MSE Trading Report for Week ending 14 November 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index closed in positive territory. The Index settled at 8,907.273 points, equivalent to a 0.4% weekly increase. A total of 22 equities were active, of which nine gained and another eight fell. Trading activity amounted to just under €0.5m, generated across 139 transactions.

The MSE Corporate Bonds Total Return Index closed 0.2% higher, as it reached 1,157.397 points. Out of 70 active issues, 27 headed north, while another 16 closed in the opposite direction. The 4.25% IZI Finance plc Unsecured € 2029 issue recorded the best performance, up by 4%, to close at €98.8. Conversely, the 3.75% Tumas Investments plc Unsecured € 2027 lost 3%, ending the week at €97.

The MSE MGS Total Return Index edged 0.1% lower, closing at 968.759 points, amid heightened trading activity in anticipation of the upcoming new Malta Government Stocks’ (MGS) release. Three new MGSs will be issued at par, namely, the 2.55% MGS 2030, the 3.40% MGS 2035 and 3.80% MGS 2040. Out of 32 active issues, 12 headed north while another 17 closed in the opposite direction. Leading the gainers was the 1.8% MGS 2051, which closed 2% higher at €63.6. On the other hand, the 4.00% MGS 2043 lagged, finishing 2.81% lower at €100.01.

| Market Highlights: |

In the banking sector, Bank of Valletta plc held steady, closing at €1.90. Over the week, 129,303 of the bank’s shares changed hands. Total trading value reached €244,769 over 42 trades.

APS Bank plc saw its share price increase by 8.7%, ending the week at €0.5. This was the outcome of three transactions of 1,536 shares, amounting to a total turnover of just €771.

HSBC Bank Malta plc, ended the week at €1.41 as three deals involving 10,989 shares were executed, translating into a decline of 1.4%. The equity generated a total turnover of €15,494.

Mapfre Middlesea plc ended the week 6% down, closing at a weekly low of €1.40. Trading activity comprised of three deals involving 2,586 shares, with a total trading turnover of €3,638.

GO plc recorded a 4.03% jump in its share price, closing at a weekly high of €2.58. A total of 10 transactions involving 7,076 shares were executed during the week, generating a total turnover of €17,700.

International Hotel Investments plc was also among the list of positive performers, recording a gain of 4.8%. The equity closed at a weekly high of €0.438, surging ahead from a stagnant streak. This was the outcome of two deals, involving 2,000 shares worth just €858.

Simonds Farsons Cisk plc experienced a 2.7% drop in its share price, closing the week at €5.40. The equity featured in three trades worth a total of €4,941, in which 915 shares changed ownership.

Its subsidiary, Quinco Holdings plc reported a significant drop in its share price, as it fell by 16.67%, to close at €1. In total, 9500 shares were traded over five deals, worth €9,530.

In the property sector, AX Real Estate plc experienced the biggest loss of the week. The equity fell by 22.1% to close at €0.296. This was the result of a sole trade which saw 5,000 shares changing hands.

The Convenience Shop plc had its share price surge by 26.6%, to close at €1. Only two trades were recorded, as 1,100 shares were exchanged.

| Company Announcements: |

Bank of Valletta plc announced that it has reached the initial €100m issuance of its Series 1 Tranche 1, 5% unsecured subordinated bonds maturing between 2030–2035 under the €325m Euro Medium Term Bond Programme and will exercise its over-allotment option up to €125m. The offer remains open for the general public and Preferred Applicants until November 25. The Bank reserves the right to close the offer earlier for any applicant class.

APS Bank plc announced that the MFSA has authorised it to act as a tied insurance intermediary for Atlas Insurance PCC Limited and Atlas Healthcare Insurance Agency Limited. This marks the Bank’s entry into general and health insurance and strengthens its relationship with Atlas, with further details to be announced separately.

CPHCL Finance plc announced that the MFSA has approved the admissibility to listing of its €45m 5.35% Unsecured Bonds maturing in 2035, guaranteed by CPHCL Company Limited. Full bond details are provided in the prospectus dated November 12, 2025.

MIDI plc has replied to the Government’s second judicial letter, firmly rejecting all allegations and stating it is contractually entitled to automatic extensions since the final Manoel Island development permit is still pending. The Company maintains it has not breached any obligations and has asked the authorities to withdraw their claims, reserving its right to take legal action. Discussions with Government continue, including the review of MIDI’s submitted expenses, and the market will be updated as developments arise.

