MSE Trading Report for Week ending 17 October 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index remained in positive territory, as it closed 0.5% higher at 8,811.694 points. A total of 26 equities were active, 12 of which headed north while another eight closed in the opposite direction. A total weekly turnover of €1.4m was generated across 228 transactions.

The MSE Corporate Bonds Total Return Index declined by 0.2%, as it finished at 1,157.646 points. Out of 66 active issues, 19 advanced while another 31 closed in the red. The 5.75% Phoenicia Finance Company plc Unsecured Bonds 2028-2033 headed the list of gainers, as it closed at €105, equivalent to a 2.9% change. Conversely, the 4% MIDI plc Secured € 2026 closed 6.2% lower at €90.01.

The MSE MGS Total Return Index registered a 0.8% gain, as it closed at 971.254 points. A total of 33 issues were active, 28 of which traded higher while another two lost ground. The 2.4% MGS 2041 was the best performer, as it closed 2.4% higher at €84. On the other hand, the 4.8% MGS 2028 ended the week 0.2% lower at €106.7.

| Market Highlights: |

In the banking sector, Bank of Valletta plc (BOV) closed higher by 1.1% to close at a weekly high of €1.9. The equity was the second most liquid, consisting of 45 trades of 150,113 shares, generating a total of €283,038 in turnover.

APS Bank plc shares advanced by 1.6%, closing at €0.498, after the Bank reported positive feedback on the first phase of its rights issue. Further details about the offering are available in the announcements section of this round-up. During the week the equity traded at a low of €0.44. A total of 11 trades involving 18,532 shares worth €8,864 were executed.

Following weeks of strong trading activity, HSBC Bank Malta plc remained stable to close flat, at a price level of €1.43. A total of 15 trades including 65,582 shares were executed, generating €93,000 in value.

Meanwhile, FIMBank plc experienced a jump of 28.7%, the largest gain of the week, to close at $0.148. The banking equity traded three times with 14,400 shares changing hands. Trading turnover totalled $1,753.

Malta International Airport plc headed south, as it closed the week at €5.90, declining by 0.8%. The weekly high and low were €5.95 and €5.85, respectively. This was the outcome of seven transactions worth €24,457.

International Hotel Investments plc rebounded by 4.7% to close at €0.45. The equity saw four trades of 13,181 shares being traded, generating a weekly turnover €5,941.

Meanwhile, Hili Properties plc dropped sharply by 8.3% to close at €0.22 after 11 weeks of price stability. A total of nine trades took place resulting in a turnover of €22,792.

Mapfre Middlesea plc was the worst performer, as the equity lost 18.1% in value. The equity’s share price traded between a weekly high of €1.58 and low of €1.30, closing at €1.31. This was the outcome of four deals worth €5,382.

The share price of GO plc gained 1.5% to close at €2.64, after having traded at a weekly low of €2.46. A total of 52 deals of 309,653 shares worth €778,642 were recorded.

The share value of RS2 plc increased by 2.9% to close at a weekly high of €0.35. Six trades worth €17,315 were executed.

| Company Announcements: |

APS Bank plc announced that all rights to 67,648,793 shares, lapsed by the Archdiocese of Malta and the Diocese of Gozo, at €0.44 per share, amounting to €29.8m, have been fully taken up.

In addition, the Bank has applied to the MFSA for authorisation of a 3-for-11 rights issue. If not fully subscribed, a public offer of excess shares will take place through an intermediaries’ offer. The rights will be offered at €0.44 per share.

The Bank also announced that it will hold an online market briefing on October 27, following the publication of the Bank’s financial statements for the nine-months ended September 30.

BOV announced that the MFSA has approved the base prospectus and authorised the listing of its €325m Unsecured Euro Medium Term Bond Programme on the MSE. The first issue will comprise €100m 5% Unsecured Subordinated bonds maturing 2030–2035, with an over-allotment option up to €125m.

