MSE Trading Report for Week ending 13 February 2026

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index recorded a strong gain of 2.1%, to end the week at 9,089.325 points. A total of 20 equities were active, with 10 closing in the green, and another seven declining. Total turnover reached €1.2m, up from €0.8m last week, as Bank of Valletta plc (BOV) dominated activity.

The MSE Corporate Bonds Total Return Index ended the week 0.2% higher at 1,155.835 points. Throughout the week, there were a total of 82 active bonds, with 41 gainers and 20 losers. The 4.3% Mercury Projects Finance plc Secured 2032 was the best performing issue, advancing by 6.9% to close at €99.43, while the 5% Izola Bank Unsecured 2032 suffered the biggest decline, as it dropped by 5.9% to €94.1.

The MSE MGS Total Return Index declined by 0.1%, to end the week at 970.748 points. A total of 20 sovereign bonds were active, as six declined while 12 gained. The 3.4% MGS 2042 gained 1.4% and ended the week as the best performer at €94.30. On the other hand, the 1.8% MGS 2051 suffered the biggest drop, as it declined by 2.5%, to close at €62.04.

| Market Highlights: |

BOV continued its positive momentum by extending its winning streak for the third consecutive week, to close at a price level of €2.04. The equity traded at a weekly low of €1.93 and briefly touched the €2.10 limit, that has not been reached since April of last year. As the most liquid equity of the week, a total of 287,418 shares exchanged hands over 98 deals, worth €573,360.

HSBC Bank Malta plc edged 1.4% higher, to close at €1.45. This was the result of 15 trades involving 29,360 shares worth €42,047. This was the first week the bank ended in the green following three stagnant weeks.

Similarly, the share price of APS Bank plc rose by 2%, closing at a weekly high of €0.50. This was the result of three deals worth €6,911 and involving 14,100 shares.

Lombard Bank Malta plc continued heading south, as the banking equity decreased a further 7.9% to €0.70. A total of three transactions worth €7,892 were recorded.

Malita Investments plc rebounded to a price level of €0.40, translating to a 17% increase. Trading activity included only four trades on a volume of 7,351 shares. Trading turnover tallied to €2,562.

RS2 plc preference experienced an exceptional week, as it headed the list of winners to close at a price level of €0.59, its highest peak since April 2025. A total of 15,000 shares exchanged ownership across only two trades, generating €5,268 in turnover.

In the consumer staples industry, PG plc gained 2.5%, as it closed at a weekly high of €1.65. Trading activity included 50,135 shares exchanging hands over eight transactions, with a total turnover of €81,955.

Simonds Farsons Cisk plc gained a solid 9.8% and closed at a weekly high of €5.60. Trading was minimal, as only three trades, involving 1,500 shares were executed. Total trading value equalled €8,101.

Malta International Airport plc closed lower by 0.9% to finish at €5.80 after trading at a weekly high of €5.85. A total of 12 transactions worth €35,378 were executed.

Meanwhile, in the communications sector, GO plc edged 0.8% higher, trading at a weekly low of €2.46 before closing at €2.52. During the week 16,390 shares change hands, generating €40,683 in total trading turnover.

| Company Announcements: |

Malta International Airport plc announced that its Board will convene on February 25, 2026, to review and approve the financial statements for the year ended December 31, 2025. During the meeting, the Board will also consider the declaration of a dividend to shareholders.

In terms of operational performance, the airport registered 594,889 passenger movements in January. Aircraft movements increased by 9.7% year-on-year to 4,324 movements, while the seat load factor improved by 2.3% to 76.1%, indicating stronger capacity utilisation. Italy ranked as the airport’s largest market in January, accounting for 18.4% of total passenger movements. Poland followed with 16.4% ahead of the United Kingdom at 15.7%.

M&Z plc has authorised the repurchase of a further 250,000 shares under its approved buy-back programme, within a price range of €0.45 to €0.62 per share. To date, 339,689 shares have been acquired out of the 750,000 previously approved. The Company currently holds 839,689 shares in treasury out of 44,000,000 ordinary shares in issue.

Loqus Holdings plc announced that its Board is scheduled to meet on February 26, 2026, to consider and, if deemed appropriate, approve the Company’s half-yearly report for the six-month period ended December 31, 2025.

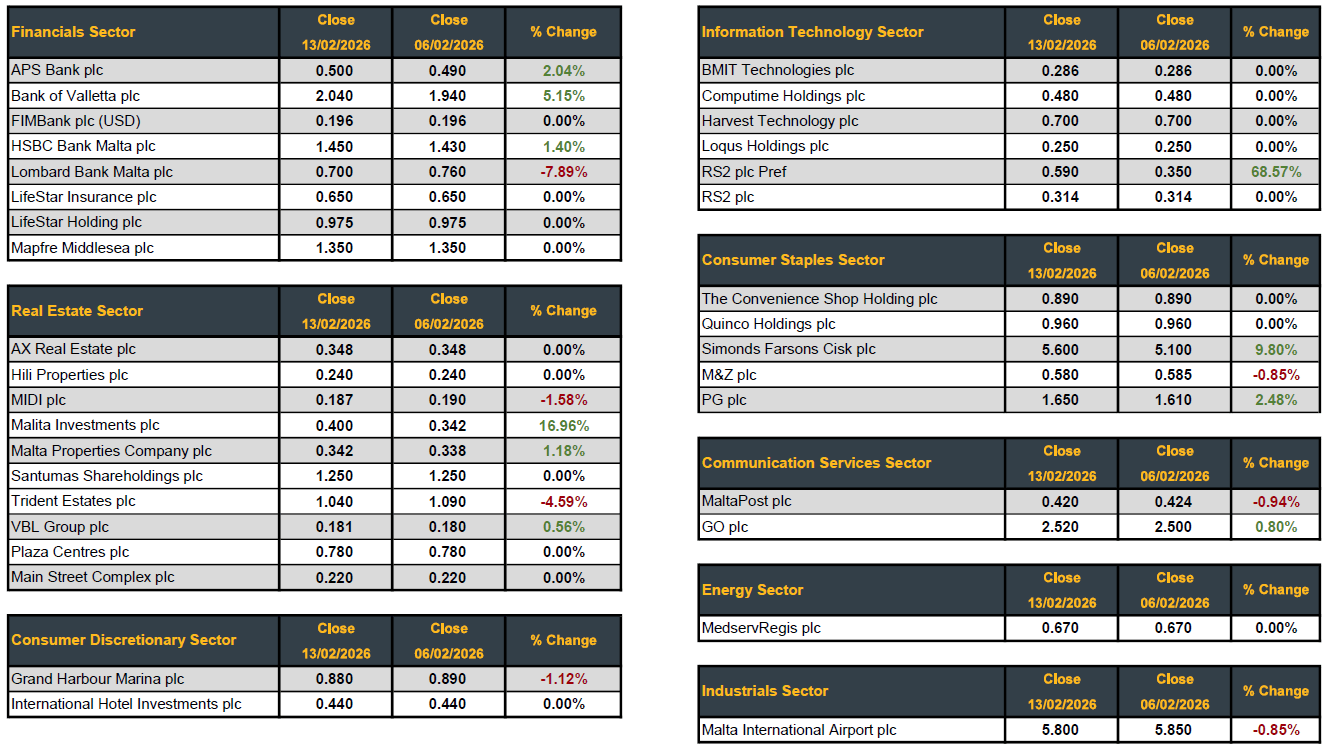

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]