MSE Trading Report for Week ending 10 October 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index ended the week in positive territory, closing 0.2% higher at 8,769.306 points. A total of 22 issues were active, eight of which headed north while another nine closed in the opposite direction. The weekly total turnover dropped by €0.5m from the previous week to €0.9m, generated across 156 transactions.

The MSE Corporate Bonds Total Return Index registered a 0.1% gain, as it closed at 1,160.291 points. A total of 59 issues were active, 19 of which traded higher while another 17 lost ground. The 4% MIDI plc Secured € 2026 was the best performer, as it closed 6.7% higher at €96. On the other hand, the 4.3% Mercury Projects Finance plc Secured € 2032 ended the week 4.1% lower at €93.

The MSE MGS Total Return Index retracted marginally by 0.2%, as it settled at 963.538 points. Out of 30 active issues, 21 advanced while another seven closed in the red. The 1.50% MGS 2045 headed the list of gainers, as it closed at €65.70, equivalent to a positive 1.1% change. Conversely, the 3% MGS 2040 closed 4.7% lower at €91.

| Market Highlights: |

In the banking sector, APS Bank plc shares declined by 4.9% to end the week at €0.49, after trading at a weekly low of €0.48 and a high of €0.515. Turnover reached €32,984, as 27 deals were executed.

Lombard Bank Malta plc faced a challenging week, slipping 2.9% to close at €0.68. The equity was involved in three trades, with prices varying between a weekly high of €0.69 and a low of €0.66. Market activity consisted of 31,691 shares changing hands, resulting in a weekly turnover of €21,674.

Bank of Valletta plc remained steady this week, closing unchanged at €1.88. The equity recorded a weekly high of €1.90 and a low of €1.86. It was the most liquid equity on the market, with 32 trades executed and a substantial 283,410 shares changing hands, generating a robust weekly turnover of €0.5m.

HSBC Bank Malta plc gained 1.4% to close at €1.43. The equity traded four times during the week, as a total of 9,383 shares changed hands, generating a weekly turnover of €13,286.

Malta International Airport plc edged 1.71% higher, as it closed at €5.95. Trading activity included 14 trades of 18,552 shares and a total turnover of €110,192.

Mapfre Middlesea plc registered a weekly gain of 7.4%, with its share price closing at €1.60. The equity traded 10 times, with a total of 9,614 shares being exchanged, totalling to a value of €14,929.

RS2 plc registered the strongest weekly performance, advancing by 9.7% to close at €0.34. Three trades were executed with the price oscillating between €0.31 and €0.34. Trading activity reached 9,650 shares, for a total weekly value of €2,992.

Malita Investments plc posted the sharpest decline of the week, falling by 7.7%, to close at €0.406. The equity was active over eight tradesas a total, 54,260 shares changed ownership.

International Hotel Investments plc ended the week 1.9% higher at €0.43. The equity featured in six trades, for a trading activity of 48,849 shares, translating into a weekly value of €21,003.

Quinco plc made its debut on the MSE this week, opening at €1.30 and closing at €1.31, recording a modest gain of 0.8%. The equity saw eight trades during the week, with 6,932 shares exchanged, resulting in a total weekly turnover of €9,046.

| Company Announcements: |

Bank of Valletta plc announced that it has submitted an application to the Malta Financial Services Authority (MFSA) for the listing of an Unsecured Euro Medium Term Bond Programme of up to €325m subject to regulatory approval. The Bank intends to issue the first tranche of €100m Tier 2 Bonds, with preference given to existing bondholders, shareholders, and employees, and the remaining bonds available to professional and public investors.

Hili Finance Company plc announced that it has submitted an application for the listing of €60m Unsecured Bonds redeemable in 2032. The Company will be granting preference to its existing bondholders together with holders of securities, including bonds and equity currently listed and trading on the MSE of sister companies Hili Properties plc, Harvest Technology plc and, Premier Capital plc. The Company will also be granting preference to shareholders, directors and employees of Hili Ventures Limited and its subsidiaries.

