MSE Trading Report for Week ending 26 September 2025

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index remained flat, as the index closed at 8,892.248 points. A total of 24 equities were active, as eight closed in the green, while another six closed in negative territory. Total turnover reached €1.2m, spread across 181 deals.

The MSE Corporate Bonds Total Return Index closed flat, finishing the week at 1,164.512 points. Throughout the week, there were a total of 72 active bonds. The 4% MIDI plc Secured € 2026 was the best performing issue, advancing by 6.5%, to close at €98, while the 4% Cablenet Communication Systems plc Unsecured € 2030 suffered the biggest decline, as it dropped by 2.9% to €95.11.

The MSE MGS Total Return Index entered negative territory, recording a 0.1% loss, to end the week at 963.999 points. A total of 28 sovereign bonds were active. The 2.1% MGS 2039 gained 11% and ended the week as the best performer at €90. On the other hand, the 3.5% MGS 2035 suffered the biggest drop, as it declined by 1.1%, closing at €99.

| Market Highlights: |

HSBC Bank Malta plc was the most liquid equity of the week with a volume of 271,700 shares over 30 trades, generating a value of €388,707. The trading activity resulted in an increase of 0.7% which meant the equity closed at a share price of €1.43.

Bank of Valletta plc closed at a price level of €1.85, with no movement in its share price. The bank witnessed 58 transactions involving 193,205 shares, resulting in a total turnover of €360,338.

Malta International Airport plc reported a weekly drop of 1.7%, to close the week at €5.85. A total of 8,639 shares exchanged hands over 13 deals, totaling a trading value of €51,338.

International Hotel Investments plc (IHI) experienced a 3.9% increase to close at a weekly high of €0.478. Trading activity included just three trades, of 18,945 shares for a total trading value of €8,364. Since the beginning of the year IHI shares are up by 4%.

RS2 plc headed the list of losers, as the equity reported a sudden 10.9% decline in its share price to close at €0.312. This was the result of two trades worth €2,206 that drove the price downwards for the second consecutive week.

BMIT Technologies plc fell by 3.2%, closing the week at €0.30. A total of eight trades worth €58,224 were executed.

Mapfre Middlesea plc advanced by 3.5% during the week, closing at €1.49. One trade worth €8,436 was executed.

Trading in Simonds Farsons Cisk plc remained stable at €6.20. A total of 19,969 shares changed hands across 23 deals, amounting to a turnover of €124,096.

Computime Holdings plc headed north as a result of 20,000 shares traded over three deals, worth €10,000. The equity rose to the €0.50 price level, translating to a 2.9% increase.

MedservRegis plc saw its share price decline by 2.8%, slipping into negative territory for the first time in four weeks. Trading activity was minimal, with a sole transaction recorded, closing the week at €0.53.

| Company Announcements: |

MIDI plc has received a judicial letter from the Government of Malta over its Manoel Island and Tigné Point concession, demanding it to fix alleged delays within six months or risk losing the contract by March 2026. The company denies any wrongdoing, arguing deadlines were extended due to permit delays, archaeological works, heritage rules, and other factors beyond its control. While preparing a legal defense, MIDI is also in discussions with the authorities to reach a fair solution while continuing to protect the interests of both shareholders and bondholders.

Simonds Farsons Cisk plc reported a profit after tax for the Group of €9.4m for the six months ended July 31, 2025, up from €8.8m in 2024, marking a 6.8% increase. This improvement was driven by higher turnover in both the beverage and food segments, with the beverage sector showing stronger margins. Earnings per share rose to €0.261 from €0.245 last year. Reflecting these results, the Board declared an interim cash dividend of €0.065 per share (€2.3m in total), up from €0.06 per share in 2024. The Board has also resolved to distribute a dividend in kind through the distribution of shares in Quinco Holdings lplc. worth €46.8m. Subject to regulatory approval, the above in specie dividend will be distributed on October 6, 2025, to those shareholders appearing on the Company’s register as at the close of business on September 30, 2025.

Trident Estates plc reported revenue of €2.8m for the six months ended July 31, 2025, up from €2.5 last year, reflecting higher occupancy levels at Trident Park compared to the previous period. Direct costs rose to €540,000 from €457,000 in 2024, mainly driven by professional fees and other expenses incurred in relation to the Group’s property portfolio strategy review. Profit after tax for the period increased to €0.7m.

Yesterday, Loqus Holdings plc announced that in connection with the voluntary bid received from JFC Holdings Limited, the latter informed Loqus Holdings plc, that the Manager and Registrar of the voluntary bid received acceptances representing approximately 9.54% of the Company’s issued share capital.

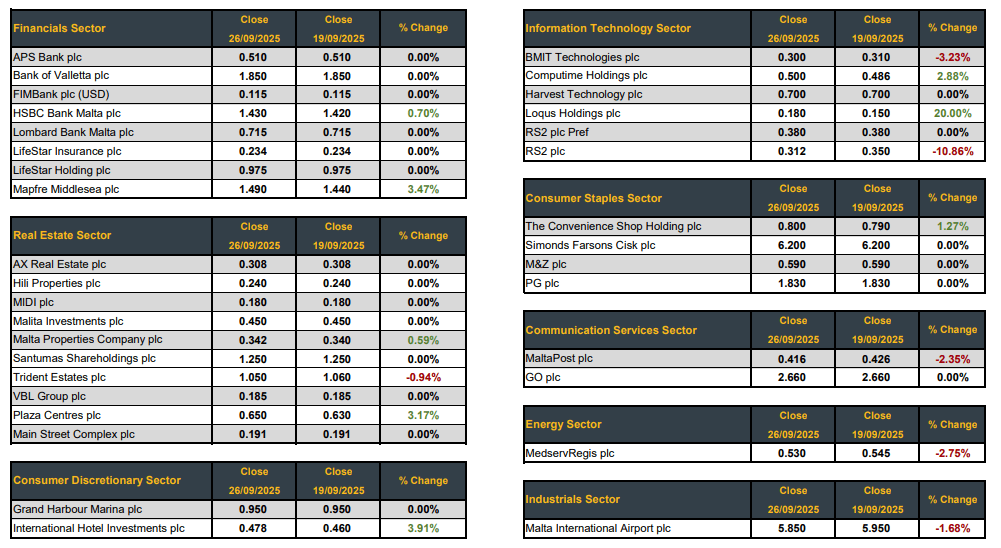

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]