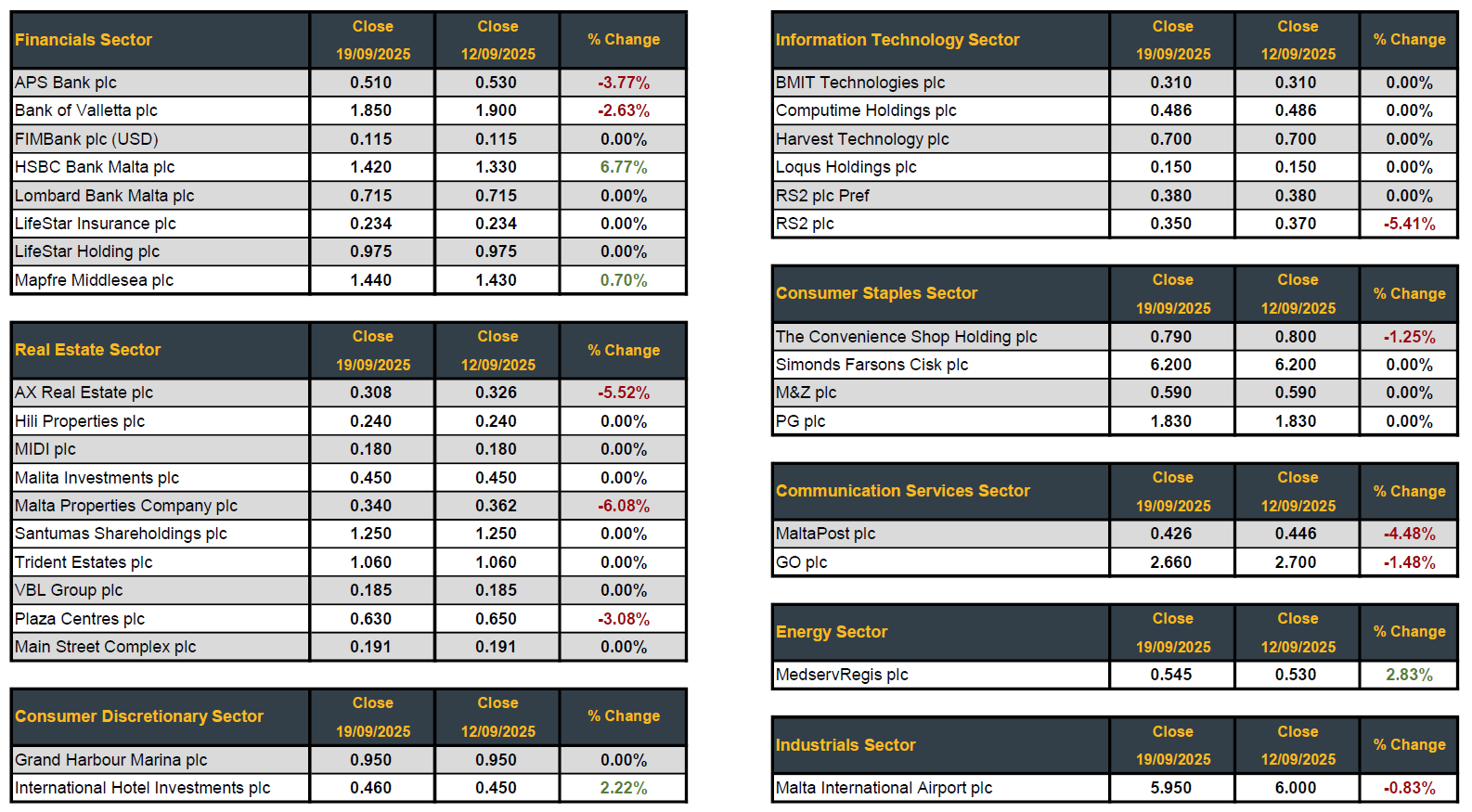

The MSE Equity Total Return Index closed in the red for a third consecutive week, 0.4% lower at 8,892.602 points. A total of 25 issues were active, four of which headed north while another 10 closed in the opposite direction. The weekly total turnover reached €1.5m across 238 transactions.

The MSE Corporate Bonds Total Return Index registered a 0.2% decline, as it closed at 1,164.550 points. A total of 69 issues were active, 20 of which traded higher while another 27 lost ground. The 4.65% Smartcare Finance plc Secured € 2032 was the best performer, as it closed 3.1% higher at €100. On the other hand, the 4% MIDI plc Secured € 2026 ended the week 6.1% lower at €92.

