MSE Trading Report for Week ending 31 October 2025

| Movement in Equity and Bond Indices: |

This week the MSE Equity Total Return Index decreased by 0.2%, closing at 8,740.371 points. A total of 28 equities were active, seven of which headed north while another 17 closed in the opposite direction. Total turnover exceeded €1.2m. A total of 238 deals were executed.

The MSE MGS Total Return Index recorded a negative 0.2% movement, settling at 968.4 points. Out of 31 active issues, only three registered gains, while 27 lost ground. The 0.4% MGS 2026 headed the list of gainers, as it closed 1.4% higher at €98.16. On the other hand, the 3.50% MGS 2034 lost 1%, ending the week at €101.50.

The MSE Corporate Bonds Total Returns Index also registered a decrease of 0.1%, as it closed at 1,153.814 points. A total of 69 issues were active, of which 23 traded higher, while 26 closed in negative territory. The 4% MIDI plc Secured € 2026 traded 12.21% higher, closing at €96.50. On the other hand, the 6% Pharmacare Finance plc Unsecured € 2033 lost 4%, to close at €97.

| Market Highlights: |

Bank of Valletta plc was the most traded equity during the week, with total turnover of just over €0.7m. Despite reporting positive quarterly results, its share price remained steady at the €1.88 level. The equity traded between a high of €1.91 and a low of €1.86.

Within the banking industry, APS Bank plc posted a decline of 5.7%, ending the week at €0.462. Trading activity included the exchange of 73,058 shares across 16 trades worth €34,611.

HSBC Bank Malta plc joined the list of losers, recording a decline of 0.7%, to close at €1.41. A total of 12 trades took place, involving 28,552 shares worth €40,363.

FIMBank plc recorded the biggest gain of the week, surging by 68.9%. This was the result of 30 trades in which just over 0.5m shares were exchanged. The equity closed at a price of $0.25, marking its first finish above the price level of $0.20 this year.

Malta International Airport plc advanced by 0.9%, closing at €5.90. The Company was active across 16 trades, with 17,123 shares transacted for a total value of €100,307.

The share price of GO plc rose by 2.4%, closing the week at a high of €2.56. GO saw a total of 15,050 shares exchange hands across five deals, recording €38,526 in turnover.

International Hotel Investments plc saw its share price decline by 6.7%, closing at a weekly low of €0.42. Trading activity included nine transactions, with 36,223 shares changing hands for a total value of €15,468.

RS2 plc led the list of weekly losers, as the equity experienced a sharp 14.3% decline in its share price, closing at a low of €0.30. The drop followed four trades valued at €11,028, which collectively exerted downward pressure on the stock. Trading activity was limited, suggesting that even modest selling volume had a significant impact on the share price.

Similarly in the Information Technology sector, Computime Holdings plc plunged by 11.1%. The equity closed at its weekly low of €0.40. This was the result of just two trades in which 22,200 shares, worth €8,880, changed hands.

BMIT Technologies plc recorded a 2.6% decline over the week. A total of 41,264 shares changed hands across 11 trades, generating a total value of €11,926.

| Company Announcements: |

Bank of Valletta plc reported a profit before tax of €192.1m for the first nine months of 2025, a decrease of 14.2% from the comparable period last year, but in line with expectations. Net interest income declined marginally while net fees and commission income increased when compared to the same period last year. The Group’s total assets surpassed €16b by September 2025, growing by nearly €1b during the nine months.

APS Bank plc reported a profit before tax of €17.8m for the first nine months of 2025, up from €16.5m last year. Net interest income rose to €56.5m, driven by lending growth, while impairments fell to €0.5m. Total assets reached €4.4b and deposits €4.1b. The Bank’s CET1 ratio stood at 14.7% and total capital ratio at 20.2%, indicating strong performance and stability.

HSBC Bank Malta plc reported €82.5m profit before tax for the first nine months of the year, down 30% from last year, mainly due to the normalisation of interest rates and lower recoveries on expected credit losses. Revenue fell 13% year-on-year due to lower interest income, although structural hedges cushioned part of the decline and other income streams including fees, foreign exchange and transaction banking grew. Credit quality improved, leading to a €4.6m release in expected credit losses, albeit lower than last year’s €10.8m.

FIMBank plc announced that Jordan Kuwait Bank (JKB) plans to acquire an 88.9% controlling stake from United Gulf Holding (80.4%) and Burgan Bank (8.5%). Completion requires regulatory approvals in Jordan, Malta, and the EU.