MedservRegis plc announced that its Board approved a draft prospectus for the issue of up to €25m in 5.5% Euro and 6.5% US Dollar Unsecured bonds due 2031–2036 and has submitted an application to the MFSA for listing on the MSE. Subject to approval, the new bonds will be offered to existing bondholders via an exchange offer, with any remaining bonds will be made available to the public through intermediaries.

Malta International Airport plc reported 990,556 passenger movements in September, with aircraft movements up 7.2% to 6,013 and a seat load factor of 90.7%. The United Kingdom accounted for the largest share of traffic at 22.3%, followed by Italy at 19.6%, Germany 8.1%, Poland 7.1% and France 6.3%.

Computime Holdings plc reported that its board of directors approved a gross interim dividend of €900,000 or €0.0145 per share, payable on or around October 31, 2025 to shareholders on record as of October 15.

Loqus Group plc announced that following a conditional voluntary public takeover bid by JFC Holdings Limited, 3,044,737 shares or 9.54% of issued share capital were transferred to the Offeror on October 1, with cash consideration settled on October 6, resulting in the Offeror’s voting rights increasing to 59.54%.

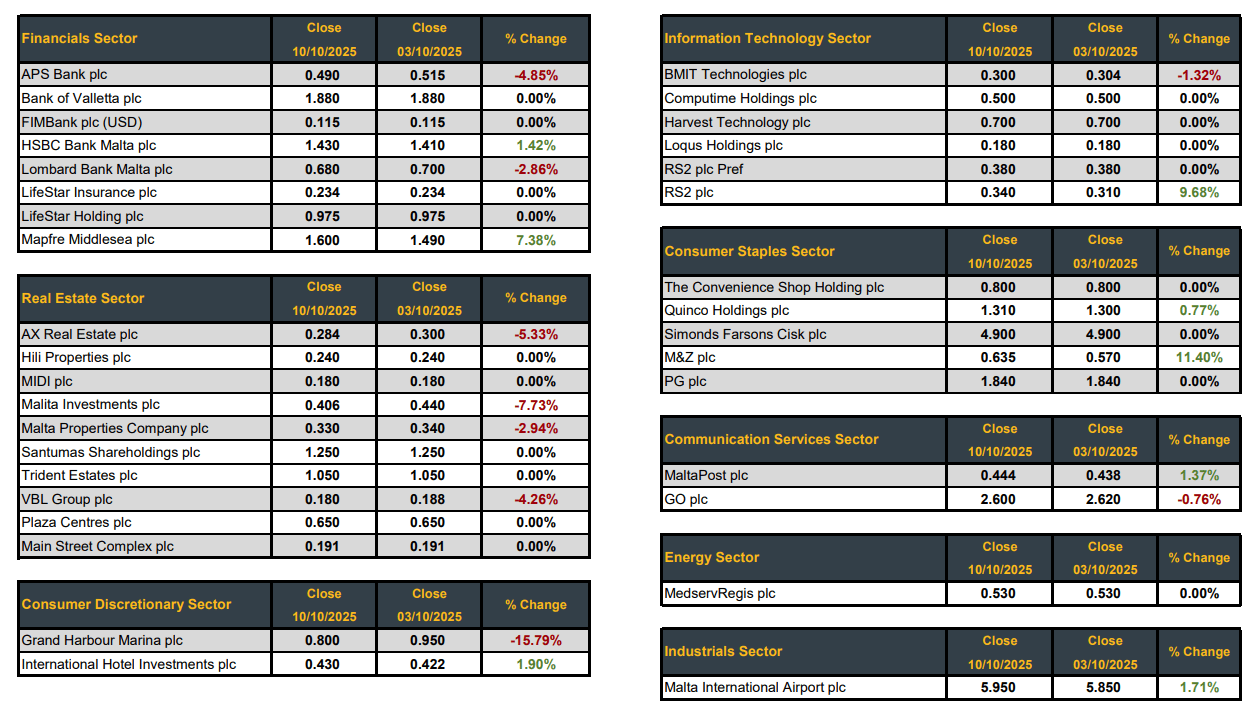

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]