The MSE MGS Total Return Index increased marginally by 0.2%, as it reached 964.526 points. Out of 22 active issues, 11 advanced while another 10 closed in the red. The 3% MGS 2040 headed the list of gainers, as it closed at €92, equivalent to a positive 1.6% change. Conversely, the 4.65% MGS 2032 closed 0.3% lower at €109.92.

| Market Highlights: |

Following the potential sale of HSBC Bank Malta plc, the bank was the top performer of the week, as the share price spiked 6.8% to close at €1.42. The equity traded between a weekly low of €1.32 and a high of €1.44. Trading activity included 54 trades, spread across 255,785 shares for a total trading value of €360,205.

Bank of Valletta plc was the most liquid equity despite posting a loss for two consecutive weeks. The price declined by 2.6% in share value and closed at a weekly low of €1.85. This was the result of 328,708 shares exchanging hands over 54 deals, worth €620,659.

APS Bank plc shares closed at a weekly low of €0.51, following an announcement of a rights issue of ordinary shares. The bank witnessed a 3.8% decrease in share price, resulting from 14 deals, tallying to a value of €21,480.

Malta International Airport plc reported a 0.8% decline, to close at a price level of €5.95. The equity traded between a weekly high of €6 and a low of €5.80. A total of 25 trades involving 30,595 shares worth €182,830 were executed.

PG plc announced the development of a new shopping mall, however the equity price remained flat throughout the week and closed at €1.83. This was the result of nine transactions amounting to €44,873 in value.

MedservRegis plc recorded a 2.8% increase in share price, to close at a weekly high of €0.545. Two deals involving 5,300 shares generated €2,810 in turnover.

The share price of GO plc retracted to the €2.66 level, translating to a 1.5% decline. Seven deals of 17,120 shares worth €45,812 were recorded.

International Hotel Investments plc rebounded by 2.2%, after a couple of weeks of negative market sentiment. The equity traded at a weekly low of €0.45 and closed at a weekly high of €0.46. A total turnover of €13,973 was generated across six deals.

A total of 12 deals of 24,930 RS2 plc shares worth €7,839 pushed the equity into negative territory. The share price declined by 5.4%, finishing the week at €0.35.

AX Real Estate plc was the worst performer as the equity lost 5.5% in value. The company’s share price traded between a weekly high of €0.35 and closed at a low of €0.308. This was the outcome of seven deals worth €28,765.

| Company Announcements: |

HSBC Bank Malta plc announced that HSBC Continental Europe (HBCE) has signed a put option agreement with CrediaBank S.A. for the potential sale of its 70% stake in the Bank. The deal values HBCE’s holding at €200m (€0.793 per share). If completed, CrediaBank would become majority shareholder and launch a mandatory takeover offer for minority shareholders at €1.44 per share, based on the MFSA’s equitable price formula as of September 15, 2025. CrediaBank plans to retain the Bank’s management team, maintain its MSE listing, and keep employees on materially the same terms for at least two years. The transaction is expected to be completed by the end of 2026, subject to employee consultation in France, definitive agreements, and approvals from the ECB, MFSA, and Bank of Greece. Dividends are planned quarterly from 2026 at a 60% payout ratio, subject to board and regulatory approval. CrediaBank would also assume certain Tier 2 and MREL loan obligations and confirmed that it will continue to provide information to the market in line with its obligations under the Capital Markets Rules of the MFSA.

APS Bank plc plans to raise about €45m in new equity through a Rights Issue of ordinary shares, subject to regulatory approval. The move supports growth, capital strengthening, and regulatory compliance, while aligning with dilution plans of major shareholders AROM Holdings (54.7%) and the Diocese of Gozo (12.5%), who are expected not to subscribe significantly. Their holdings will dilute, with AROM likely falling below 50%. Unsubscribed rights will be placed with investors committing at least €0.5m, including intermediaries, shareholders, and bondholders. Full details, including terms, ratio, and price, will be published in October 2025, with completion expected by year-end. CEO Marcel Cassar said that the new capital will boost lending, technology investment, and expansion beyond Malta.

PG plc, through subsidiary DB Gauci Shopping Mall Limited, is developing a new retail project on the former Institute for Tourism Studies site at St George’s Bay, St. Julian’s, scheduled for completion in 2026. It will include a shopping mall with retail outlets, a PAVI-PAMA supermarket, catering establishments, and a car park. In November 2024, DBG signed a preliminary agreement with DB San Gorg Property Limited for the property to be granted on sub-emphyteusis, subject to conditions. The project is now at an advanced stage, and both parties intend to finalise the deed.

MedservRegis plc holds €22m in 4.5% EURO bonds and $8m in 5.75% USD bonds maturing on February 5, 2026. It plans to partly refinance these through a new bond issue of up to €25m, split between Euro and USD. For the purposes of the issue, the Company is due to file an application for admissibility to listing with the MFSA. Additionally, it intends to repurchase up to €4m EURO bonds before maturity.

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]