Loqus Holdings plc announced that its Board is scheduled to meet on October 29, to consider and approve the Company’s audited financial statements for the financial year ended June 30, 2025.

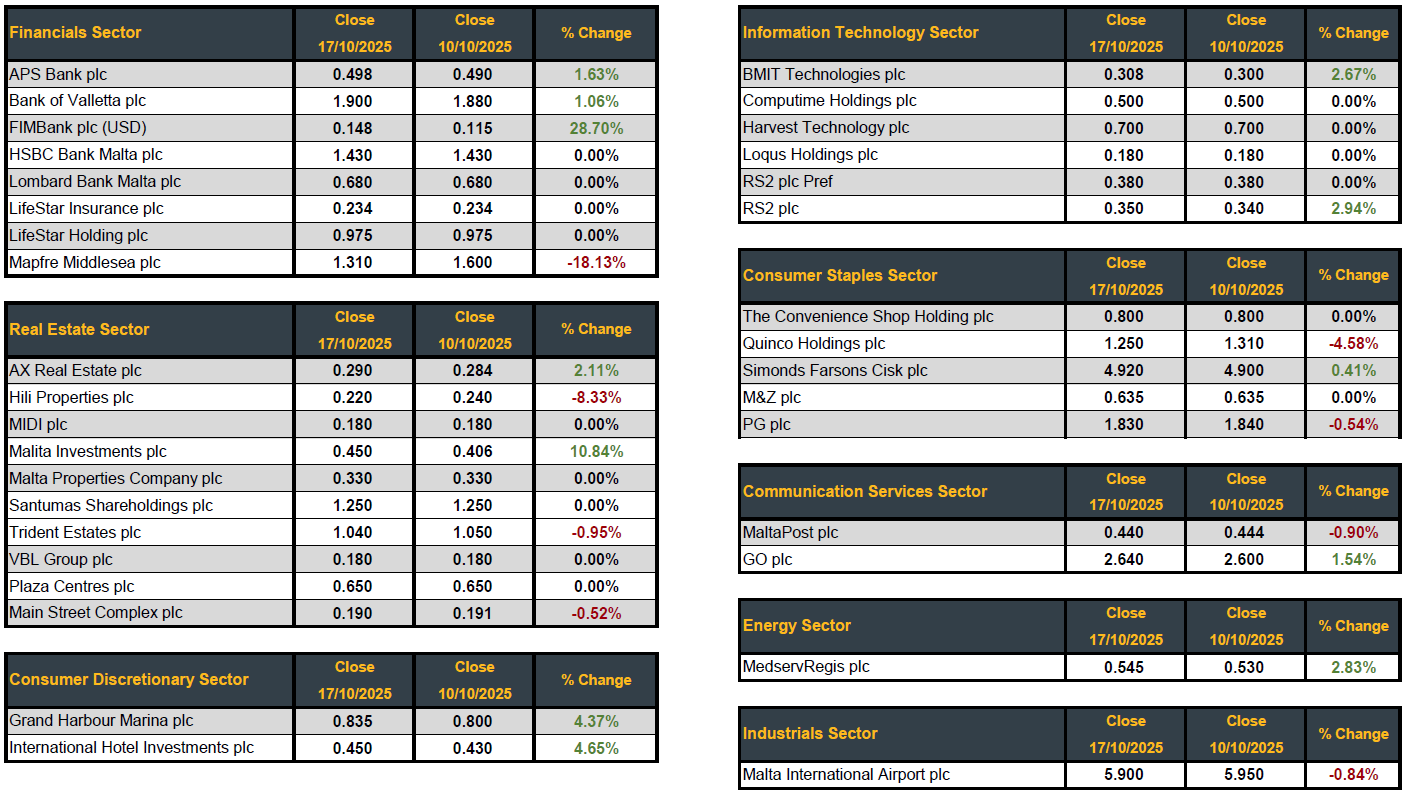

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]