MSE Trading Report for Week ending 3 October 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index declined by 1.6%, to close at 8,748.843 points. A total of 19 issues were active, as six headed north while another 10 closed in the opposite direction. The total weekly turnover edged €0.17m higher to €1.37m. This was generated across 226 transactions.

The MSE Corporate Bonds Total Return Index registered a 0.5% loss, as it closed at 1,159.03 points. A total of 70 issues were active, 17 of which traded higher while another 33 lost ground. The 3.75% Bortex Group Finance plc Unsecured € 2027 was the best performer, as it closed 3.1% higher at €100. On the other hand, the 4% MIDI plc Secured € 2026 ended the week 8.2% lower at €90.

The MSE MGS Total Return Index posted a 0.1% gain, as it reached 965.027 points. Out of 30 active issues, 10 advanced while another 16 declined. The 3.50% MGS 2035 headed the list of gainers, as it closed at €99.74, equivalent to a positive 0.8% change. Conversely, the 2.1% MGS 2039 closed 9.4% lower at €81.53.

| Market Highlights: |

In the banking sector, Bank of Valletta plc ticked higher to close at a weekly high of €1.88. The equity was the most liquid, consisting of 53 trades of 321,182 shares, generating a total of €596,482 in turnover.

APS Bank plc edged 1% higher, to close at €0.515. This was the result of 12 trades involving 33,182 shares worth €17,309. This was the first week the bank ended in the green since the start of September.

Following two weeks of consecutive gains, HSBC Bank Malta plc slipped by 1.4%, to close at a weekly low of €1.41. A total of 23 trades of 84,539 shares were executed, generating €120,668 in value.

Meanwhile, Lombard Bank Malta plc saw a modest decline of 2.1%, closing the week at €0.70. The banking equity traded at that price level as three transactions of 28,615 shares were recorded. Trading turnover totalled €20,031.

Simons Farsons Cisk plc declined following the announcement of the declaration of a net dividend in kind through the distribution of shares in Quinco Holdings plc. These shares are expected to be admitted to the official list of the MSE on October 6. The equity adjusted 21% downwards as it closed at a price level of €4.90. Trading activity included 25,994 shares changing hands across 28 deals for a total trading value of €131,251.

International Hotel Investments plc headed south, as it closed the week at €0.422, declining by 11.7%. The weekly high and low were €0.45 and €0.414, respectively. This was the outcome of four transactions worth just €1,529.

In the communications sector, GO plc’s shares experienced a loss in value of 1.5%. The equity traded at a weekly high of €2.66 and a low of €2.60, to eventually settle at €2.62. A total of 54,183 shares exchanged hands, generating €142,640 in turnover throughout the week.

Malta International Airport plc remained steady, closing at a price of €5.85. A total of 18,763 shares were traded across 25 transactions, amounting to €112,084.

Maltapost plc was the week’s best performing equity recording a 5.3% increase, closing at €0.438. A total of 55,048 shares were traded across six transactions, for a total trading value of €23,061.

PG plc climbed by 0.6%, to close at a weekly high of €1.84. This was the result of four trades involving 16,045 shares worth €29,503.

| Company Announcements: |

Bank of Valletta plc announced the submission of an application for listing its Unsecured Euro Medium Term Bond Programme of up to €325m. Subject to regulatory approval, the Bank plans to issue the first series of up to €125m 5% unsecured subordinated bonds 2030–2035.

APS Bank plc announced details of its planned €45m Rights Issue, subject to regulatory approval. Shareholders on record as of October 6, 2025, will be entitled to subscribe at a ratio of three new shares for every 11 held, priced at €0.44 per share. Any unsubscribed shares will be offered to the public through an intermediaries’ offer at the same price. The prospectus and application forms are expected in the second half of October 2025.

PG plc will hold its Annual General Meeting (AGM) on October 24, 2025. Shareholders will consider the approval of the audited financial statements for the year ended April 30, 2025, the re-appointment of PricewaterhouseCoopers as auditors with remuneration approval and the remuneration report for the same period.

The Convenience Shop plc announced that the Group’s retail operations will be rebranded into two formats: MyConvenience, targeting community-based outlets, and MySupermarket, marking the Group’s entry into larger-scale supermarket operations.

BMIT Technologies plc announced that at its Extraordinary General Meeting, shareholders approved the acquisition of 49,642,139 ordinary shares (49% of issued share capital) in Malta Properties Company plc. under the terms of the share purchase agreement.

Santumas Shareholdings plc will hold its AGM on October 31, 2025 to approve the annual Report and financial Statements for the year ended April 30, 2025, confirm the auditors’ appointment, conduct the election of directors and approve the directors’ remuneration report.

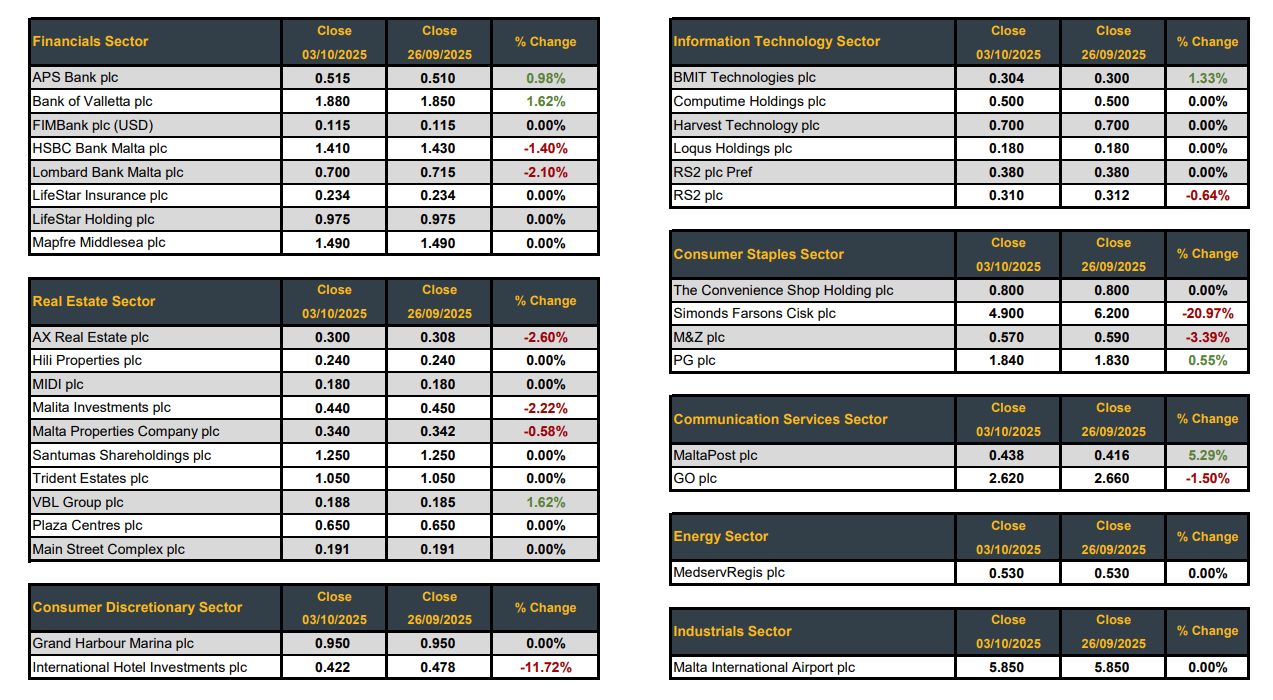

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]