Malta International Airport plc reported Q1–Q3 2025 revenue of €118.5m, up 10% on 2024, with net profit of €41.4m. Passenger traffic reached 7.6m, driven by strong results in Malta and Cyprus. October saw 978,445 passengers (+16.7%), led by the UK, Italy, Germany, Poland, and France. Capital expenditure totalled €42.2m, focusing on Apron 8 and SkyParks Business Centre II, with a positive outlook for Q4 2025 and 2026

MedservRegis plc reported strong Q3 2025 year-to-date results, with revenue up 37% to €68.8m, driven mainly by ILSS growth in Malta and Cyprus. EBITDA increased to €16.4m from €12.6m. The Company expects continued momentum into Q4 2025 and 2026, as activity expands in Malta, Libya, Cyprus, and the Middle East, supported by a solid order book and upcoming projects in Suriname and Namibia.

MaltaPost plc will hold a board meeting on December 18, 2025 to review and approve its financial statements for the year ended September 30, 2025.

Loqus Holdings plc announces that its Annual General Meeting will be held on Friday, January 23, 2026.

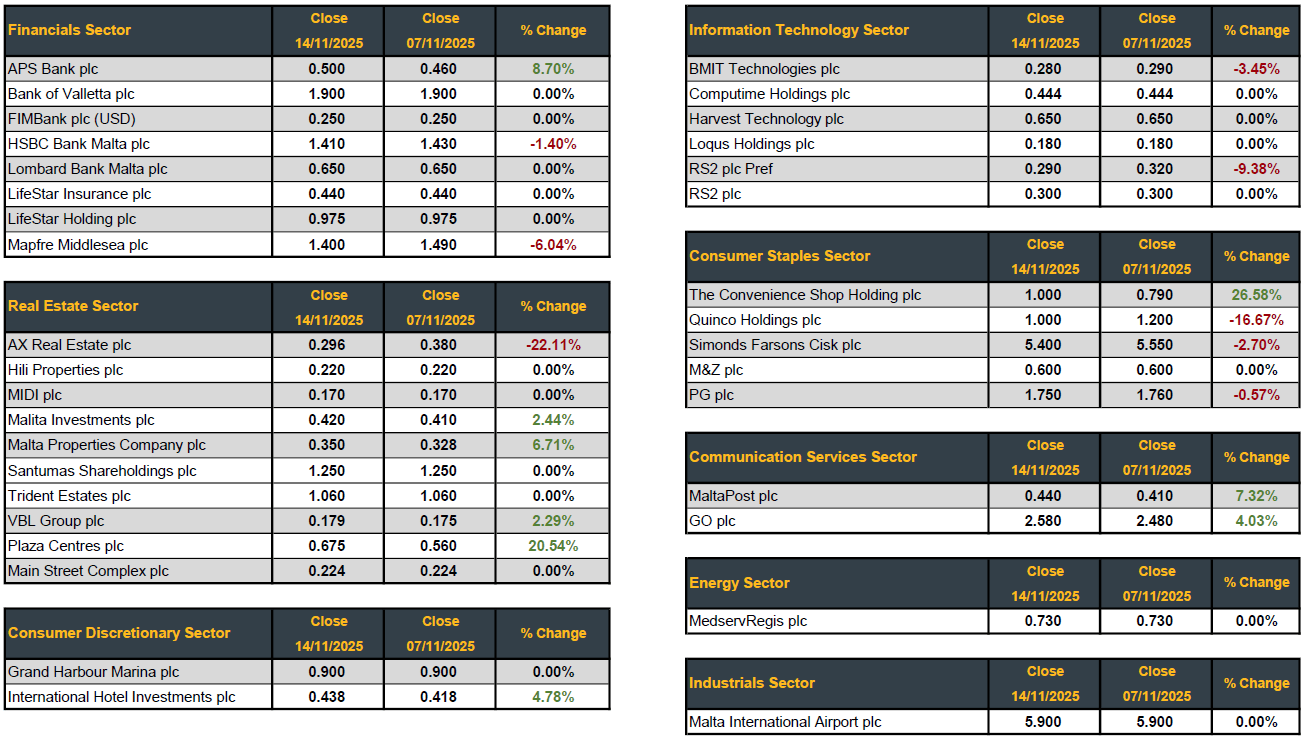

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]