MSE Trading Report for Week ending 16 January 2026

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index ended the week in negative territory, closing 0.6% lower at 8,912.975 points. A total of 19 equities were active, as three headed north while another six closed in the opposite direction. The total weekly turnover stood at just over €1m across 156 transactions.

The MSE Corporate Bonds Total Return Index closed 0.22% higher at 1,153.203 points. A total of 71 issues were active, 19 of which traded higher while another 31 lost ground. The 4.25% Mercury Projects 2031 was the best performer, as it closed 3.4% higher at €99.75. On the other hand, the 6.25% Together Gaming Solutions 2032 ended the week 5.2% lower at €99.

The MSE MGS Total Return Index posted a 0.01% loss, as it reached 967.721 points. Out of 22 active issues, 13 advanced while another five closed in the red. The 2.5% MGS 2036 headed the list of gainers, as it closed at €88.92, equivalent to a positive 0.5% change. Conversely, the 3% MGS 2040 closed 1.4% lower at €89.22.

| Market Highlights: |

In the banking sector, Bank of Valletta plc shares declined by 1% to end the week at €1.90. The equity saw the highest activity with 335,030 shares changing hands across 70 transactions, generating a turnover of €640,671.

HSBC Bank Malta plc gained 1.4% to close at €1.43. The equity traded 11 times during the week, generating a turnover of €62,682 across 43,917 shares.

APS Bank plc shares declined by 4.1% to end the week at €0.47. Turnover reached €42,701, as six deals were executed involving 87,355 shares.

Malta Properties Company plc experienced a 4.6% decrease in its share price, closing at €0.334. Trading activity comprised of four deals, involving 14,300 shares, with a total trading turnover of just €4,933.

Malta International Airport plc shares closed the week 0.86% higher at €5.85. A total of 22 transactions valued at €121,223 were executed.

Telecommunications company GO plc trended 2.4% lower to close at €2.48. Trading activity involved 10 trades worth €64,338, on a volume of 25,400 shares.

Its subsidiary, BMIT Technologies plc fell by 3.5% to close at a weekly low of €0.28. The decrease resulted from 62,215 shares spread across six deals, worth €17,942

Sector peer, Harvest Technology plc recorded the strongest gain of the week, as its share price climbed by 9.4%, closing at €0.70.

Simonds Farsons Cisk plc remained steady at the €5.35 price level. Trading activity was muted as a sole trade was executed, with 3,000 shares changing hands, generating a weekly turnover of just €16,050.

Quinco Holdings plc posted the steepest decline of the session, as it saw its share price fall by 6.2%, closing at €0.91. This was the result of three trades involving 5,400 shares.

| Company Announcements: |

Malta International Airport plc reported the full-year passenger traffic of 10.1m in 2025, up 12.3% year-on-year, with December traffic increasing 19.9% to 709,352 movements. The Company issued 2026 guidance targeting 10.5m passengers, €162m in revenue and €51m in net profit. In addition, the Company announced the repurchase of 2,278 shares during the week ended January 9, 2026 under its share buyback programme.

Bank of Valletta plc announced that no shares were repurchased during the week ended January 9, 2026. Since the commencement of the share buyback programme, the Bank has acquired 564,032 shares, representing 0.09% of its share capital, at an average price of €1.8989 per share.

LifeStar Insurance plc announced the receipt of a notification of major holdings from LifeStar Holding plc, confirming that on January 13, 2026, the latter acquired 759,541 shares in the Company. Following this transaction, LifeStar Holding’s shareholding increased from 74.23% to 75.40%, exceeding the 75% threshold, with the public free float consequently falling below 25% of the issued share capital.

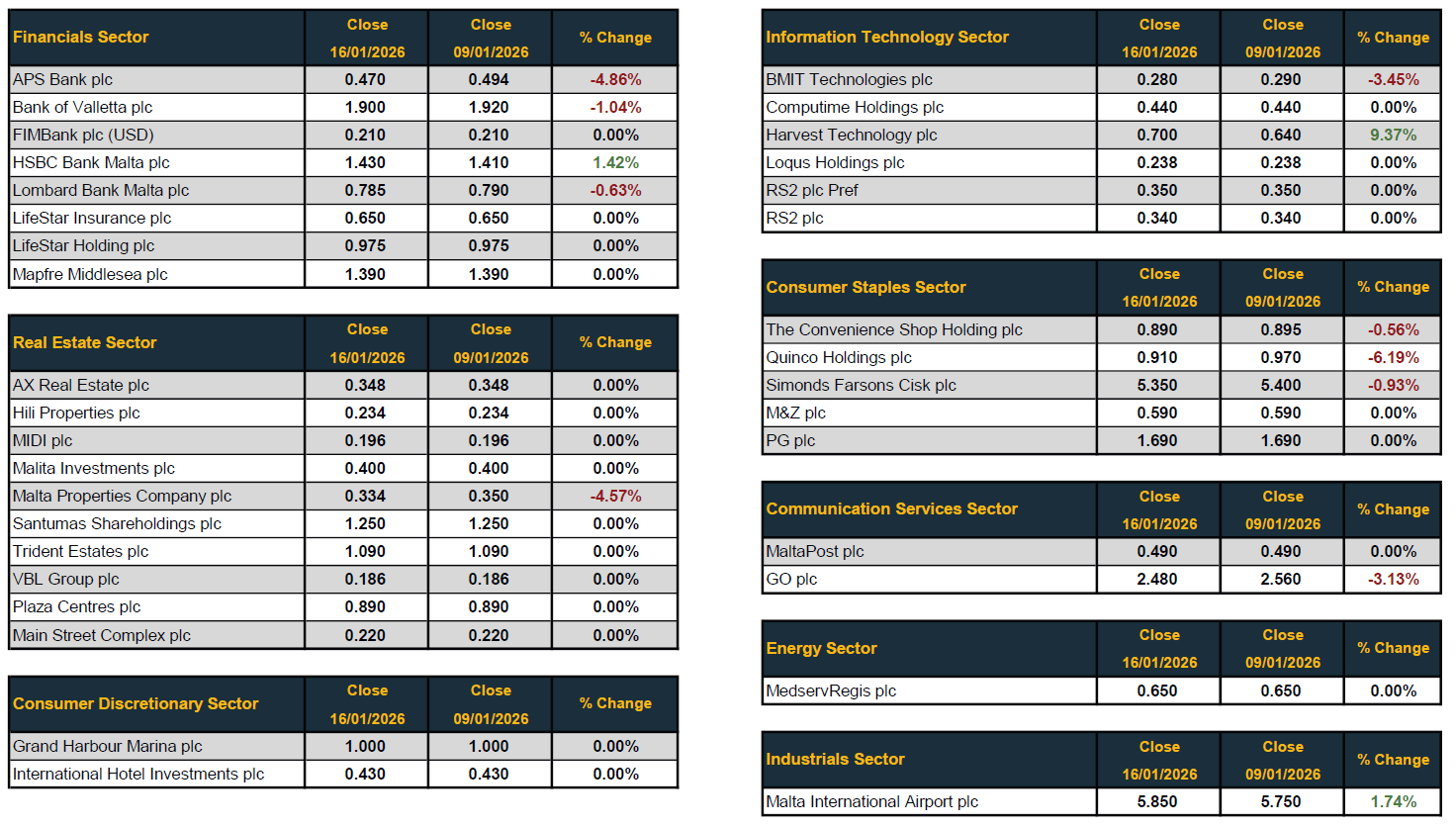

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]