MSE Trading Report for Week ending 7 November 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index closed in positive territory. The Index settled at 8,869.108 points, equivalent to a 1.5% weekly increase. A total of 25 equities were active, of which 11 gained and another 10 fell. Trading activity amounted to €0.6m, generated across 177 transactions.

The MSE Corporate Bonds Total Return Index closed 0.1% higher, as it reached 1,154.641 points. Out of 42 active issues, 18 headed north, while another 12 closed in the opposite direction. The 6% Pharmacare Finance plc Unsecured € 2033 issue recorded the best performance, up by 3.1%, to close at €100. Conversely, the 3.25% AX Group plc Unsecured 2026 lost 2.1%, ending the week at €97.

The MSE MGS Total Return Index edged 0.1% higher, closing at 969.664 points. Out of 31 active issues, 18 headed north while another 10 closed in the opposite direction. The 4% MGS 2043 headed the list of gainers, as it closed 1.3% higher at €102.90. On the other hand, the 2.4% MGS 2041 closed 0.2% lower at €83.36.

| Market Highlights: |

Bank of Valletta plc gained 1.1%, to close at €1.90. During the week, the Bank’s equity traded between a high of €1.90 and a low of €1.87, as 96,860 shares exchanged ownership. Total trading value tallied to €182,879.

APS Bank plc shares declined by 0.4% to close at €0.46, after having traded at a weekly high if €0.51. A total of 23 trades took place, generating a turnover of €60,457.

Similarly, HSBC Bank Malta plc rose by 1.4% to the €1.43 level. Trading activity included 10,754 shares over seven trades, worth €15,261.

Following the announcement that LifeStar Holdings plc plans to buy ordinary shares of LifeStar Insurance plc, the equity soared 120%. After three trades which generated a value of €6,846, the equity closed at a weekly high of €0.44. This marked the largest gain of the week.

In the communication services sector, GO plc posted a negative 3.1% change in its share price, to close at €2.48. A total of 17 trades generated a weekly turnover of €103,237 as 40,871 shares changed ownership.

Simonds Farsons Cisk plc was also amongst the winners with an 11.5% jump. This was the result of six trades worth €11,781 while 2,376 shares exchanged hands. The equity traded between a weekly low of €4.92 and a weekly high of €5.55.

Quinco Holdings plc also had a positive week, climbing by 11.1%, to close at a weekly high of €1.20. The Company reported 10 trades with a volume of 8,620 shares worth €9,275.

PG plc entered positive territory, as it closed at €1.76, jumping by 0.6%. This was the result of only two trades, involving 5,100 shares for a total value of €8,976.

In the property sector, shares of AX Real Estate plc jumped 25% to €0.38. Six trades involving the exchange of 45,021 shares were recorded. Total trading value was just €13,478.

Malita Investments plc shares decreased by 8% to close at €0.41, making it the second biggest loser of the week. This decrease was the result of nine trades which generated a weekly turnover of €29,922.

| Company Announcements: |

Malita Investments plc stated that work on its Ħal Farruġ affordable housing project was suspended by the Company itself, and not contractors, as part of a strategic reassessment. It confirmed liquidity constraints and ongoing discussions with the Housing Authority and government entities to determine the project’s future. The Company clarified it is not seeking a government bailout, with the review expected to conclude by Q4 2025.

LifeStar Holding plc announced plans to buy ordinary shares of LifeStar Insurance plc from the market when priced below the company’s independently assessed fair value of €1.013 per share. The shares have recently traded at an average of €0.40. The Company stated it is not obliged to make any purchases but will update the market as required.

Main Street Complex plc announced plans to retain its Paola property as a mixed-use commercial hub, enhancing its retail, service, and entertainment offerings. The company signed a new lease with ‘Little Greens,’ which will open a 400 sqm supermarket, café, and 160 sqm storage area. Works are set to begin in April 2026 and conclude by late 2026.

MedservRegis plc announced an extension of the issue period for its €25m unsecured bond issue due 2031–2036. The exchange offer period for existing bondholders and the intermediaries’ offer will now both close on November 20, 2025. The revised timetable shifts the announcement of allocations to November 25, refunds and allotment letters to December 3, and bond trading to commence on December 4. All other terms of the bond issue remain unchanged.

VBL plc announced that the final gross dividend of €0.22m approved at its AGM, will be paid on November 25, 2025 to shareholders registered as at July 1.

PG plc announced that its board of directors will meet on November 25 to consider approving an interim dividend for the financial year ending April 30, 2026.

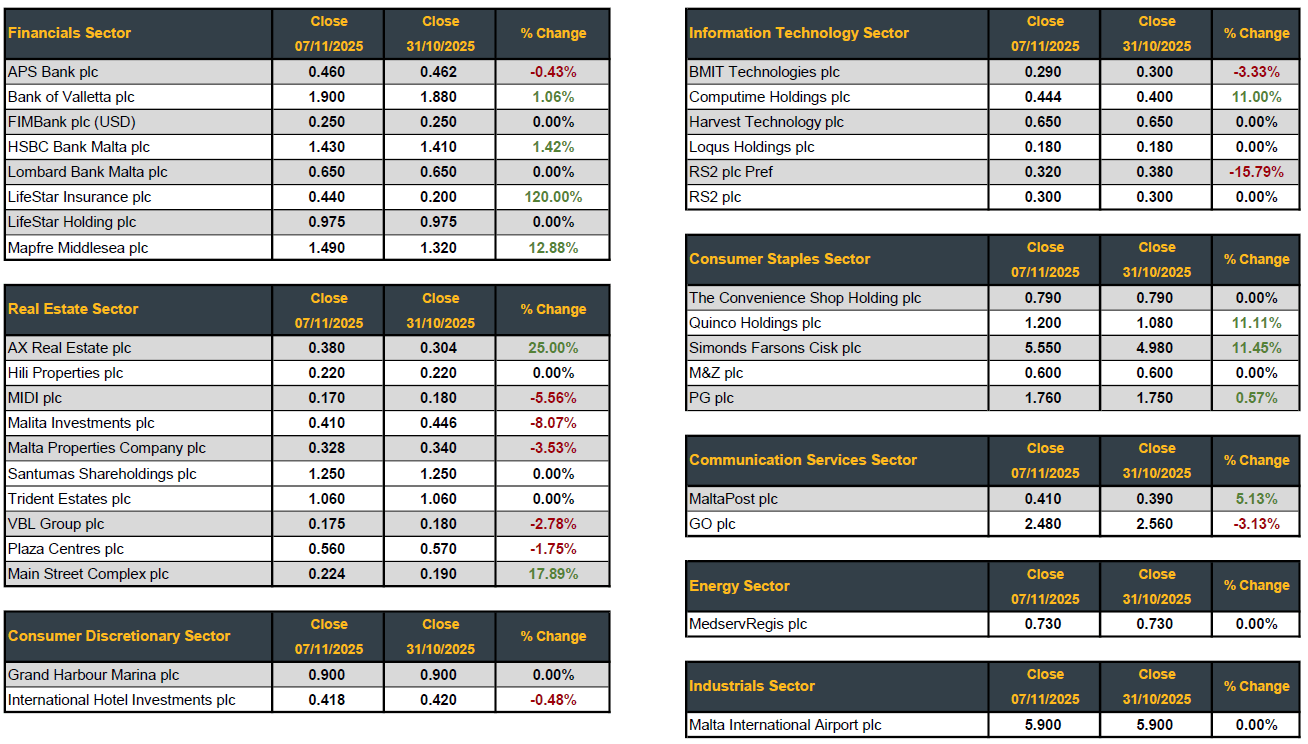

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]