Trident Estates plc signed a promise of sale on October 2, 2025 with BBT plc and OS Developments Limited, to sell the ‘Trident House’ complex in Marsa, Malta, for €29,2m. The property generates €0.3m in annual rental income, and proceeds will fund new acquisitions, debt refinancing, or working capital.

Loqus Holdings plc announced that its board of directors approved the audited financial statements for the year ended June 30, 2025. The Company will submit these statements for shareholder approval at the forthcoming AGM.

SD Finance plc announced the full subscription of its €33m 5.2% unsecured bonds 2031, issued under the prospectus dated October 3, 2025. The Board thanked all investors, financial intermediaries, and stakeholders for their support in the successful bond issue.

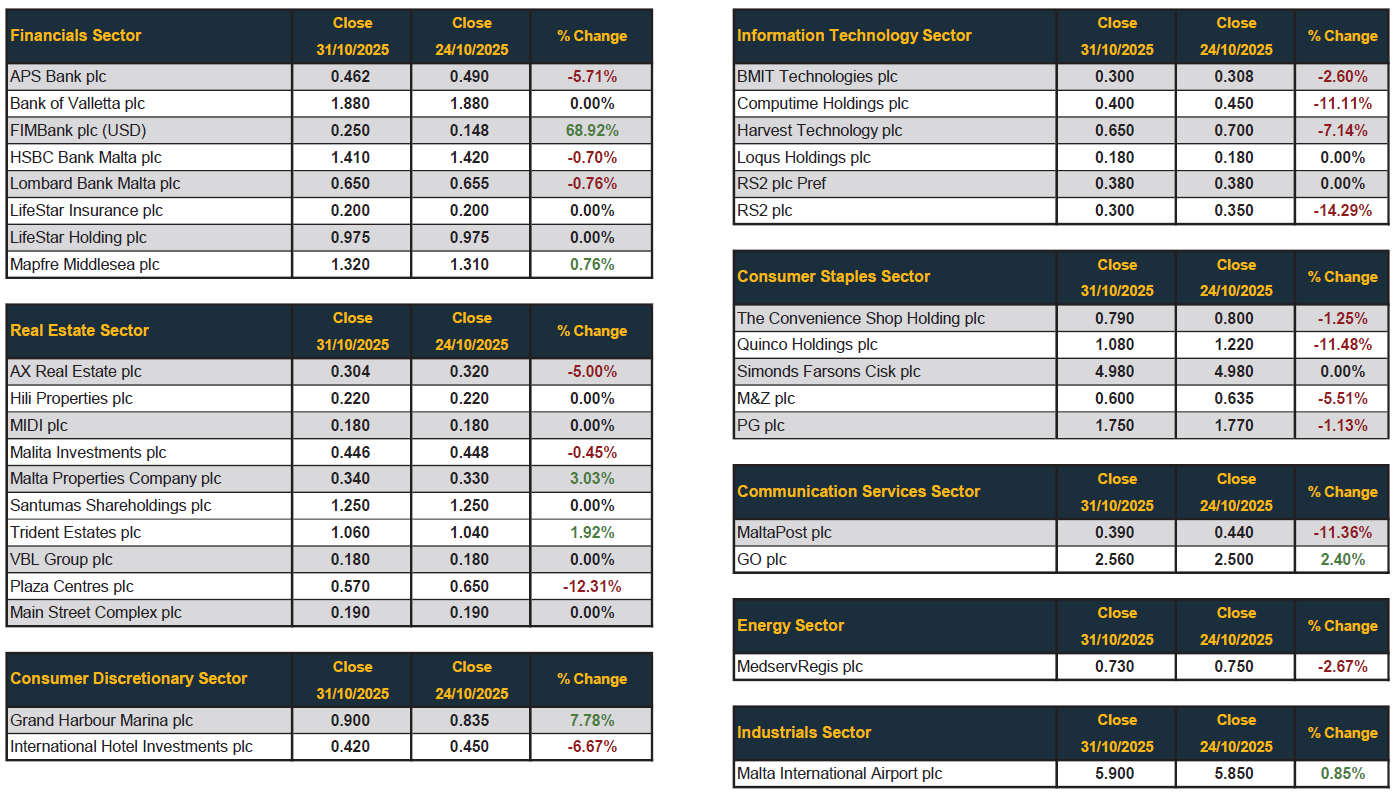

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]