MSE Trading Report for Week ending 23 December 2025

| Market Highlights: |

As we approach the end of the year, the MSE Equity Total Return Index (MSE) is on track to close 2025 in the green but also on mixed and generally subdued note, with performance diverging markedly across sectors and individual equities. While a small number of companies recorded strong gains, the broader market was characterised by declining share prices, reflecting cautious investor sentiment, company-specific challenges and the continued impact of limited liquidity in the local market. The MSE is up by 3.6% since the beginning of the year.

This week’s report focuses on four of the eight sectors represented on the Malta Stock Exchange, namely Financials, Communication Services, Energy and Industrials. We review how these sectors performed year-to-date, the key drivers behind share price movements and how trading activity compared to the previous year. The remaining sectors, which include Real Estate, Information Technology, Consumer Discretionary and Consumer Staples, will be covered in next week’s commentary.

The four sectors under review this week comprise twelve listed equities. As at the last trading session on December 23, six of these equities were trading higher compared to the beginning of the year, while the remaining six were in negative territory.

Within the Financials sector, Bank of Valletta plc (BOV) dominated market activity. A total of €21.5m worth of BOV shares were traded across 2,846 transactions, making it the most actively traded equity on the market. BOV shares closed the latest trading session at €1.91 and are among the strongest performers year-to-date, posting a gain of 22%. Performance was supported by renewed investor confidence, underpinned by greater stability and normalisation in the Bank’s profitability and dividend outlook. During the summer months, the Bank also launched its first-ever share buy-back programme. To date, over €1m worth of shares have been repurchased at a weighted average price of €1.8989.

HSBC Bank Malta plc (HSBC) featured prominently in headlines for much of the year amid developments surrounding the sale, by HSBC Holdings plc of its 70% shareholding in the Maltese operations. While initial market expectations pointed towards APS Bank plc (APS) as the frontrunner, APS subsequently withdrew from the bidding process. During the summer, Greek lender Credia Bank emerged as the preferred bidder and submitted an offer of €200m for the entire 70% shareholding held by HSBC Holdings plc, while also committing to launch a mandatory offer to minority shareholders at €1.44 per share, subject to regulatory approval. Despite the heightened corporate activity, HSBC shares have declined by just 0.7% since the start of the year and were last trading at €1.42, having reached a yearly high of €1.58. Year-on-year trading turnover has declined marginally to €4m.

APS shares experienced a volatile year, ending the period down 14.6%. The equity began the year on a positive footing, likely reflecting optimism surrounding the potential acquisition of HSBC. However, sentiment shifted in April when the Bank announced its withdrawal from the bidding process, triggering a downward trend in the share price. Investors’ focus later turned to the Bank’s rights issue, which was approved at the AGM in May and successfully completed in October and November, raising €45.8m. The equity’s price moved between a low of €0.44 and a high of €0.64 to close the last trading day at €0.478. Trading turnover declined from €2.1m last year to €1.6m.

LifeStar Holding plc shares are up by 150% on a year-to-date basis, however, trading activity in the equity was minimal. Only three small trades were executed during the year, with the share price moving between a low of €0.39 and a high of €0.975. The last transaction took place on 15 January 2025.

Turning to the Industrials sector, Malta International Airport plc (MIA) was the second most actively traded equity on the market, with €5.1m exchanged across 865 transactions, down from €7.6m in 2024. During the year, MIA’s share price ranged between a low of €5.70 and a high of €6.25. The equity was last traded at €5.85, representing a gain of just under 1% since January. Early in 2025, the share price rallied following the announcement of details relating to the Company’s share buy-back programme. However, by the time the programme commenced in June, investor enthusiasm had moderated and the share price subsequently traded within relatively narrow ranges.

In the Communication Services sector, GO plc shares are down 6% since the beginning of the year. The equity traded between a low of €2.44 and a high of €2.90, with the latter reached in August following the publication of the Company’s unaudited interim financial statements. GO reported revenue of €124m, while operating profit increased by 24.5% to almost €21m. Profit after tax amounted to €11.5m, and the Company increased the interim net dividend to €0.07 per share, compared to €0.05 in the corresponding period of the previous year.

