MSE Trading Report for Week ending 21 November 2025

| Movement in Equity and Bond Indices: |

This week the MSE Equity Total Return Index edged higher by 0.3%, for the third consecutive week, closing at 8,929.894 points. A total of 22 equities were active, 10 of which headed north while another seven closed in the opposite direction. Total turnover tallied to €0.7m, slightly higher when compared to the previous week. A total of 154 deals were executed.

The MSE Corporate Bonds Total Returns Index registered a decline of 0.1%, as it closed at 1,155.772 points. A total of 57 issues were active. The 5.75% Phoenicia Finance Company plc Unsecured 2028-2033 traded 2.8% higher, closing at €104.37. On the other hand, the 4% Central Business Centres plc Unsecured € 2027-2033 lost 4.7% to close at €91.01.

The MSE MGS Total Return Index recorded a positive 0.2% movement, reaching 970.879 points. A total of 32 stocks were active during the week. The 0.80% MGS 2027 headed the list of gainers, as it closed 8.8% higher at €98. On the other hand, the 3.4% MGS 2027 lost 2%, ending the week at €100.

| Market Highlights: |

APS Bank plc (APS) rebounded with a positive 5% movement in its share price, closing at a weekly high of €0.525. This was the result of eight deals spread across 22,061 shares. APS shares generated a total turnover of €11,499.

Trading in Bank of Valletta plc remained stable at €1.90. The bank’s shares were the most liquid, as 223,447 shares were exchanged across 63 deals, amounting to a turnover of €424,145.

Similarly in the banking sector, the price of Lombard Bank plc rose by 3.1%, closing at a weekly high of €0.67. Trading activity included only two trades on a volume of 10,500 shares. Trading turnover tallied to €7,035 in value.

FIMBank pls headed the list of losers, as its price per share plummeted by 28% to close at $0.18. This was the result of three trades worth $36,557 that drove the price downwards for the first time since September.

RS2 plc experienced a double-digit increase of 16% to close at a weekly high of €0.348. A total of 12 deals were recorded across 115,141 shares for a total trading value of €33,817.

Malita Investments plc experienced a 1% decline in its share price, following an extremely volatile week, to close at €0.416. Trading activity included the exchange of 32,733 shares worth €11,449.

Malta International Airport plc (MIA) recorded a slight 0.9% increase in its share price, closing at a weekly high of €5.95. MIA recorded a total of 12 transactions, involving 5,904 shares executed during the week, generating a total turnover of €34,967.

Meanwhile, Mapfre Middlesea plc registered a gain of 2.1%. The equity traded at a weekly low of €1.20 before rising to €1.43. Activity was spread across five transactions, with 22,240 shares exchanged for a total turnover of €26,706.

BMIT Technologies plc registered three deals involving the exchange of 20,020 shares. The equity traded at a weekly low of €0.282 but ultimately closed the week at €0.29. On a week-on-week basis the equity increased by 3.6%.

In the communication services sector, GO plc posted a negative 0.8% change in its share price, to close at a weekly low of €2.56. This was the result of just two trades generating a weekly turnover of €40,448.

| Company Announcements: |

VBL plc announced that it expects strong full-year results for 2025, supported by robust first-half performance and continued improvement in the second half. Development of the flagship Silver Horse Block project is on track for completion in late 2026, set to deliver an 88-room hotel and between €2m to €2.5m in additional annual EBITDA. The Group forecasts year-end revenues of around €4.3m, a €90m investment property value, and a 23% debt-to-equity ratio. Since its 2021 IPO, VBL has grown revenues more than fourfold and EBITDA over sixfold, reflecting strong delivery of its development and operational plans.

APS Bank plc has successfully closed its rights issue, raising €46.4m. The rights issue, offered at €0.44 per share in a 3-for-11 ratio, closed on November 14.

RS2 plc announced that its subsidiary, RS2 Financial Services GmbH, is now a Principal Issuing Member of Visa and Mastercard in Europe, enabling it to directly issue cards and run full payment card programs. Under the brand Beyond by RS2, the Group joins a select set of European providers with full issuing capabilities, offering BIN sponsorship, co-branding, and flexible debit, credit, prepaid, and corporate card solutions, including Apple Pay and Google Pay. Beyond by RS2 will also provide full program management, fraud prevention, compliance, and regulatory support across the EU and EEA. This development strengthens RS2’s position as a fully integrated payments partner offering issuing, acquiring, and processing services.

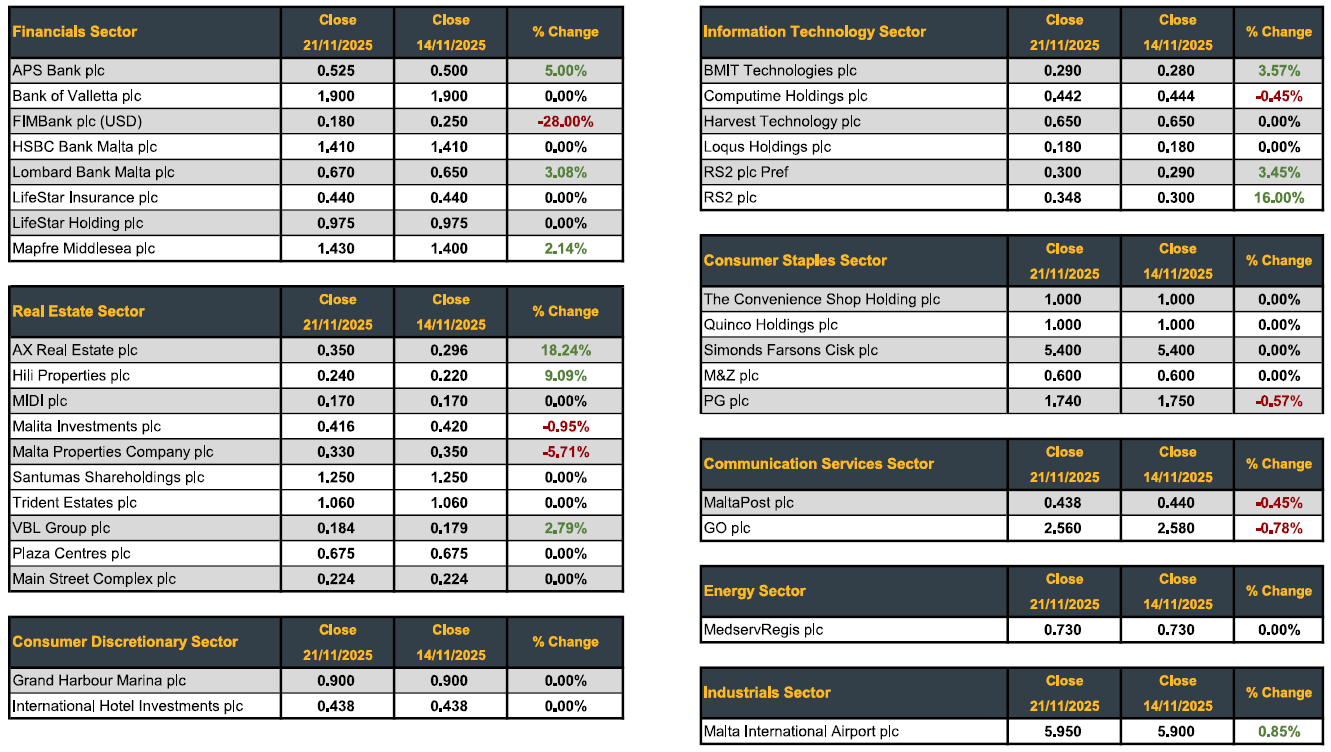

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]