MSE Trading Report for Week ending 24 October 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index entered negative territory, as it closed 0.7% lower at 8,754.310 points. A total of 23 equities were active, three of which headed north while another 11 closed in the opposite direction. A total weekly turnover of €1m was generated across 164 transactions.

The MSE Corporate Bonds Total Return Index declined by 0.2%, as it finished at 1,154.933 points. Out of 60 active issues, 10 advanced while another 30 closed in the red. The 5.3% Golden Triangle plc Secured Bonds 2030 headed the list of gainers, as it closed at €102, equivalent to a 2% change. Conversely, the 5.75% Phoenicia Finance Company plc Unsecured Bonds 2028-2033 closed 4.8% lower at €100.

The MSE MGS Total Return Index registered a 0.1% loss, as it closed at 970.667 points. A total of 31 issues were active, 15 of which traded higher while another 13 lost ground. The 1.5% MGS 2045 was the best performer, as it closed 2.1% higher at €67.10. On the other hand, the 2.8% MGS 2030 ended the week 0.5% lower at €100.

| Market Highlights: |

Bank of Valletta plc dropped by 1.1%, to close at a price level of €1.88. The equity traded between a weekly high of €1.92 and a low of €1.87. Trading activity included 300,142 shares exchanging hands over 55 deals for a total trading value of €569,173.

APS Bank plc also experienced a decline of 1.6%, closing at €0.49. APS shares traded between a weekly low of €0.462 and a high of €0.49. The equity recorded a modest eight weekly trades, with 22,692 shares changing hands, totalling €10,686.

Its peer, HSBC Bank Malta plc declined by 0.7%, closing at a weekly low of €1.42. A total of 32,807 shares were traded across seven deals, amounting to €46,906.

Finally, in the banking sector, Lombard Bank Malta plc tumbled 3.7%, closing at a weekly low of €0.655. Trading activity was limited to just one deal, spread across 3,516 shares, for a total trading value of €2,303.

Malta International Airport plc shed nearly 1%, closing at €5.85, as the share price hovered between €5.90 and €5.85. Four trades involving 3,910 shares were executed.

The telecommunications company GO plc fell 5.3% to €2.50. This decline was the result of four trades worth €30,224. The Company’s shares are down by 5.3% on a year-to-date basis.

Post announcement of a new bond issue, MedservRegis plc soared 37.6%, as the equity was the top performer of the week. MedservRegis reported six trades with a volume of 25,350 shares generating a turnover of €13,807. The equity closed at a price level of €0.75.

PG plc entered negative territory, as it closed at €1.77, slipping by 3.3%. The equity fluctuated throughout the week, as it traded between a high of €1.83 and a low of €1.76. This was the result of 12 trades, involving 100,649 shares for a total value of €177,489.

AX Real Estate plc held up better than its peers in the real estate sector, recording a positive performance of 10.3% to close at €0.32. Three trades of 16,600 shares generated a turnover of €5,319.

The share price of Computime Holdings plc experienced a drop of 10%, closing at €0.45. This was the worst performing equity, as two trades of just €7,753 were recorded.

| Company Announcements: |

APS Bank plc announced a Rights Issue for shareholders on the register as at October 6, 2025, offering three new shares for every eleven held at €0.44 per share. The offer period runs from October 27 to November 14, 2025. Any remaining shares will be offered to APS bondholders, Group directors, employees, and the public between November 24 and December 5, 2025.

PLAN Group plc announced that the MFSA approved its €40m secured bond issuance programme. The first tranche is comprised of €24m 5.1% secured bonds maturing between 2028 and 2030 and is being issued at par.

MedservRegis plc announced that the MFSA approved the admissibility to listing of up to €25m in 5.5% Euro-denominated and 6.5% US dollar-denominated unsecured bonds maturing between 2031 and 2036. The bonds will be offered to holders of the current bonds which are due to mature in February 2026. Any unsold bonds after the exchange offer may be offered to the public through an intermediaries’ offer.

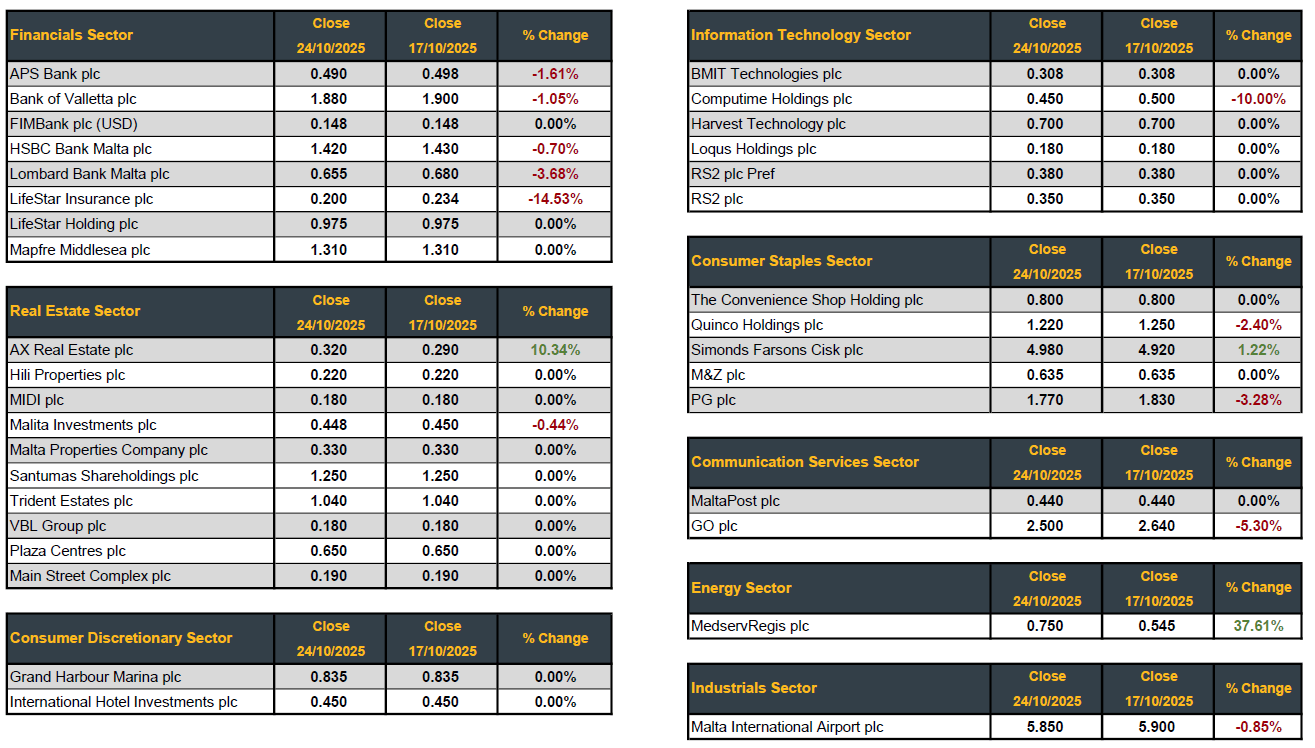

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]