Meanwhile, MaltaPost plc shares gained 7.5% and are currently trading at a year-to-date high of €0.505, having traded as low as €0.382 earlier in the year. A total of 199 transactions amounting to €0.4m were recorded. Recently, the Company announced that profit before tax for the financial year ended September 30, 2025 increased to €6.4m from €4.7m in 2024. This improvement was driven by enhanced operational efficiencies and strategic investments in logistics and e-commerce services. Group turnover also rose by 6.1% to €42.6m, primarily reflecting growth in cross-border inbound parcel volumes.

Lastly, in the Energy sector, MedservRegis plc shares rose by 15% to €0.65. Trading activity remained relatively light, with 53 transactions amounting to €155,000. The share price fluctuated between a low of €0.37 and a high of €0.75 during the year. MedservRegis announced several positive developments which supported the equity’s share price, including the renewal of a significant contract for integrated logistics and shore base services by its Egyptian subsidiary, as well as the award of a multi-million-dollar marine logistics base contract in Suriname during the third quarter. In November, the Company also raised €17m and $6m through a local bond issue.

We wish our readers a happy holiday season and a prosperous new year.

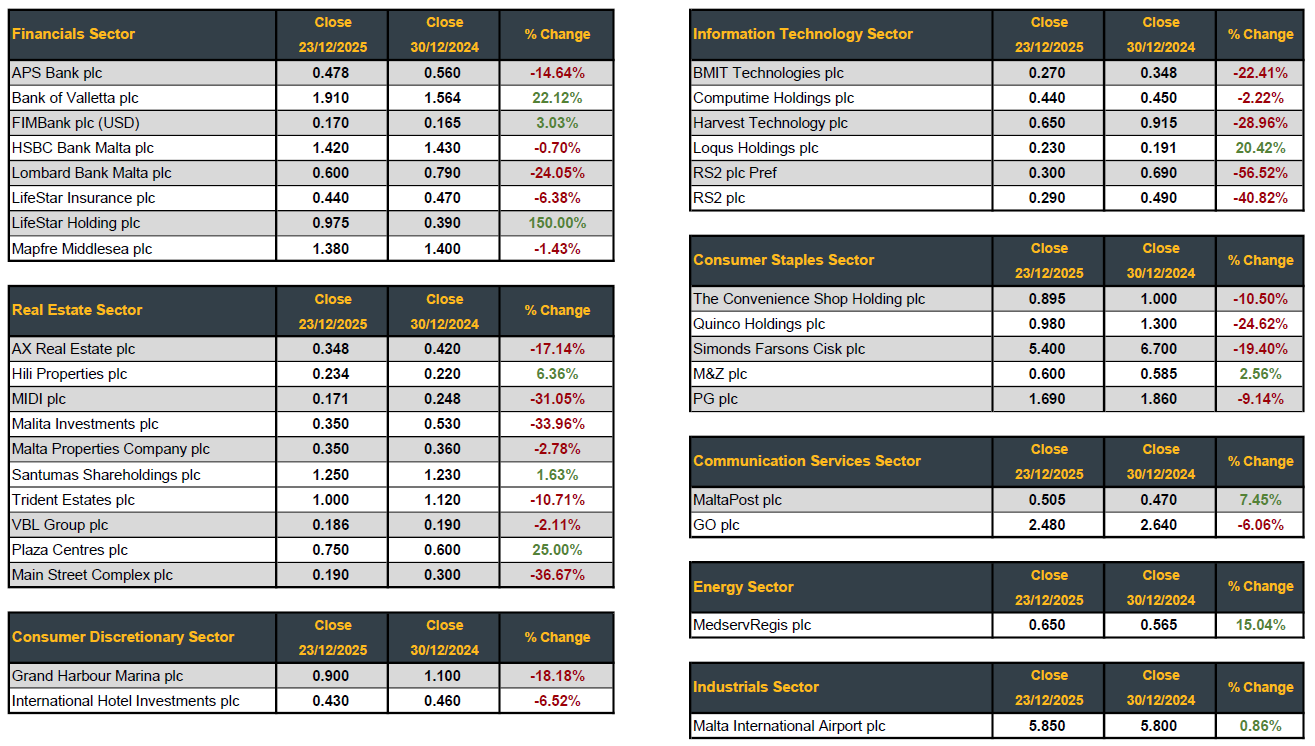

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services under the Investment Services Act by the MFSA and is a Member of the Malta Stock Exchange. The directors or related parties, including the company and their clients, are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]